Global Warehousing and Distribution Market By Ownership, By Warehouse Type, By Organization Size, By Regional Coverage, By Industry Verticals & By Region: Global Insights, Growth, Size, Comparative Analysis, Trends and Forecast, 2023 – 2031

- Industry: Automotive & Transportation

- Report ID: TNR-110-1022

- Number of Pages: 420

- Table/Charts : Yes

- November, 2023

- Base Year : 2024

- No. of Companies : 27+

- No. of Countries : 29

- Views : 10195

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

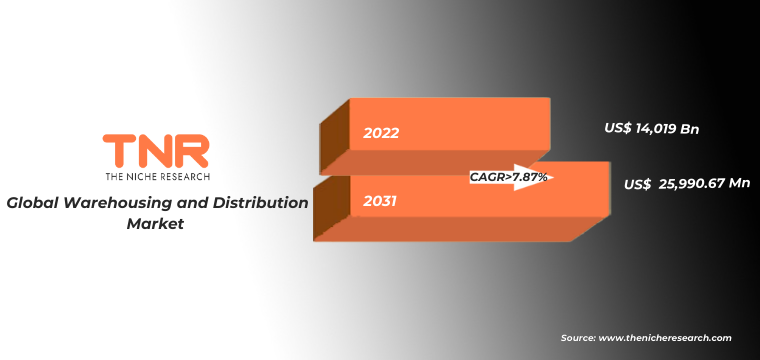

Global Warehousing and Distribution Market Accounted for US$ 14,019 Billion in 2022, Growing at an Estimated CAGR of 7.87% from 2023-2031.

Warehousing and distribution are essential components of the supply chain management process, helping companies store and transport goods efficiently to meet customer demand. These two functions play crucial roles in ensuring that products are available when and where they are needed.

Warehousing involves the physical storage of goods and materials. Warehouses are facilities where companies store their inventory before it is needed for production, distribution, or sale. On the other hand, distribution is the process of getting products from the manufacturer or warehouse to the end customers or intermediaries (e.g., retailers or wholesalers). It involves a series of activities and transportation methods to ensure that products reach their intended destinations efficiently and on time.

Efficient warehousing and distribution practices are critical for reducing lead times, minimizing costs, improving customer satisfaction, and ensuring smooth flow of goods through supply chain. Many businesses rely on advanced technology, such as warehouse management systems (WMS) and transportation management systems (TMS), to optimize these processes and stay competitive in the warehousing and distribution market.

Global Warehousing and Distribution Market Revenue & Forecast, (US$ Million), 2015 – 2031

Pandemic Impact on Global Warehousing and Distribution Market

The COVID-19 pandemic had a significant impact on the warehousing and distribution market. The share of the warehouse and logistics industry increased dramatically, from 2% in 2020 to 20% in 2021. This indicates that these sectors played a crucial role in addressing the increased demand for essential goods and the shift towards e-commerce during the pandemic. While some aspects of the industry experienced challenges, others saw increased demand and opportunities.

Increased Demand for E-commerce:

With lockdowns and restrictions in place, there was a surge in online shopping as more consumers turned to e-commerce for their retail needs. This led to a higher demand for warehousing and distribution market facilities to store and fulfill online orders.

Supply Chain Disruptions:

The pandemic disrupted global supply chains, causing delays in the production and transportation of goods. This disruption highlighted the need for more resilient and adaptable supply chain strategies, including warehousing and distribution market solutions.

Inventory Challenges:

Many companies faced challenges in managing their inventory due to fluctuating demand patterns and disruptions in the supply chain. Some had to increase their warehousing capacity to store excess inventory, while others sought more efficient inventory management solutions.

Increased Focus on Safety and Hygiene:

Warehousing and distribution facilities had to implement strict safety measures to protect workers from the virus. This included measures like social distancing, enhanced cleaning protocols, and the adoption of automation and robotics to reduce human contact.

Accelerated Adoption of Technology:

The pandemic accelerated the adoption of technology in the warehousing and distribution market. Companies invested in automation, robotics, and digital tools to improve efficiency, reduce labor dependency, and enhance order fulfillment processes.

Adaptation to Omnichannel Retail:

Retailers and brands had to adapt to omnichannel retailing, which involves seamlessly integrating online and offline sales channels. This required adjustments in warehousing and distribution market strategies to meet the demands of both digital and physical retail.

The increase in demand for warehousing and distribution market in the e-commerce sector has been a prominent trend, driven by factors such as the growth of online shopping, consumer expectations for faster deliveries, and the need for efficient supply chain management. E-commerce has been one of the fastest-growing sectors globally. In India, for instance, the e-commerce market was projected to reach over $200 billion by 2026, up from approximately $39 billion in 2019. Amazon is a prime example of an e-commerce giant with extensive warehousing and distribution capabilities.

The company operates a vast network of fulfillment centers and uses advanced logistics technology to ensure speedy and efficient deliveries. Amazon has been continuously expanding its warehouse network, both in the United States and globally. In 2020, Amazon reportedly added around 50 million square feet of warehouse space in the United States alone. E-commerce sales were on a steady upward trajectory, and the COVID-19 pandemic further accelerated this growth. In 2020, e-commerce sales in the United States reached over $791 billion, marking a 32.4% increase compared to the previous year, according to the U.S. Department of Commerce.

Beyond Amazon, other e-commerce giants like Walmart, Alibaba, and JD.com, along with numerous smaller e-commerce businesses, were investing significantly in warehousing infrastructure. This trend was driven by the growing importance of fast and reliable delivery in the e-commerce landscape Thus, e-commerce companies are increasingly using technology solutions such as warehouse management systems (WMS), automated picking and packing systems, and route optimization software to enhance the efficiency of their warehousing and distribution market operations.

Ownership and demand for bonded and non-bonded warehouses can vary depending on the specific regulations and requirements of each country or region.

Bonded Warehouse: A bonded warehouse is a storage facility where imported goods are stored without the payment of customs duties and taxes until they are either exported, re-exported, or cleared for domestic consumption. The ownership and operation of bonded warehouses can take several forms:

- Government-Owned Bonded Warehouses: In some countries, the government owns and operates bonded warehouses to facilitate international trade. These warehouses are typically managed by customs authorities.

- Private Bonded Warehouses: Private companies or individuals can also own and operate bonded warehouses. These private warehouses are often used by businesses engaged in import and export activities to defer customs duties and taxes until the goods are released for domestic consumption or export.

Demand for Bonded Warehouses: The demand for bonded warehouses in the warehousing and distribution market is influenced by several factors:

- International Trade: Countries with significant international trade activities tend to have higher demand for bonded warehouses. These facilities help businesses manage their import and export operations more efficiently.

- Industry Needs: Specific industries, such as manufacturing, logistics, and distribution, may have a higher demand for bonded warehouses due to their reliance on imported raw materials and components.

- Regulatory Environment: The demand for bonded warehouses can also be affected by changes in customs regulations, trade agreements, and tariff structures.

Non-Bonded Warehouse: A non-bonded warehouse, often simply referred to as a regular or public warehouse, is a facility where goods are stored, and customs duties and taxes have been paid. These warehouses are suitable for storing goods intended for domestic consumption or distribution within the country of operation.

Demand for Non-Bonded Warehouses: The demand for non-bonded warehouses in the warehousing and distribution market is generally influenced by the following factors:

- Domestic Distribution: Companies that distribute products within a country’s domestic market often require non-bonded warehouses to store inventory and manage supply chains.

- Retail and E-commerce: The growth of retail, e-commerce, and omnichannel distribution has increased the demand for non-bonded warehouses to support efficient order fulfillment and last-mile delivery.

- Manufacturing: Manufacturers may require non-bonded warehouses to store raw materials, work-in-progress, or finished goods before they are distributed or sold within the country.

- Seasonal Demand: Some industries, such as agriculture and retail, may experience seasonal fluctuations in demand for non-bonded warehouse space due to factors like harvest seasons and holiday shopping.

The North American warehousing and distribution market is experiencing robust growth, underpinned by the relentless rise of e-commerce, changing consumer behavior, and the need for efficient supply chain solutions. The driving force behind the surge in demand for warehousing and distribution market services in North America is the e-commerce revolution. With consumers increasingly turning to online shopping, businesses are adapting by expanding their warehousing capacities and fine-tuning their distribution networks to meet the demand for rapid, hassle-free deliveries. Green warehousing practices are gaining momentum.

Companies are embracing sustainable designs, renewable energy sources, and eco-friendly packaging to reduce their environmental footprint. Moreover, third-party logistics (3PL) providers are playing a pivotal role in the North American market. Businesses are increasingly relying on 3PLs to manage their warehousing and distribution needs, allowing them to focus on core operations. Additionally, the pharmaceutical, biotech, and food industries are driving the demand for cold storage and temperature-controlled logistics solutions. The distribution of vaccines and temperature-sensitive medical supplies has further accentuated this trend, propelling the global warehousing and distribution market demand.

Competitive Landscape

Some of the players operating in the global warehousing and distribution market are

- A.P. Moller – Maersk

- Agility

- Aramex

- CEVA

- CJ Logistics Corporation

- CWT Ltd

- DB Schenker

- Deutsche Post AG

- DHL Supply Chain

- DSV

- FedEx

- GAC

- Gemadept

- GWC

- Keppel Logistics

- Kerry Logistics

- Kuehne + Nagel

- Nippon Express Co., Ltd.

- NYK Line

- Schenker AG

- Segi Fresh

- Singapore Post

- Tiong Nam Logistics

- Toll Holdings Limited.

- United Parcel Service of America, Inc.

- WHA Corp

- XPO Logistics, Inc.

- Ych Group

- Yusen Logistics

- Other Industry Participants

Global Warehousing and Distribution Market Report Coverage

| Report Specifications | Details |

| Market Revenue in 2022 | US$ 14,019 Million |

| Market Size Forecast by 2031 | US$ 25,990.67 Million |

| Growth Rate (CAGR) | 7.87% |

| Historic Data | 2015 – 2021 |

| Base Year for Estimation | 2022 |

| Forecast Period | 2023 – 2031 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Ownership, By Warehouse Type, By Organization Size, By Regional Coverage, By Industry Verticals |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | A.P. Moller – Maersk, Agility, Aramex, CEVA, CJ Logistics Corporation, CWT Ltd, DB Schenker, Deutsche Post AG, DHL Supply Chain, DSV, FedEx, GAC, Gemadept, GWC, Keppel Logistics, Kerry Logistics, Kuehne + Nagel, Nippon Express Co., Ltd., NYK Line, Schenker AG, Segi Fresh, Singapore Post, Tiong Nam Logistics, Toll Holdings Limited., United Parcel Service of America, Inc., WHA Corp, XPO Logistics, Inc., Ych Group, Yusen Logistics, Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): – +81 663-386-8111 South Korea (Toll-Free): – +82-808- 703-126 Saudi Arabia (Toll-Free): – +966 800 850 1643 United States: +1 302-232-5106 United Kingdom: +447537105080 E-mail: askanexpert@thenicheresearh.com

|

Global Warehousing and Distribution Market

By Ownership

- Bonded Warehouse

- Non-Bonded Warehouse

By Warehouse Type

- General Warehouse

- Air Cargo Warehouse

- Rail Based Warehouse

- Cold Storage and Temperature Controlled Warehouse

- Container Freight Stations

- Others

By Organization Size

- Small and Medium Organizations

- Large Organizations

By Regional Coverage

- Domestic

- International

By Industry Verticals

- Automotive

- Agriculture

- Manufacturing

- Retail and Consumer Goods

- Food and Beverage

- Chemicals

- Pharmaceuticals and Healthcare

- Metals

- IT and Electronics

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Coverage and Deliverables: LINK

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Warehousing and Distribution Market Segmentation

By Ownership

By Warehouse Type

By Organization Size

By Regional Coverage

By Industry Verticals

By Region

**Note: The report covers cross-segmentation analysis by region further into countries

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.