Global Semiconductor & IC Packaging Materials Market: By Type, By Packaging Technology, By Industry, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Semiconductors & Electronics

- Report ID: TNR-110-1111

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10164

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Semiconductor and integrated circuit (IC) packaging materials are essential components in the manufacturing of semiconductor devices, which power a wide range of electronic devices such as smartphones, computers, automotive electronics, and industrial machinery. These materials play a crucial role in protecting semiconductor chips, providing electrical connections, dissipating heat, and ensuring reliability and performance.

Continuous advancements in semiconductor manufacturing technologies, such as Moore’s Law, have led to the development of smaller, faster, and more complex semiconductor devices. As semiconductor chips become denser and more integrated, there is a growing demand for advanced packaging materials that can meet the requirements for higher performance, reliability, and miniaturization. The increasing adoption of electronic devices, including smartphones, tablets, wearables, automotive electronics, IoT devices, and data center infrastructure, drives the demand for semiconductor and IC packaging materials. These materials are essential components in the manufacturing of semiconductor chips that power a wide range of electronic products and applications.

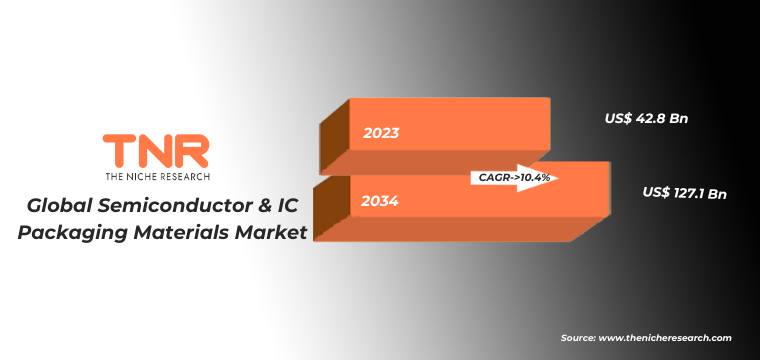

In terms of revenue, the global semiconductor & IC packaging materials market was worth US$ 42.8 Bn in 2023, anticipated to witness CAGR of 10.4% during 2024 – 2034.

Global Semiconductor & IC Packaging Materials Market Dynamics

Rapid Adoption of Emerging Technologies: The increasing adoption of emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), 5G connectivity, autonomous vehicles, and augmented reality (AR) fuels demand for semiconductor devices with higher performance, functionality, and integration. This drives the need for advanced packaging materials that can enable the development of next-generation semiconductor devices required for these applications.

Growing Demand for Electronic Devices: The proliferation of electronic devices, including smartphones, tablets, wearables, automotive electronics, and smart appliances, drives the demand for semiconductor and IC packaging materials. These materials are essential components in the manufacturing of semiconductor chips that power a wide range of consumer and industrial electronics products.

Miniaturization and Integration Trends: The trend towards miniaturization and integration of semiconductor components drives the need for advanced packaging technologies that can enable higher levels of integration and functionality in smaller form factors. Advanced packaging techniques such as flip-chip packaging, system-in-package (SiP), and chip-on-board (COB) require specialized materials capable of providing high-density interconnections, thermal management, and reliability.

Global Semiconductor & IC Packaging Materials Market Revenue & Forecast, (US$ Million), 2016 – 2034

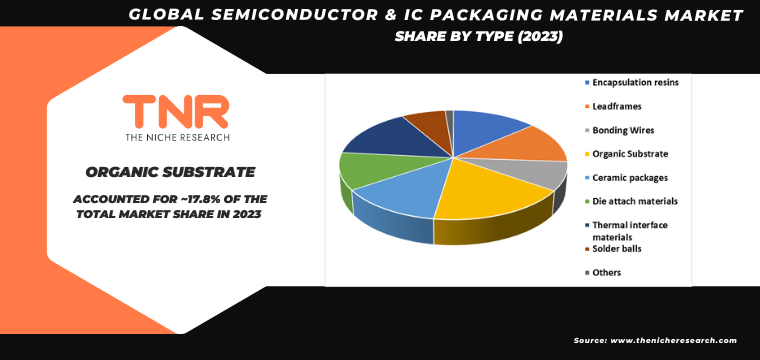

Organic Substrate Segment Dominated the Global Semiconductor & IC Packaging Materials Market During the Forecast Period (2024 – 2034).

Organic substrates offer cost advantages compared to alternative substrate materials such as ceramics and glass. Their lower manufacturing cost and compatibility with standard PCB fabrication processes make them attractive for volume production of semiconductor packages, particularly in consumer electronics and mobile devices where cost optimization is crucial. Organic substrates are compatible with advanced packaging technologies such as flip-chip packaging, chip-on-board (COB), and embedded die packaging. Their flexibility and adaptability to various packaging configurations enable the development of innovative semiconductor packages with improved performance, functionality, and form factor.

As semiconductor devices become smaller and more integrated, there is a growing demand for organic substrates that can provide high-density interconnects and support advanced packaging techniques such as fan-out wafer-level packaging (FOWLP) and system-in-package (SiP). Organic substrates offer advantages such as flexibility, lightweight, and cost-effectiveness, making them suitable for miniaturized and integrated semiconductor packages. With the increasing demand for high-speed and high-frequency semiconductor devices in applications such as 5G communication, automotive radar, and data center infrastructure, there is a need for organic substrates capable of supporting high-speed signal transmission and reducing signal loss. Organic substrates with low dielectric constant (low-k) and controlled impedance properties are preferred for such applications.

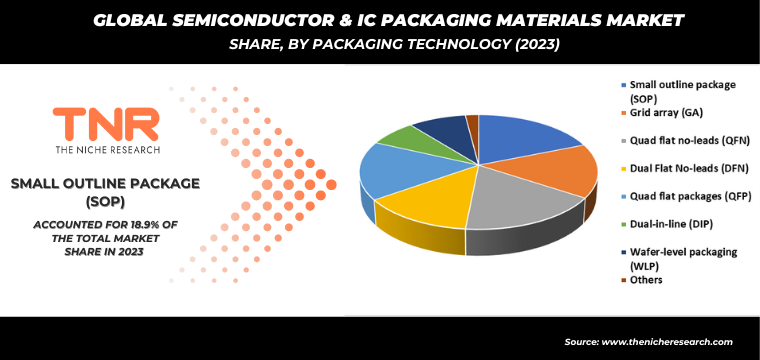

Small Outline Package (SOP) Segment had the Highest Share in the Global Semiconductor & IC Packaging Materials Market in 2023.

SOPs are favored for their compact size and space-saving design, making them ideal for applications where board space is limited. As electronic devices continue to shrink in size and demand for smaller form factors increases, there is a growing need for SOPs to accommodate the miniaturization trend in consumer electronics, automotive electronics, IoT devices, and wearables. SOPs offer cost advantages compared to larger package formats such as Dual Inline Packages (DIPs) or Quad Flat Packages (QFPs).

Their smaller size and simpler construction result in lower material and manufacturing costs, making SOPs a cost-effective option for mass-produced semiconductor devices in consumer electronics and other high-volume applications. SOPs are available in various configurations, including SOP-8, SOP-16, SOP-28, and SOP-32, among others, catering to different pin counts and package sizes. This versatility allows semiconductor manufacturers to choose the most suitable SOP variant for their specific application requirements. Additionally, SOPs adhere to industry-standard dimensions and footprints, ensuring compatibility with existing PCB layouts and assembly processes. Its superior pin density, surface mount technology (SMT) compatibility, thermal management skills, adaptability, and electrical performance make it the industry leader in semiconductor and IC packaging materials.

Consumer Electronics Industry Segment had the Highest Share in the Global Semiconductor & IC Packaging Materials Market in 2023.

The consumer electronics industry segment dominated the global Semiconductor & IC Packaging Materials market, in terms of revenue and is estimated to sustain its dominance over the forecast period. Consumer electronics manufacturers are constantly innovating to introduce smaller, lighter, and more powerful devices with enhanced features and functionalities. This trend towards miniaturization drives the demand for advanced packaging materials that can accommodate densely packed semiconductor chips while ensuring optimal performance and reliability. Consumers increasingly demand high-performance electronic devices such as smartphones, tablets, laptops, gaming consoles, and wearables. These devices require advanced semiconductor chips with higher processing power, memory capacity, and energy efficiency, driving the need for sophisticated packaging materials capable of supporting the performance requirements of these devices.

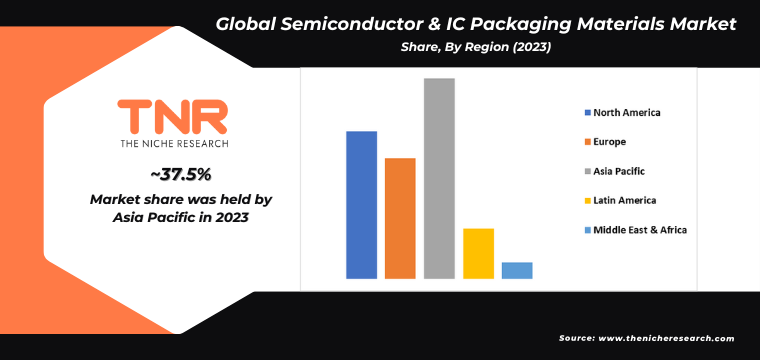

By Region Asia Pacific had the Highest Share in the Global Semiconductor & IC Packaging Materials Market in 2023.

The Asia-Pacific region is experiencing rapid industrialization and urbanization, driving the demand for electronic devices across various sectors such as consumer electronics, automotive, telecommunications, and industrial automation. This surge in demand for electronic products fuels the need for semiconductor devices and, consequently, semiconductor packaging materials. Asia-Pacific is a hub for semiconductor manufacturing, with countries like China, Taiwan, South Korea, and Japan leading the production of semiconductor chips. The region’s semiconductor industry is witnessing significant growth due to increasing investments in research and development, technology innovation, and manufacturing infrastructure. This growth in semiconductor production drives the demand for packaging materials required to package and protect semiconductor chips.

Competitive Landscape: Global Semiconductor & IC Packaging Materials Market:

- Amkor Technology

- ASE

- Henkel AG & Co. KGaA

- IBIDEN CO., LTD.

- Jiangsu ChangJian Technology Co., Ltd.

- Kyocera Corporation

- LG Chem Ltd.

- Powertech Technology Inc.

- Siliconware Precision Industries Co., Ltd.

- Texas Instruments

- Other Industry Participants

Global Semiconductor & IC Packaging Materials Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 42.8 Bn |

| Market Size Forecast by 2034 | US$ 127.1 Bn |

| Growth Rate (CAGR) | 10.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Type, By Packaging Technology, By Industry, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | LG Chem Ltd., Jiangsu ChangJian Technology Co., Ltd., Henkel AG & Co. KGaA, Kyocera Corporation, ASE, Siliconware Precision Industries Co., Ltd., Amkor Technology, Texas Instruments, IBIDEN CO., LTD., Powertech Technology Inc. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Semiconductor & IC Packaging Materials Market

By Type

- Encapsulation resins

- Leadframes

- Bonding Wires

- Organic Substrate

- Ceramic packages

- Die attach materials

- Thermal interface materials

- Solder balls

- Others

By Packaging Technology

- Small outline package (SOP)

- Grid array (GA)

- Quad flat no-leads (QFN)

- Dual Flat No-leads (DFN)

- Quad flat packages (QFP)

- Dual-in-line (DIP)

- Wafer-level packaging (WLP)

- Others

By Industry

- Consumer electronics

- Automotive

- Aerospace & defence

- IT & telecommunication

- Healthcare

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Semiconductor & IC Packaging Materials Market

By Type

- Encapsulation resins

- Leadframes

- Bonding Wires

- Organic Substrate

- Ceramic packages

- Die attach materials

- Thermal interface materials

- Solder balls

- Others

By Packaging Technology

- Small outline package (SOP)

- Grid array (GA)

- Quad flat no-leads (QFN)

- Dual Flat No-leads (DFN)

- Quad flat packages (QFP)

- Dual-in-line (DIP)

- Wafer-level packaging (WLP)

- Others

By Industry

- Consumer electronics

- Automotive

- Aerospace & defence

- IT & telecommunication

- Healthcare

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.