Global Air Purifier Market: By Technology, By Mounting Type, By Application, Coverage Area, By Distribution Channel, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Semiconductors & Electronics

- Report ID: TNR-110-1271

- Number of Pages: 420

- Table/Charts : Yes

- August, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10104

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

An air purifier is a device designed to enhance indoor air quality by removing contaminants from the air. Its primary function is to filter out pollutants such as dust, pollen, pet dander, smoke, and volatile organic compounds (VOCs), thereby reducing allergens and harmful particles that can affect respiratory health. Air purifiers utilize a range of filtration technologies, including HEPA filters that capture 99.97% of particles as small as 0.3 microns; activated carbon filters that absorb odors and gases; and UV-C light, which aids in eliminating viruses and bacteria.

The benefits of air purifiers are significant. According to the U.S. Environmental Protection Agency (EPA), indoor air can be up to five times more polluted than outdoor air, highlighting the importance of effective air purification. Studies show that air purifiers can significantly reduce airborne particles, with some models reducing particulate matter (PM2.5) levels by upto 99% in controlled environments. This can lead to improvements in health outcomes, particularly for individuals with asthma and allergies. For instance, research published in the American Journal of Respiratory and Critical Care Medicine found that air purifiers using HEPA filters can decrease asthma symptoms and reduce respiratory infections in children.

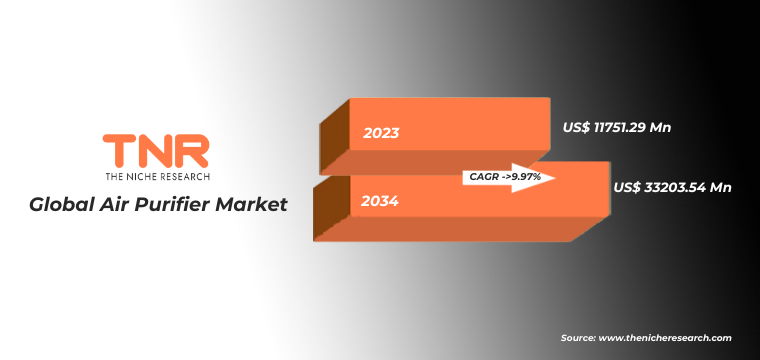

The global air purifier market is experiencing robust growth. In 2023, the market size was valued at approximately $ 11751.29 Mn, and it is projected to reach over $ 33203.54 Mn by 2034, growing at a compound annual growth rate (CAGR) of around 9.97% during 2024 – 2034. This growth reflects increasing awareness of indoor air quality and the rising prevalence of respiratory conditions worldwide. Air purifiers have become essential in both residential and commercial settings, driven by concerns about air pollution and the desire for cleaner, healthier living environments.

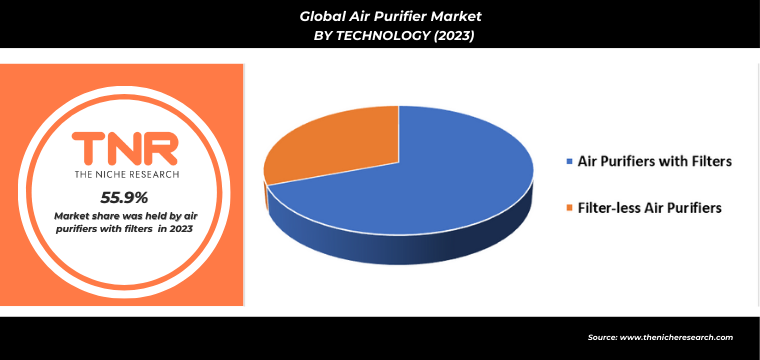

In 2023, air purifiers equipped with filters commanded the largest market share, reflecting their widespread acceptance and effectiveness in enhancing indoor air quality.

The dominance of filter-based air purifiers can be attributed to their proven performance in removing a broad spectrum of airborne pollutants. These purifiers highlight a significant shift towards solutions that offer comprehensive air purification. The primary types of filters used in these air purifiers include High-Efficiency Particulate Air (HEPA) filters, activated carbon filters, and pre-filters. HEPA filters are particularly notable for their ability to capture 99.97% of particles as small as 0.3 microns, including common allergens like dust mites, pollen, and pet dander. This exceptional level of filtration efficiency makes HEPA filters highly effective in reducing allergen levels and improving overall air quality in both residential and commercial settings.

Activated carbon filters are another crucial element, engineered to absorb gases, odors, and volatile organic compounds (VOCs) from the air.

These filters are crucial for eliminating unpleasant smells and harmful chemical pollutants, which enhances the overall comfort and healthiness of indoor environments. Activated carbon filters are often used in tandem with HEPA filters to provide a more comprehensive air purification solution. Pre-filters play a supportive role by capturing larger particles such as dust and hair, which helps to extend the life of the primary filters. By removing these larger contaminants, pre-filters reduce the strain on HEPA and activated carbon filters, improving their efficiency and reducing maintenance costs.

The growth and popularity of filter-based air purifiers are reflected in their significant market share, driven by increasing consumer awareness of indoor air quality and the health benefits associated with effective air filtration. As concerns about air pollution and respiratory health continue to rise, the demand for air purifiers with advanced filter systems is expected to maintain its upward trajectory.

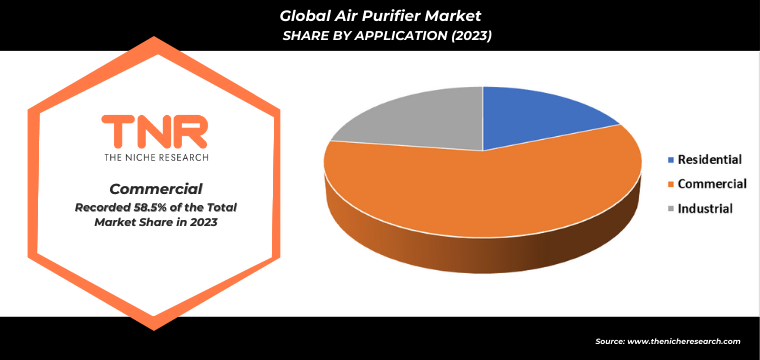

In 2023, fixed air purifiers led the market, capturing the highest share due to their efficiency and widespread application in maintaining high indoor air quality.

Fixed air purifiers, often installed as part of a building’s HVAC system or as standalone units, are designed to offer consistent and reliable air purification over larger areas. This makes them particularly suited for environments where air quality management is critical and where high air circulation is required.

For instance, in commercial settings such as office buildings and shopping malls, fixed air purifiers are integrated into the HVAC systems to ensure comprehensive air filtration across large spaces. Companies like Honeywell and Lennox have developed advanced HVAC air purification systems that combine HEPA filters with UV-C light technology. These systems are capable of efficiently removing airborne particles and pathogens, thus contributing to a healthier work environment and improved air quality. In healthcare facilities, the use of fixed air purifiers is even more pronounced. Hospitals and clinics utilize these systems to meet stringent air quality standards and minimize the risk of airborne infections. For example, Philips and AeraMax offer specialized fixed air purifiers that include HEPA filters and antimicrobial treatments, designed to provide continuous, high-efficiency filtration. These systems are crucial in ensuring that patient areas, operating rooms, and other sensitive environments are free from harmful contaminants.

The dominance of fixed air purifiers in 2023 reflects their effectiveness and versatility in a range of settings. Their ability to integrate seamlessly with existing infrastructure, combined with their proven performance in improving air quality, makes them the preferred choice for both commercial and institutional applications.

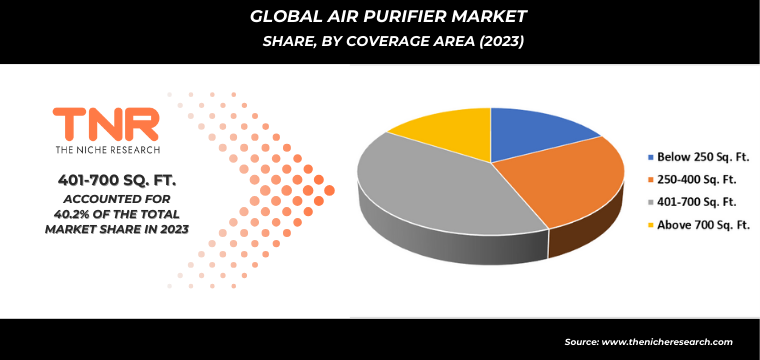

In 2023, air purifiers designed for spaces ranging from 401 to 700 square feet accounted for the largest market share, reflecting their popularity and effectiveness in both residential and small commercial environments. This segment’s prominence is driven by the versatility and practicality of air purifiers within this size range, making them an ideal choice for a wide array of applications.

For residential use, air purifiers of this size are perfectly suited for medium-sized rooms, such as living rooms, bedrooms, and home offices. Their capacity to effectively clean the air in these spaces makes them a popular choice among homeowners seeking to improve indoor air quality without requiring larger, more expensive units. Brands like Dyson and Coway have capitalized on this demand by offering compact yet powerful models that can efficiently cover areas within this range, providing significant air purification benefits for everyday use.

In small commercial settings, such as offices, boutiques, and cafes, air purifiers covering 401 to 700 square feet are highly valued for their ability to deliver effective air cleaning without occupying excessive space or requiring complex installation. These units are often favored for their balance of size, performance, and cost-efficiency. For example, the Honeywell HPA300 and the Blueair Blue Pure 411 are popular choices in this category, offering high-performance filtration in a compact design that fits well in smaller commercial environments.

The dominance of air purifiers in the 401 to 700 square feet range highlights their widespread appeal and suitability for a variety of settings. Their effective coverage of medium-sized spaces, combined with their manageable size and affordability, makes them a preferred option for consumers and businesses alike looking to enhance air quality and create healthier indoor environments.

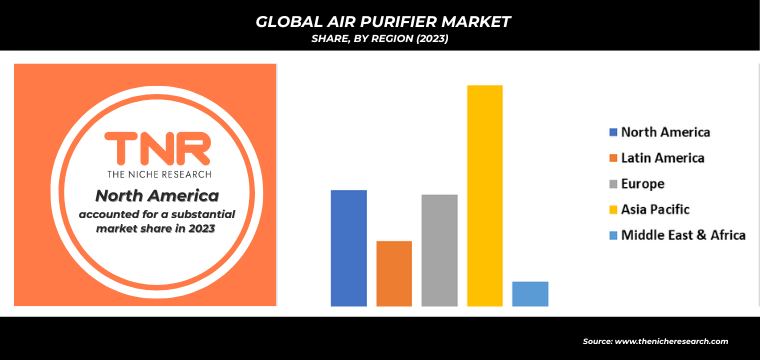

Asia-Pacific region held a dominant position in the global air purifier market in 2023, securing the lion’s share of the industry. Rapid urbanization across major cities in countries like China and India has led to increased pollution levels, driving demand for air purification solutions. Additionally, rising public awareness about the health impacts of poor air quality and the growing middle-class consumer base have further fuelled the market.

For instance, in China, cities like Beijing and Shanghai have experienced severe air pollution, prompting widespread adoption of air purifiers in residential and commercial spaces. Companies such as Xiaomi and Philips have responded to this demand by offering advanced air purifiers tailored to the specific needs of the region. Similarly, in India, the government’s initiatives to tackle air pollution, along with increasing consumer awareness, have spurred growth in the air purifier market. The Asia-Pacific region’s significant share in the air purifier market highlights its critical role in the global industry, driven by environmental concerns, economic growth, and evolving consumer preferences.

Competitive Insights: Global Air Purifier Market

- Carrier

- Dyson

- Honeywell International, Inc.

- IQAir

- Koninklijke Philips N.V

- LG Electronics

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sharp Electronics Corporation

- Unilever PLC

- Whirlpool Corporation

- Other Market Participants

Global Air Purifier Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 11751.29 Mn |

| Market Size Forecast by 2034 | US$ 33203.54 Mn |

| Growth Rate (CAGR) | 9.97% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Technology, By Mounting Type, By Application, Coverage Area, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Carrier, Dyson, Honeywell International, Inc., IQAir, Koninklijke Philips N.V, LG Electronics, Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Electronics Corporation, Unilever PLC, Whirlpool Corporation |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Air Purifier Market

By Technology

- Air Purifiers with Filters

-

- Pre-filters

- HEPA Filters

- Activated Carbon Filters

- Permanent/Washable Filters

- Filter-less Air Purifiers

-

- Air Ionizers

- Electrostatic Precipitator

- Ozone Generators

- Thermodynamic Sterilization

- Ultraviolet Germicidal Irradiation

- Photocatalytic Oxidation Cleaners

By Mounting Type

- Portable

- Fixed

By Application

- Residential

- Commercial

-

- Retail Shops

- Offices

- Healthcare Facilities

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Industrial

By Coverage Area

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

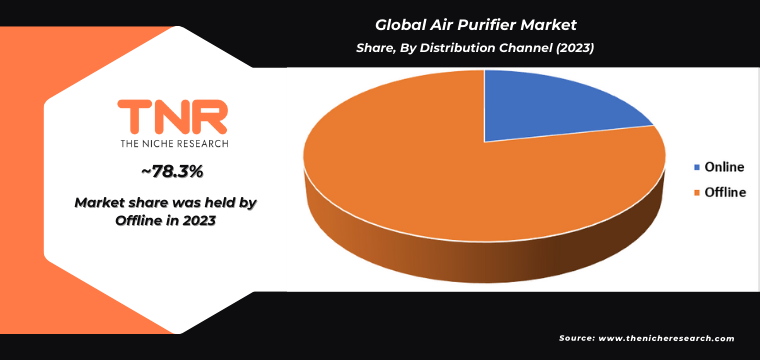

By Distribution Channel

- Online

-

- Company Owned Websites

- eCommerce Websites

- Offline

-

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Air Purifier Market

By Technology

- Air Purifiers with Filters

-

- Pre-filters

- HEPA Filters

- Activated Carbon Filters

- Permanent/Washable Filters

- Filter-less Air Purifiers

-

- Air Ionizers

- Electrostatic Precipitator

- Ozone Generators

- Thermodynamic Sterilization

- Ultraviolet Germicidal Irradiation

- Photocatalytic Oxidation Cleaners

By Mounting Type

- Portable

- Fixed

By Application

- Residential

- Commercial

-

- Retail Shops

- Offices

- Healthcare Facilities

- Schools & Educational Institutions

- Laboratories

- Transport

- Others

- Industrial

By Coverage Area

- Below 250 Sq. Ft.

- 250-400 Sq. Ft.

- 401-700 Sq. Ft.

- Above 700 Sq. Ft.

By Distribution Channel

- Online

-

- Company Owned Websites

- eCommerce Websites

- Offline

-

- Hypermarkets/Supermarkets

- Retail Stores

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.