Global Advertising Market, By Platform, By Add Format, By Industry Vertical, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Technology

- Report ID: TNR-110-1117

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10163

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

The advertising market is thriving, driven by digital transformation and data analytics. With global ad spending projected to grow, digital advertising dominates, fueled by social media, mobile usage, and programmatic advertising. Opportunities abound in personalized and interactive ads, leveraging AI and machine learning to target consumers effectively. Video and influencer marketing are also booming, capturing audience attention and engagement. Emerging trends include the rise of connected TV (CTV), augmented reality (AR) ads, and sustainable, socially responsible advertising. Brands are focusing on creating immersive, relevant experiences while respecting privacy concerns. The shift towards omnichannel strategies ensures a cohesive consumer journey across multiple platforms, reflecting the market’s dynamic and innovative nature.

In Terms of Revenue, the Global Advertising Market was Worth US$ 717.4 Bn in 2023, Anticipated to Witness CAGR of 5.4% During 2024 – 2034.

Trends in the Global Advertising Market

- Rise of Programmatic Advertising: Programmatic advertising, which uses automated processes and algorithms to purchase ad space, is revolutionizing the global advertising market. This trend enables advertisers to target specific audiences more precisely and efficiently, resulting in higher ROI. Programmatic ads leverage vast amounts of data, including user behavior, demographics, and real-time analytics, to serve personalized and relevant ads to users. This method also allows for real-time bidding, ensuring that ad space is bought and sold at optimal prices. As a result, programmatic advertising is becoming a dominant force, offering scalability and enhanced performance. Brands can now reach their audiences across various digital channels seamlessly, making their campaigns more effective and cost-efficient.

- Growth of Video and Connected TV (CTV) Advertising: Video and Connected TV (CTV) advertising are experiencing significant growth, transforming how brands engage with consumers. With the proliferation of streaming services and on-demand content, advertisers are shifting budgets towards video ads that run on platforms like YouTube, Hulu, and Netflix. CTV advertising allows for highly targeted and interactive ads that capture viewers’ attention in a more immersive environment. The rise of smart TVs and OTT (over-the-top) devices has expanded the reach and effectiveness of these ads. Moreover, advancements in measurement and attribution technologies are enabling advertisers to track the impact of CTV campaigns accurately. This trend highlights the increasing importance of high-quality, engaging video content in reaching today’s digitally-savvy audiences.

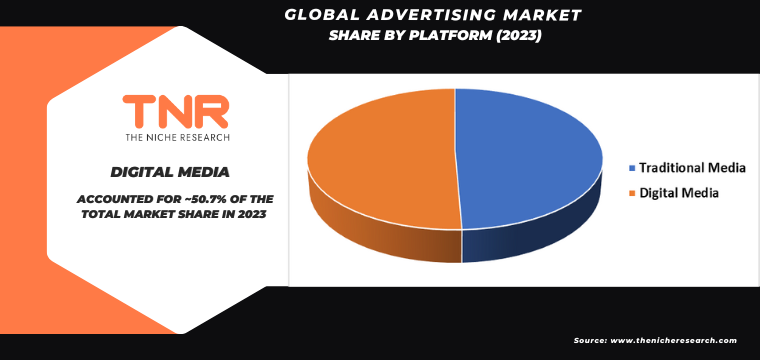

Digital media platforms have captured a substantial share of the global advertising market, driven by their ability to reach targeted audiences with precision and scale. Social media giants like Facebook, Instagram, and TikTok, along with search engines like Google, dominate ad spending due to their extensive user bases and sophisticated data analytics capabilities. These platforms offer various ad formats, including display, video, and native ads, allowing brands to engage users in diverse and interactive ways. The rise of mobile usage further amplifies digital media’s influence, with mobile advertising becoming a key revenue driver. Innovations in artificial intelligence and machine learning enhance targeting and personalization, ensuring that ads resonate with specific audiences, thereby boosting engagement and conversion rates.

In 2023, image-based advertising has emerged as the second-largest ad format in the global advertising market. This format’s popularity is driven by its visual appeal and ability to quickly convey messages, making it highly effective for brand awareness and engagement. Platforms like Instagram, Pinterest, and Facebook capitalize on image ads, leveraging their visually-driven interfaces to captivate users. High-quality images can communicate brand identity, evoke emotions, and drive consumer actions, especially when combined with compelling calls-to-action. Additionally, advancements in technology, such as augmented reality (AR) and interactive image ads, enhance user interaction and experience. The growth of e-commerce and visual search also boosts the demand for image ads, as consumers increasingly rely on visual content to inform purchasing decisions.

The entertainment and media segment within the industry vertical of the global advertising market is positioned for remarkable growth, expected to capture a substantial revenue market share of 13.1% throughout the forecast period.

This surge is fuelled by several factors, including the proliferation of digital platforms, streaming services, and the increasing demand for engaging content. Advertisers are drawn to this segment due to its ability to reach highly engaged audiences across various channels, including television, streaming platforms, podcasts, and social media. Moreover, advancements in technology enable targeted advertising, personalized content delivery, and interactive experiences, enhancing the effectiveness of campaigns within this segment. As consumers continue to prioritize entertainment and media consumption, advertisers are capitalizing on this trend, driving significant growth opportunities in the industry.

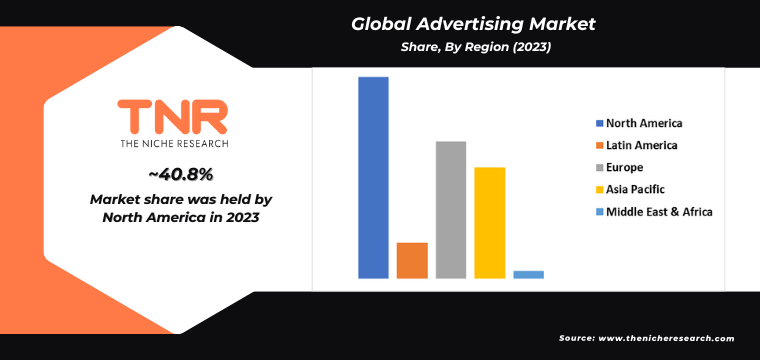

In 2023, North America asserted its dominance in the advertising market, emerging as the leading region in terms of advertising expenditure and market share.

This stronghold can be attributed to several factors, including the region’s robust economy, high levels of consumer spending, and advanced digital infrastructure. North America boasts a diverse media landscape, encompassing traditional outlets such as television, radio, and print, as well as digital platforms like social media, search engines, and streaming services. Furthermore, the presence of major tech and advertising companies headquartered in North America contributes to the region’s advertising prowess. Advertisers are drawn to the region’s affluent and tech-savvy population, offering ample opportunities to target and engage with diverse demographics. As a result, North America continues to lead the global advertising market, setting trends and driving innovation in the industry.

Competitive Landscape

Some of the players operating in the advertising market are

- Dentsu Inc.

- DIGITAS

- GroupM

- Havas

- IPG

- Omnicom Group Inc.

- Publicis Groupe

- R. Donnelley & Sons Company

- Weber Shandwick

- WPP Group PLC

- Other Industry Participants

Global Advertising Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 717.4 Bn |

| Market Size Forecast by 2034 | US$ 1,279.4 Bn |

| Growth Rate (CAGR) | 5.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Platform, By Add Format, By Industry Vertical, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Dentsu Inc., DIGITAS, GroupM, Havas, IPG, Omnicom Group Inc., Publicis Groupe, R.R. Donnelley & Sons Company, Weber Shandwick, WPP Group PLC |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Advertising Market

By Platform

- Traditional Media

- Television

- Radio

- Print

- Newspapers

- Magazines

- Others

- Billboards

- Digital Media

- Online Display Ads

- Social Media Ads

- Search Engine Marketing (SEM)

- Pay-per-click (PPC)

- Display ads

- Product Listing ads (PLAs)

- Email Marketing

- Programmatic Advertising

- Over-the-Top (OTT) Advertising

- Native ads

- Interactive ads

- Others

By Add Format

- Text

- Image

- Video

- Banners

- Others

By Industry Vertical

- Food and Beverage

- Travel and Hospitality

- Entertainment and Media

- Real Estate

- Education

- Healthcare

- Automotive

- BSFI

- Retail and Consumer Goods

- IT and Technology

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Advertising Market

By Platform

- Traditional Media

- Television

- Radio

- Print

- Newspapers

- Magazines

- Others

- Billboards

- Digital Media

- Online Display Ads

- Social Media Ads

- Search Engine Marketing (SEM)

- Pay-per-click (PPC)

- Display ads

- Product Listing ads (PLAs)

- Email Marketing

- Programmatic Advertising

- Over-the-Top (OTT) Advertising

- Native ads

- Interactive ads

- Others

By Add Format

- Text

- Image

- Video

- Banners

- Others

By Industry Vertical

- Food and Beverage

- Travel and Hospitality

- Entertainment and Media

- Real Estate

- Education

- Healthcare

- Automotive

- BSFI

- Retail and Consumer Goods

- IT and Technology

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.