Global Wealth Management Platform Market By Advisory Mode, By Business Function, By Deployment Model, By Industry, By Region: Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2023 – 2031

- Industry: Technology

- Report ID: TNR-110-938

- Number of Pages: 420

- Table/Charts : Yes

- November, 2023

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10332

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

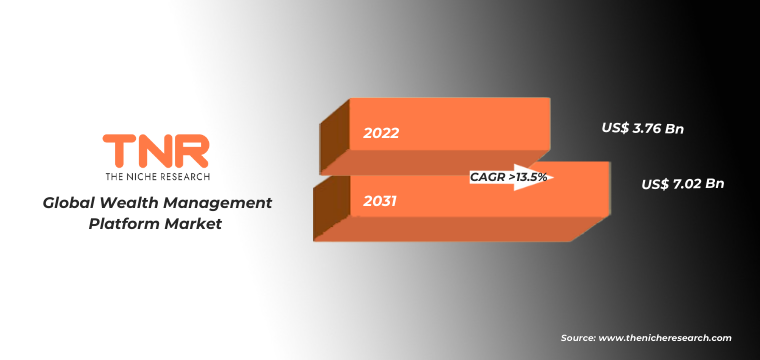

Global Wealth Management Platform Market was valued at US$ 3.76 Billion in 2022, Growing at an Estimated CAGR of 13.5% from 2023-2031.

A wealth management platform is a comprehensive software solution that assists financial institutions and advisors in managing their clients’ investments, financial planning, and wealth-related services. It offers tools for portfolio management, risk assessment, reporting, and client communication to optimize wealth growth and meet individual financial goals.

In the global wealth management platform market, human advisory was the dominating model, especially among traditional wealth management firms. These firms continued to rely on human advisors who offered personalized, high-touch services. This study found that a majority of wealth management firms in 2022 still offered human advisory services, indicating its dominant position.

COVID-19 Impact Analysis on Global Wealth Management Platform Market

Pre-COVID-19, the wealth management platform market saw steady growth due to digitalization and demand for personalized financial services. Post-COVID-19, the pandemic accelerated the adoption of digital platforms, particularly robo advisory, as investors sought remote, tech-driven solutions amid market volatility, reshaping the industry towards accessibility and technology integration.

Global Wealth Management Platform Market Revenue & Forecast, (US$ Million), 2015 – 2031

A key driver in the wealth management platform market is the ongoing digital transformation of the financial industry. The proliferation of online and mobile channels has pushed firms to enhance their digital capabilities to meet the changing preferences of clients, especially younger generations. The adoption of digital tools and robo-advisory platforms has improved accessibility and reduced operational costs, attracting a broader clientele. This driver highlights the pivotal role of digitalization in reshaping wealth management.

One significant restraint in the wealth management platform market is the increasingly complex and evolving regulatory environment. Regulations, such as MiFID II in Europe or the Department of Labor’s fiduciary rule in the US, have imposed stricter rules on financial institutions, impacting fee structures and transparency requirements. Compliance with these regulations requires substantial investments in technology and operational adjustments, which can strain profit margins. Achieving and maintaining compliance is a challenging and costly endeavor for wealth management firms, posing a notable restraint in the market and limiting their flexibility in pricing and service offerings.

Financial advice management was the dominating business function in the wealth management platform market in 2022. This category encompasses the core advisory services provided by wealth managers, and its dominance is attributed to the importance of human expertise in wealth management.

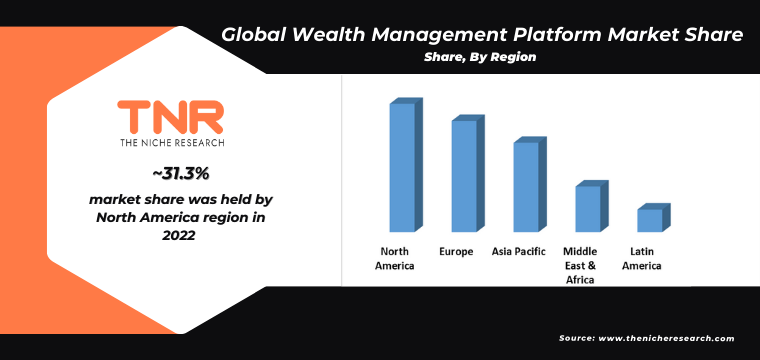

North America dominated the global wealth management platform market in 2022. The region’s dominance is supported by statistics indicating significant assets under management (AUM) and a mature financial services industry. According to the study, North America had the highest AUM in the world in 2022, with the US being a key contributor.

Competitive Landscape

A few of the key players operating in the global wealth management platform market are

- Broadridge Financial Solutions, Inc.

- Comarch SA

- Dorsum

- FIS

- Fiserv, Inc.

- InvestEdge, Inc.

- Profile Software

- SEI

- SS&C Technologies, Inc.

- Temenos Headquarters SA

- Verdict Media Limited

- Other Industry Participants

Report Summary of Global Wealth Management Platform Market

| Report Specifications | Details |

| Market Revenue in 2022 | US$ 3.76 Billion |

| Market Size Forecast by 2031 | US$ 7.02 Billion |

| Growth Rate (CAGR) | 13.5% |

| Historic Data | 2015 – 2021 |

| Base Year for Estimation | 2022 |

| Forecast Period | 2023 – 2031 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Advisory Mode, By Business Function, By Deployment Model, By Industry |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Broadridge Financial Solutions, Inc., Comarch SA, Dorsum, FIS, Fiserv, Inc., InvestEdge, Inc., Profile Software, SEI, SS&C Technologies, Inc., Temenos Headquarters SA, Verdict Media Limited, Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): – +81 663-386-8111 South Korea (Toll-Free): – +82-808- 703-126 Saudi Arabia (Toll-Free): – +966 800 850 1643 United States: +1 302-232-5106 United Kingdom: +447537105080 E-mail: askanexpert@thenicheresearch.com

|

Global Wealth Management Platform Market:

By Advisory Model

- Human Advisory

- Robo Advisory

- Hybrid

By Business Function

- Financial Advice Management

- Portfolio, Accounting, and Trading Management

- Performance Management

- Risk and Compliance Management

- Reporting

- Others

By Deployment Model

- On-Premises

- Cloud

By Industry

- Banks

- Investment Management Firms

- Trading and Exchange Firms

- Brokerage Firms

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Coverage and Deliverables:

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Wealth Management Platform Market Segmentation

By Advisory Model

By Business Function

By Deployment Model

By Industry

By Region

**Note: The report covers cross-segmentation analysis by region further into countries

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.