Global Neobanking Market By Account Type, By Service Type, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: BFSI

- Report ID: TNR-110-1326

- Number of Pages: 420

- Table/Charts : Yes

- October, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10023

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Neobanking refers to digital-only banks that operate without traditional physical branches. These banks offer services through mobile apps and websites, providing customers with easy, round-the-clock access to financial services. The global neobanking market has seen significant growth, driven by increasing smartphone penetration and demand for convenient banking solutions. As of 2024, the market is expected to expand rapidly, with notable players like Revolut, N26, and Chime leading the charge.

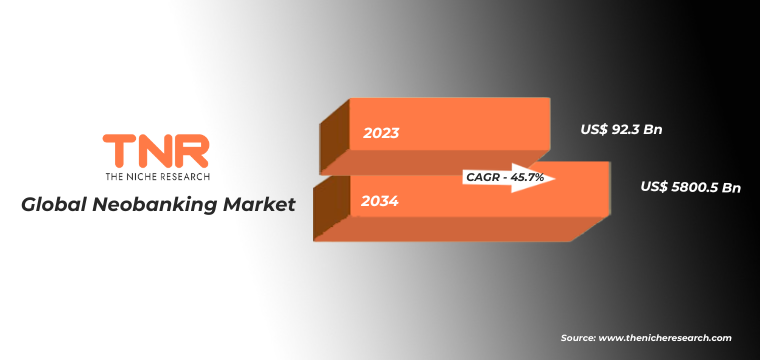

Neobanks offer services such as savings accounts, personal loans, and investment options with minimal fees, making them attractive to younger, tech-savvy users. For example, Monzo allows customers to manage their finances, set budgets, and track spending in real-time. Neobanking is important because it democratizes banking access, offering personalized services and promoting financial inclusion for underbanked populations. “In terms of revenue, the global neobanking market was worth US$ 92.3 Bn in 2023, anticipated to witness a CAGR of 45.7% during 2024 – 2034.”

| Feature/Development | Description | Applications | Examples | Year |

| User-Friendly Interfaces | Intuitive mobile applications designed for seamless navigation and usability. | Enhances customer engagement and satisfaction. | Chime and N26 both emphasize simple, clean app designs. | 2023 |

| Real-Time Notifications | Instant alerts for transactions, helping users track their spending and account activity. | Improves financial awareness and control. | Monzo offers real-time notifications for every transaction. | 2023 |

| Budgeting and Saving Tools | Built-in tools to help users manage their finances, set budgets, and save automatically. | Encourages better financial habits. | Revolut allows users to set budgets and track spending by category. | 2023 |

| Integrated Financial Services | Combining multiple financial products such as loans, investments, and insurance in one app. | Streamlines banking experiences for users. | N26 offers integrated savings and investment products within its app. | 2023 |

| Personalized Financial Insights | Use of AI and data analytics to provide tailored recommendations based on user behavior. | Aids in informed financial decision-making. | Starling Bank provides personalized spending insights using AI. | 2023 |

| Cryptocurrency Services | Offering features for buying, selling, and holding cryptocurrencies directly within the app. | Attracts tech-savvy and investment-oriented users. | Revolut provides a platform for cryptocurrency trading alongside traditional banking services. | 2023 |

| Instant Loan Approvals | Quick and easy access to personal loans with minimal paperwork. | Meets urgent financial needs of users. | N26 allows users to apply for personal loans directly through the app, with quick approvals. | 2023 |

| Multi-Currency Accounts | Enabling users to hold and exchange multiple currencies seamlessly. | Ideal for frequent travelers and international transactions. | Wise (formerly TransferWise) and Revolut offer multi-currency accounts for global use. | 2023 |

| Seamless Payments | Instant money transfers and payment processing features integrated within the app. | Facilitates everyday transactions effortlessly. | Chime provides instant transfers between users and supports payments via Apple Pay and Google Pay. | 2023 |

| Enhanced Security Features | Advanced security measures such as biometric authentication and two-factor authentication. | Protects user data and enhances trust. | N26 employs biometric login and real-time transaction alerts to enhance security. | 2023 |

Global Neobanking Market Segmental Analysis:

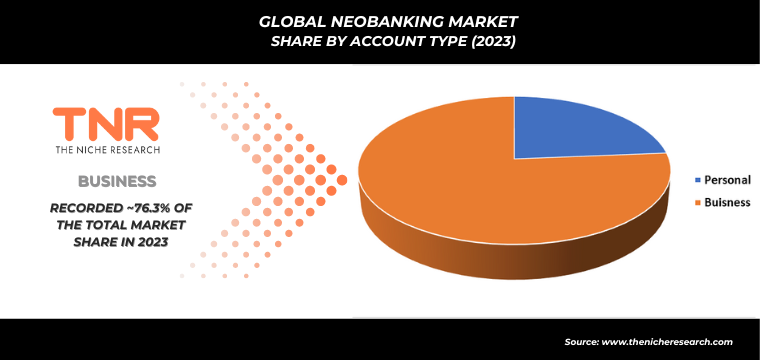

Neobanking Market By Account Type

Business segment dominated the global neobanking market in 2023 with revenue share of 76.3%. Neobanks catering to businesses offer tailored solutions such as streamlined payments, expense management, and digital invoicing. For instance, Tide and Qonto are popular neobanks focusing on small to medium-sized enterprises (SMEs), providing easy integration with accounting software and efficient financial management tools. These banks offer flexible, low-cost services, reducing the need for traditional banking processes. For example, Airwallex enables businesses to manage cross-border payments seamlessly, supporting global operations. Such services make neobanks a preferred option for startups and SMEs seeking cost-effective and efficient financial management solutions in 2023.

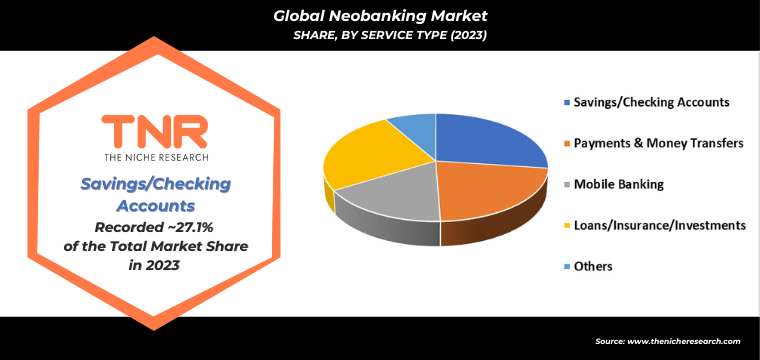

Neobanking Market By Service Type

In 2023, loans/insurance/investments segment is anticipated to grow fastest in the global neobanking market, capturing a revenue share of 25.5% in 2023. Neobanks like N26 and Revolut are expanding their services by offering personal loans, investment options, and insurance products, which attract tech-savvy customers. For example, Monzo provides access to investment opportunities through its app, enabling users to manage their portfolios conveniently. These services appeal to users seeking affordable, transparent financial products without the complexities of traditional banks. Chime, for instance, offers credit-building loans with no hidden fees, making financial tools more accessible. This rapid growth reflects the increasing demand for integrated financial services from digital banks in 2023.

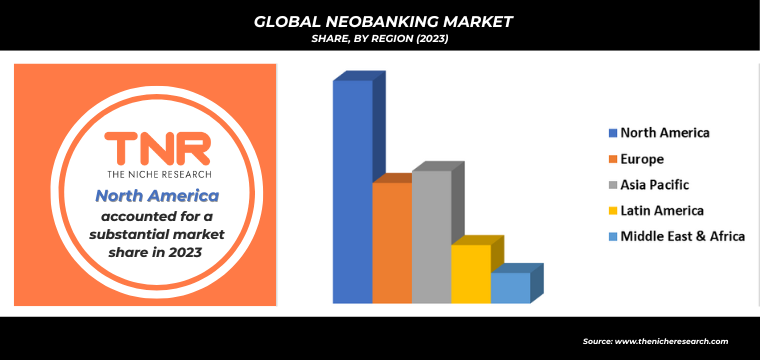

Neobanking Market By Region

Europe is expected to be the fastest-growing region in the neobanking market during the forecast period, capturing a revenue share of 21.3% in 2023. The rise of digital-first banks like Revolut, N26, and Monzo has fueled this growth, with these neobanks offering user-friendly platforms, low fees, and innovative services. Countries such as the UK and Germany are leading the charge, as consumers increasingly prefer digital banking solutions over traditional banks. For example, N26 provides comprehensive mobile banking services, including budgeting tools and investment options, catering to the needs of European users. This rapid growth in Europe is driven by high smartphone penetration, increased digital adoption, and a demand for more flexible banking services in 2023.

Global Neobanking Market Dynamics

Global Neobanking Market Growth Driver:

- Increased Smartphone Penetration: Smartphone adoption globally is driving the growth of the neobanking market, as customers prefer managing finances through mobile apps. In 2023, banks like Chime and Monzo gained popularity for offering seamless mobile experiences. With digital access, users can quickly open accounts, make transactions, and track expenses, fueling market growth.

- Cost-Effective Banking Services: Neobanks provide low-cost alternatives to traditional banking, appealing to customers seeking budget-friendly financial solutions. For instance, Revolut and Tide offer minimal fees on services like transfers and loans. This affordability, combined with transparent pricing models, is drawing more consumers and businesses, boosting the global neobanking market’s expansion in 2023.

Global Neobanking Market Restraint:

- Regulatory Challenges: Neobanks face strict regulations across different countries, complicating their operations. For instance, N26 had to withdraw from the U.S. market in 2021 due to compliance issues. Varying regulations on data protection, security, and financial practices can slow market expansion, making it difficult for neobanks to scale globally in 2023.

- Limited Customer Trust: Despite offering innovative services, some consumers are hesitant to trust neobanks due to the lack of physical branches. For example, customers may feel uneasy about entrusting all their finances to entirely digital platforms like Chime or Monzo. This perceived risk can limit the adoption of neobanking services, restraining market growth in 2023.

Global Neobanking Market Opportunity:

- Expansion into Underserved Markets: Neobanks have significant growth potential in underserved markets, such as rural areas and emerging economies where traditional banking is limited. For example, Tandem Bank and Monzo can tap into these regions by offering accessible, digital banking solutions, expanding financial inclusion and accelerating market growth globally in 2023.

- Integration of Advanced Technologies: The adoption of AI and blockchain presents opportunities for neobanks to enhance customer experience and security. For instance, Revolut uses AI to provide personalized financial insights, while blockchain technology can improve transaction transparency. These innovations are likely to drive customer acquisition and growth in the global neobanking market in 2023.

Global Neobanking Market Trends:

- Personalized Financial Services: In 2023, neobanks are increasingly leveraging AI to offer personalized financial services. For example, Revolut provides customized budgeting tools and spending insights tailored to individual users’ habits. This trend enhances user experience, helping customers make informed financial decisions, while positioning neobanks as innovative, customer-centric alternatives to traditional banks.

- Partnerships with Fintechs: Neobanks are forming strategic partnerships with fintech companies to enhance service offerings. In 2023, Monzo collaborated with third-party fintech platforms to integrate investment and insurance products. These partnerships allow neobanks to expand their product range, meeting diverse customer needs and staying competitive in the evolving digital banking landscape.

Competitive Landscape

The global neobanking market is highly competitive, with key players like Revolut, Chime, N26, and Monzo dominating in 2023. These neobanks compete by offering low fees, user-friendly apps, and innovative features such as AI-driven financial insights. Tide and Qonto focus on business customers, while Starling Bank excels in customer service and lending. The competition is intensified by the rapid adoption of digital banking and fintech partnerships, as seen with Monzo’s collaboration to offer insurance products. Traditional banks are also entering the digital space, increasing competition and pushing neobanks to continually innovate to attract and retain customers.

- In October 2023, Neobank PoetrYY collaborated with Mbanq to deliver digital financial solutions aimed at startups, underserved communities, individuals, and small businesses.

Some of the players operating in the neobanking market are

- Atom Bank PLC

- Fidor Bank Ag

- Monzo Bank Ltd.

- Movencorp Inc.

- Mybank

- N26

- Revolut Ltd.

- Simple Finance Technology Corp.

- Ubank Limited

- Webank, Inc.

- Other Industry Participants

Global Neobanking Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 92.3 Bn |

| Market Size Forecast by 2034 | US$ 5800.5 Bn |

| Growth Rate (CAGR) | 45.7% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Account Type, By Service Type, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Atom Bank PLC, Fidor Bank Ag, Monzo Bank Ltd., Movencorp Inc., Mybank, N26, Revolut Ltd., Simple Finance Technology Corp., Ubank Limited, Webank, Inc. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Neobanking Market

By Account Type

- Personal

- Business

By Service Type

- Savings/Checking Accounts

- Payments & Money Transfers

- Mobile Banking

- Loans/Insurance/Investments

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Neobanking Market

By Account Type

- Personal

- Business

By Service Type

- Savings/Checking Accounts

- Payments & Money Transfers

- Mobile Banking

- Loans/Insurance/Investments

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.