Global Switchgear Market By Component, By Voltage, By Insulation Type, By Installation Type, By End Use Industry, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Semiconductors & Electronics

- Report ID: NR-110-1293

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10201

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Switchgear Market refers to the collection of devices that control, protect, and isolate electrical circuits and equipment in power systems. These devices, such as circuit breakers, fuses, switches, and protective relays, play a crucial role in ensuring the safety and efficiency of electrical grids and industrial power systems. Switchgear ensures uninterrupted electricity flow, minimizes risks of electrical faults, and isolates sections of electrical networks for maintenance or fault rectification.

Historically, the switchgear market has evolved from basic mechanical devices to highly sophisticated electrical and electronic systems. The growing demand for reliable and efficient power distribution, coupled with the need for safety in industrial, commercial, and residential settings, has driven this evolution. Initially, switchgear was primarily mechanical, with manual operations for disconnecting and protecting circuits. However, with technological advancements, switchgear systems have integrated digital controls, automation, and intelligent systems, allowing for remote monitoring and operation.

In recent years, the switchgear market has also shifted towards eco-friendly and compact designs, with a focus on reducing carbon emissions, improving energy efficiency, and meeting modern safety standards. This has led to the development of smart switchgear, which is equipped with sensors and real-time data analysis for predictive maintenance, thereby minimizing downtime and enhancing performance.

Global Switchgear Market Trends & Insights

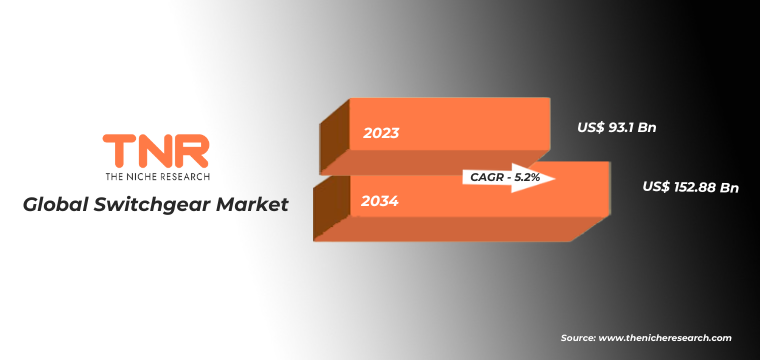

In terms of revenue, the global switchgear market was valued at US$ 93.1 Bn in 2023, anticipated to gain CAGR of 5.2% During 2024 -2034. The switchgear market is undergoing substantial growth and transformation, driven by several pivotal trends. Digitalization and smart grids are significantly reshaping the landscape, with the global smart grid technology market expected to reach USD 61.9 billion by 2028, growing at a CAGR of 19.1% from 2023 to 2028. This surge is propelled by the integration of automation, IoT sensors, and real-time data analytics in switchgear systems, which enhance operational efficiency, improve fault detection, and enable predictive maintenance. In 2024, over 30% of new switchgear installations in the industrial sector are anticipated to incorporate smart monitoring capabilities, fostering intelligent energy management and reducing downtime.

The growing demand for renewable energy is another critical driver for the switchgear market. As global investments in renewable energy sources like solar and wind power are projected to exceed USD 1.5 trillion by 2025, there is an increasing need for advanced switchgear solutions that can manage the variable energy inputs and ensure seamless power transmission. These switchgear systems are essential for integrating renewable energy into existing power grids, accommodating the intermittent nature of renewable sources, and enhancing grid stability and reliability.

Urbanization and industrialization are further fuelling the demand for efficient power distribution systems. Rapid urban expansion, particularly in emerging economies, coupled with the development of extensive industrial infrastructure, is driving the need for robust and scalable switchgear solutions. The number of urban infrastructure projects is expected to grow at a CAGR of 6.2% through 2027, necessitating advanced switchgear to support the expanding electrical networks and ensure uninterrupted power supply to burgeoning urban and industrial areas.

There is a notable shift towards eco-friendly switchgear that utilizes non-toxic and recyclable materials, aligning with global sustainability goals. Approximately 45% of switchgear manufacturers have introduced green switchgear products in the past three years, reflecting the industry’s commitment to reducing carbon footprints and promoting sustainable practices. This trend is driven by stringent environmental regulations and the growing preference for sustainable infrastructure among consumers and businesses alike.

Segmental Insights: Global Switchgear Market

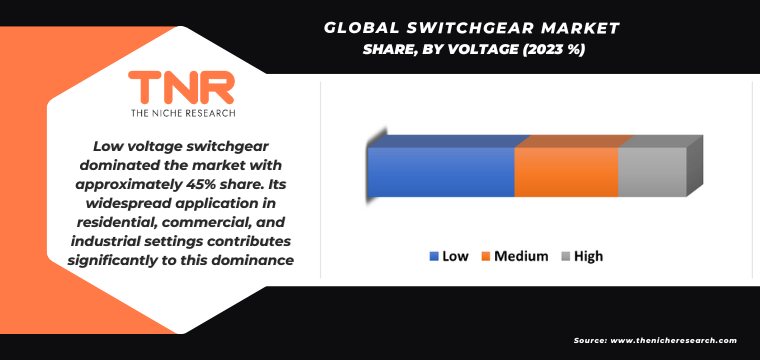

Low Voltage Switchgear segment led the switchgear market in 2023, primarily due to its extensive use across residential, commercial, and industrial sectors. Low voltage switchgear, which controls electrical circuits upto 1,000 volts, is essential for power distribution in buildings, infrastructure projects, and manufacturing plants.

For example, in commercial buildings such as offices and shopping malls, low voltage switchgear ensures the safe distribution of power to lighting, air conditioning, and elevators. In residential settings, low voltage switchgear is critical for managing electricity within homes and apartment complexes, ensuring safe operation of electrical appliances and protection against faults like short circuits.

In industrial environments, manufacturers use low voltage switchgear to manage machinery, equipment, and production lines, where uninterrupted power is essential for operational efficiency. Global players like ABB, Schneider Electric, and Siemens lead this segment, offering advanced low-voltage switchgear integrated with smart monitoring systems for improved performance and reduced downtime.

The dominance of this segment in 2023 was further driven by increased urbanization and industrialization, particularly in developing countries across Asia and Africa, where demand for reliable electricity is surging. For instance, infrastructure expansion in countries like India and China has spurred the adoption of low voltage switchgear systems in new housing projects and smart city developments. By 2023, the low voltage switchgear segment accounted for over 45% of the overall market, and it is expected to maintain its leadership due to continued infrastructure growth and the need for reliable power distribution.

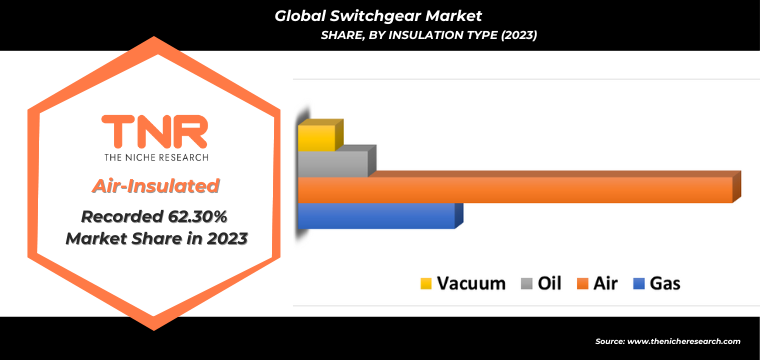

In 2023, the Air-Insulated Switchgear (AIS) segment emerged as the largest in the global switchgear market, accounting for over 60% of total market share. This dominance is primarily due to its cost-effectiveness, ease of installation, and suitability for a wide range of applications. Air-insulated switchgear utilizes air as the primary dielectric medium for insulation between electrical components, which makes it a reliable and economical choice for medium-voltage and low-voltage applications.

For example, AIS is commonly used in power distribution networks for industrial plants, commercial buildings, and urban infrastructure projects. The technology is particularly preferred in open-air substations and areas where space is not a constraint. Its popularity is also driven by the fact that it requires less maintenance compared to gas-insulated switchgear (GIS), making it a cost-efficient solution for many utilities and industries.

Major companies like Siemens, ABB, and Schneider Electric are at the forefront of developing air-insulated switchgear solutions, continuously enhancing their designs to meet modern safety standards and efficiency requirements. With rising investments in power infrastructure in regions like Asia-Pacific and Africa, where the expansion of grids is crucial for economic development, AIS is expected to remain a dominant segment. Its affordability and ease of use in diverse environments, combined with advancements in safety features, make it the preferred option for utilities and industries.

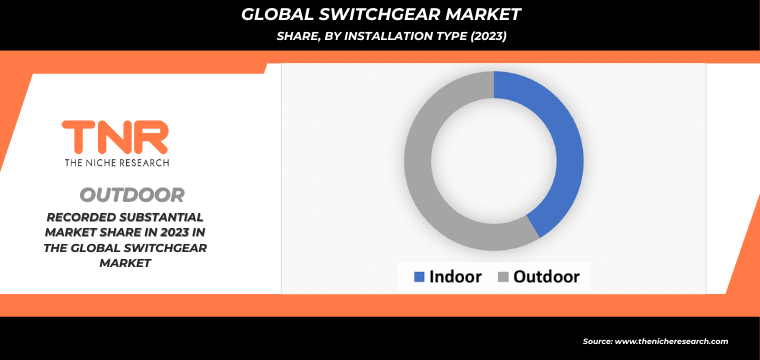

The outdoor installation segment held a significant share of the switchgear market due to its vital role in power transmission and distribution systems, especially in large-scale infrastructure projects. Outdoor switchgear installations are designed to withstand harsh environmental conditions and are primarily used in substations, industrial plants, and utility grids where the control and distribution of electricity over long distances are essential.

This segment’s large market share is driven by the growing need for reliable power transmission infrastructure in regions experiencing rapid urbanization and industrialization. For example, countries such as India, China, and Brazil are investing heavily in upgrading and expanding their power grids to meet increasing energy demands, driving the demand for outdoor switchgear installations. These systems are critical for maintaining uninterrupted power supply across large geographical areas, especially in remote or rural regions where indoor installations are impractical.

Moreover, outdoor switchgear installations are essential for renewable energy projects such as solar and wind farms, which require robust systems to handle variable power inputs. With the rise in renewable energy projects globally, especially in areas with vast open spaces, outdoor switchgear has become a preferred solution for efficient power distribution. Companies like Eaton, GE, and Siemens are focusing on developing outdoor switchgear with enhanced durability and safety features to cater to the growing demand in regions with extreme weather conditions.

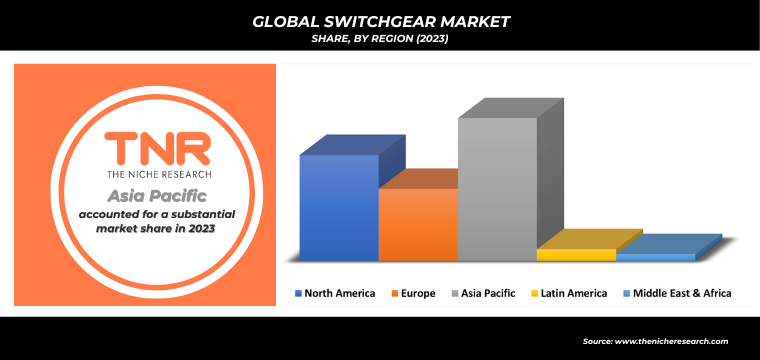

In 2023, the Asia-Pacific region secured the highest market share in the global switchgear market, driven by rapid urbanization, industrial growth, and large-scale infrastructure development projects. Countries such as China, India, Japan, and South Korea have emerged as key contributors to the region’s dominance, with substantial investments in upgrading and expanding power generation and distribution networks.

China, as the largest consumer of switchgear in the region, plays a pivotal role, supported by its massive infrastructure initiatives such as the Belt and Road Initiative (BRI) and ongoing urbanization efforts. In 2023, China accounted for over 30% of the Asia-Pacific market share, driven by its focus on renewable energy projects and smart grid implementation. Similarly, India is witnessing robust growth in the switchgear market, largely fuelled by the Smart Cities Mission and increasing demand for electricity in both rural and urban areas. The Indian government’s target to generate 450 GW of renewable energy by 2030 further accelerates the demand for advanced switchgear solutions, particularly for solar and wind power generation.

The region’s dominance is also underpinned by its significant investments in industrial infrastructure and power distribution systems to accommodate rising energy consumption. In Southeast Asia, countries like Vietnam and Indonesia are rapidly expanding their energy infrastructure, further boosting the switchgear market in the region.

Overall, in 2023, Asia-Pacific region captured over 40% of the global switchgear market share, with continued growth anticipated due to the expanding grid networks, renewable energy projects, and a surge in industrial and commercial activities across developing economies. The presence of key industry players such as Hitachi Energy, Fuji Electric, and Toshiba further strengthens the region’s market leadership.

Key companies operating in the global switchgear market are:

- ABB Ltd.

- Abdullah Abunayyan Holding

- Alstom

- BHEL

- Caterpillar

- CG Power & Industrial Solutions Ltd.

- Eaton Corporation

- Fuji Electric

- Havells India Pvt. Ltd.

- Hitachi Limited

- Hyundai Electric and Energy Systems

- IEM

- Meta Switchgear

- Noja Power Switchgear Pty. Ltd.

- Powell Industries

- Schlender Electric

- Siemens AG

- TIPECO

- Toshiba Corporation

- Wahah Electric Supply Company

- WEG SA

- Other Industry Participants

Global Switchgear Market: Key Highlights

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 93.1 Bn |

| Market Size Forecast by 2034 | US$ 152.88 Bn |

| Growth Rate (CAGR) | 5.2% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component, By Voltage, By Insulation Type, By Installation Type, By End Use Industry |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | ABB Ltd., Abdullah Abunayyan Holding, Alstom, BHEL, Caterpillar, CG Power & Industrial Solutions Ltd., Eaton Corporation, Fuji Electric, Havells India Pvt. Ltd., Hitachi Limited, Hyundai Electric and Energy Systems, IEM, Meta Switchgear, Noja Power Switchgear Pty. Ltd., Powell Industries, Schlender Electric, Siemens AG, TIPECO, Toshiba Corporation, Wahah Electric Supply Company, WEG SA ,Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com |

Global Switchgear Market

By Component

- Power-Conducting Components

- Switches

- Circuit Breakers

- Fuses

- Insulators

- Others

- Control-System Components

- Transformers

- Control Panel

- Others

- Relays

- Capacitor

- MCCB

- Bus Bars

- Bushings

- Others

By Voltage

- Low

- Medium

- High

By Insulation Type

- Gas

- Air

- Oil

- Vacuum

By Installation Type

- Indoor

- Outdoor

By End-User Industry

- Residential

- Commercial

- Industrial

- Utilities

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Global Switchgear Market Report Layout

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion

**Exclusive for Multi-User and Enterprise User.

Global Switchgear Market

By Component

- Power-Conducting Components

- Switches

- Circuit Breakers

- Fuses

- Insulators

- Others

- Control-System Components

- Transformers

- Control Panel

- Others

- Relays

- Capacitor

- MCCB

- Bus Bars

- Bushings

- Others

By Voltage

- Low

- Medium

- High

By Insulation Type

- Gas

- Air

- Oil

- Vacuum

By Installation Type

- Indoor

- Outdoor

By End-User Industry

- Residential

- Commercial

- Industrial

- Utilities

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.