Global Insurtech Market, By Component, By Technology, By Insurance Type, By End User, By Application, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: BFSI

- Report ID: TNR-110-1148

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10166

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

In Terms of Revenue, the Global Insurtech Market was Worth US$ 6.7 Bn in 2023 and is Anticipated to Witness a CAGR of 32.6% During 2024 – 2034.

Insurtech refers to the use of innovative technologies like AI, machine learning, and blockchain to improve and streamline the insurance industry’s processes, products, and customer experiences. The Insurtech market is experiencing rapid growth driven by technological advancements and evolving consumer preferences. Key growth drivers include the adoption of artificial intelligence (AI) and machine learning, which optimize underwriting, claims processing, and customer service through data analysis and automation. Additionally, the proliferation of mobile technology and digital platforms is fostering the rise of on-demand insurance products, catering to gig economy workers and those seeking flexible, short-term coverage.

A notable trend in the market is the shift towards personalized, user-centric insurance solutions. Consumers increasingly demand seamless, accessible, and customized experiences, which Insurtech companies are addressing through innovative digital interfaces and tailored products. Opportunities abound in the integration of blockchain technology for enhanced transparency and security, as well as the use of IoT devices for real-time risk assessment and prevention. As Insurtech continues to disrupt traditional insurance models, companies that leverage these technologies and trends stand to gain a competitive edge in this dynamic market.

Insurtech Market Dynamic

Growth Driver-

Increasing Adoption of Artificial Intelligence (AI) and Machine Learning Technologies

These technologies enable insurers to automate and optimize various processes, such as underwriting, claims processing, and customer service. AI algorithms can analyze vast amounts of data to identify patterns and predict risks more accurately, leading to more personalized and efficient insurance products. Moreover, AI-driven chatbots and virtual assistants enhance customer experience by providing instant, 24/7 support. The ability to leverage AI for fraud detection also reduces losses and operational costs. As insurers continue to recognize the transformative potential of AI and machine learning, the Insurtech market is poised for substantial growth driven by these technological advancements.

Trends-

Rise of On-Demand Insurance Products

These flexible insurance solutions cater to the evolving needs of modern consumers, offering coverage that can be activated and deactivated as required. On-demand insurance is particularly appealing to gig economy workers, freelancers, and short-term renters, providing coverage for specific activities or time periods rather than traditional long-term policies. This trend is facilitated by advancements in mobile technology and digital platforms, allowing users to purchase and manage insurance policies with ease through apps and online portals. The convenience and customization offered by on-demand insurance align with consumer preferences for tailored, user-friendly services, driving its growing popularity and adoption within the Insurtech landscape.

Challenge-

Regulatory Compliance

The insurance industry is heavily regulated, with stringent rules varying significantly across different regions and countries. Insurtech companies, often driven by innovation and rapid technological advancement, must navigate these complex regulatory environments to ensure their products and services comply with legal requirements. This can be particularly challenging for startups lacking the resources or expertise to handle regulatory intricacies. Additionally, regulators may be slow to adapt to new technologies, creating a lag between innovation and regulation. This regulatory uncertainty can hinder the pace of development and adoption of new Insurtech solutions, as companies must constantly adapt to evolving legal landscapes while maintaining compliance to avoid penalties and ensure consumer trust.

Insurtech Market Segmentation by Component, Technology, Insurance Type, End User, Application, Region

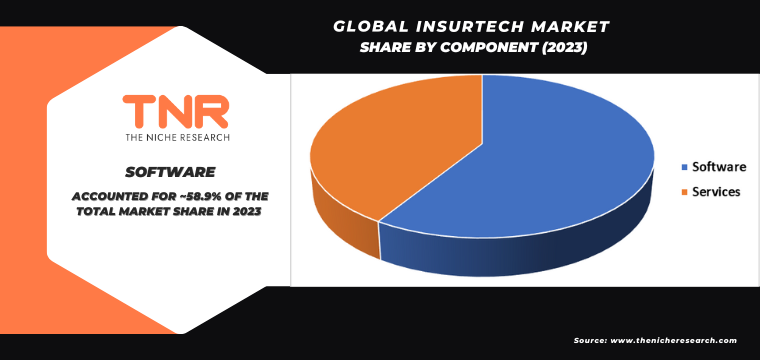

The software segment is set to dominate the insurtech market, commanding a substantial revenue share of 58.9% over the forecast period. This dominance is attributed to the increasing demand for advanced software solutions that enhance efficiency and customer experience in the insurance industry. Insurtech software facilitates automation of underwriting, claims processing, and customer service, leading to reduced operational costs and improved accuracy. Moreover, the integration of artificial intelligence and machine learning into software solutions allows for better risk assessment and fraud detection. The shift towards digitalization and the need for scalable, flexible platforms further drive the adoption of innovative software in the insurtech market.

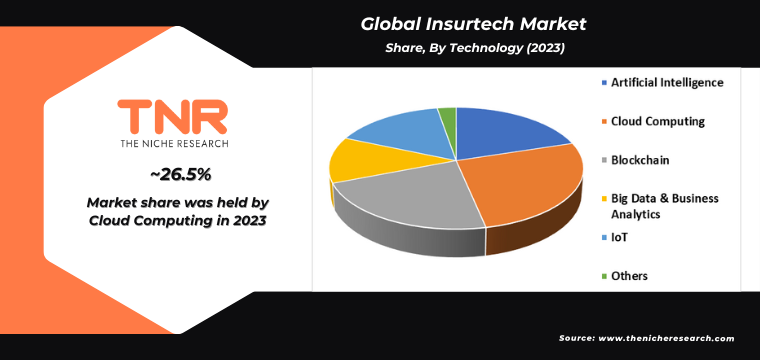

Blockchain segment is anticipated to be the fastest-growing technology in the insurtech market, capturing a substantial revenue share of 22.4% over the forecast period. This rapid growth is driven by blockchain’s ability to enhance transparency, security, and efficiency in insurance transactions. Blockchain technology ensures immutable and transparent record-keeping, reducing fraud and errors while streamlining claims processing and policy management. Smart contracts, powered by blockchain, automate and enforce contract terms, further improving efficiency and trust between insurers and policyholders. As the industry increasingly recognizes these benefits, blockchain adoption in Insurtech is expected to accelerate, transforming traditional insurance operations.

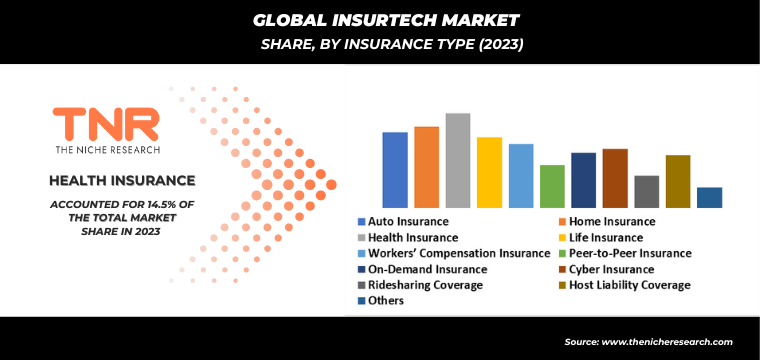

The health insurance segment dominated the Insurtech market, capturing a significant revenue share of 14.5% over the forecast period. This dominance is driven by the increasing demand for personalized and efficient health insurance solutions. Insurtech innovations in health insurance focus on enhancing customer experience through digital platforms, telemedicine, and AI-driven analytics for better risk assessment and personalized policy offerings. Additionally, the rise of wearable health devices and IoT technology allows insurers to collect real-time health data, improving underwriting processes and encouraging preventive care. These advancements contribute to the growing adoption and revenue share of the health insurance segment in the Insurtech market.

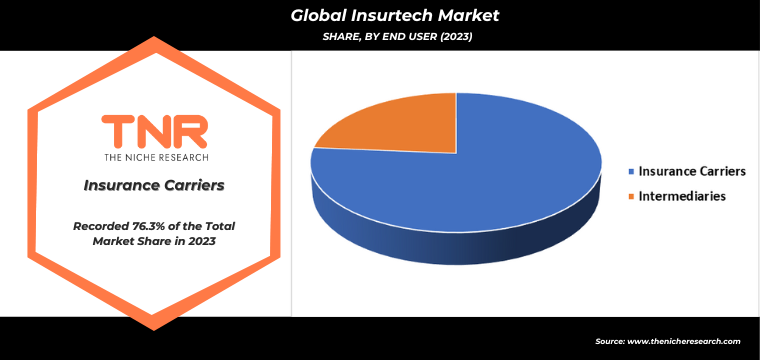

The insurance carriers segment dominated the insurtech market, accounting for a significant revenue share of 76.3%. This dominance is due to carriers’ extensive adoption of innovative technologies to streamline operations, enhance customer experience, and stay competitive. Insurtech solutions enable carriers to automate underwriting, claims processing, and customer service, leading to cost savings and improved efficiency. Additionally, carriers leverage data analytics, AI, and machine learning to better assess risks, personalize policies, and detect fraud. The push towards digital transformation and the need to meet evolving consumer expectations are driving insurance carriers to heavily invest in Insurtech, solidifying their market leadership.

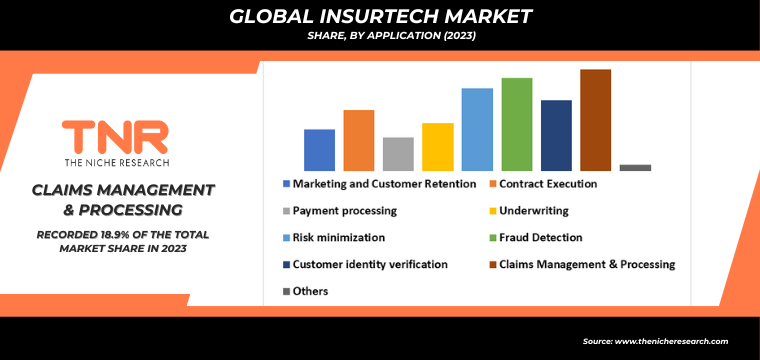

Fraud detection segment by application category dominated the insurtech market with a revenue share of 17.2% over the forecast timeline. This dominance is attributed to the growing necessity for advanced fraud prevention measures as insurance fraud cases continue to rise. Insurtech innovations in fraud detection leverage artificial intelligence, machine learning, and big data analytics to identify and predict fraudulent activities with greater accuracy. These technologies enhance the ability of insurers to detect anomalies, streamline claims processing, and reduce financial losses. The increasing emphasis on security and accuracy in insurance transactions has driven significant investment in fraud detection solutions, reinforcing its leading market position.

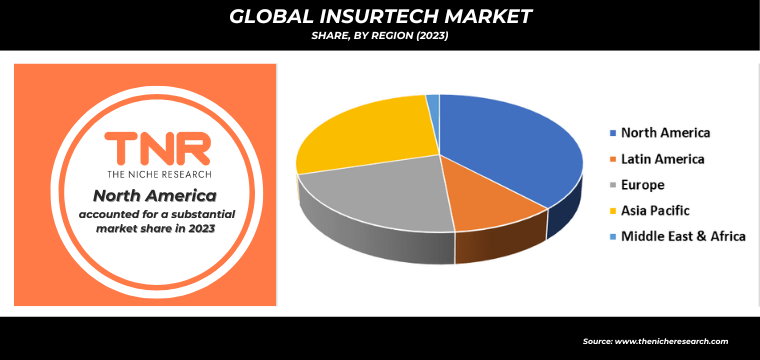

In 2023, North America is anticipated to play a significant role in propelling the growth of the insurtech market, contributing approximately 37.9% to its overall expansion. This significant role is attributed to the region’s robust technological infrastructure, high adoption rate of digital solutions, and strong presence of established insurance companies willing to invest in innovation. North America’s market leadership in Insurtech is further bolstered by favorable regulatory frameworks that encourage technological advancements in insurance practices. The region’s proactive approach towards leveraging AI, blockchain, and data analytics to enhance operational efficiency and customer experience positions it at the forefront of global Insurtech growth in the coming years.

Key Developments

- In June 2023, Clover Health Investments Corp., known for enhancing Medicare access to healthcare, announced a tentative partnership agreement to settle seven derivative lawsuits pending in Delaware, New York, and Tennessee courts.

- In November 2021, Heritage Insurance Holdings Inc., a property and casualty insurer, announced a partnership with Slide, an insurtech carrier. The collaboration aims to enhance underwriting and rating decisions through Slide’s capabilities.

- In 2021, Damco Group announced plans to prioritize partnerships with insurance carriers and integrate advanced data analytics for enhanced risk assessment.

Major Players in Insurtech Market

- Accenture

- Capgemini

- Clearcover

- Cognizant

- Damco Group.

- DXC Technology Company

- IBM

- Infosys Limited

- se

- Lemonade

- LTIMindtree Limited

- Metromile

- Microsoft

- Oracle

- Oscar Health

- Pacific Prime Insurance Brokers Limited (PPIB)

- Root Insurance

- SAP SE

- Shift Technology

- Tata Consultancy Services Limited

- Wipro Limited

- YF Life Insurance International Ltd.

- Zensar Technologies Ltd

- Other Industry Participants

Global Insurtech Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 6.7 Bn |

| Market Size Forecast by 2034 | US$ 148.3 Bn |

| Growth Rate (CAGR) | 32.6% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component, By Technology, By Insurance Type, By End User, By Application, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Accenture, Capgemini, Clearcover, Cognizant, Damco Group, DXC Technology Company, IBM, Infosys Limited, insicon.se, Lemonade, LTIMindtree Limited, Metromile, Microsoft, Oracle, Oscar Health, Pacific Prime Insurance Brokers Limited (PPIB), Root Insurance, SAP SE, Shift Technology, Tata Consultancy Services Limited, Wipro Limited, YF Life Insurance International Ltd., Zensar Technologies Ltd |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Insurtech Market

By Component

- Software

- Cloud Based

- On Premise

- Services

- Consulting

- Support & Maintenance

- Managed Services

- Others

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data & Business Analytics

- IoT

- Others

By Insurance Type

- Auto Insurance

- Home Insurance

- Health Insurance

- Life Insurance

- Workers’ Compensation Insurance

- Peer-to-Peer Insurance

- On-Demand Insurance

- Cyber Insurance

- Ridesharing Coverage

- Host Liability Coverage

- Others

By End User

- Insurance Carriers

- Intermediaries

By Application

- Marketing and Customer Retention

- Contract Execution

- Payment processing

- Underwriting

- Risk minimization

- Fraud Detection

- Customer identity verification

- Claims Management & Processing

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Global Insurtech Market

By Component

- Software

- Cloud Based

- On Premise

- Services

- Consulting

- Support & Maintenance

- Managed Services

- Others

By Technology

- Artificial Intelligence

- Cloud Computing

- Blockchain

- Big Data & Business Analytics

- IoT

- Others

By Insurance Type

- Auto Insurance

- Home Insurance

- Health Insurance

- Life Insurance

- Workers’ Compensation Insurance

- Peer-to-Peer Insurance

- On-Demand Insurance

- Cyber Insurance

- Ridesharing Coverage

- Host Liability Coverage

- Others

By End User

- Insurance Carriers

- Intermediaries

By Application

- Marketing and Customer Retention

- Contract Execution

- Payment processing

- Underwriting

- Risk minimization

- Fraud Detection

- Customer identity verification

- Claims Management & Processing

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.

Procure Comprehensive Study of

Global Insurtech Market

Online Only

- Online Access

- Read Only File

- Validity 3 Months

- Print, Copy, Paste & Download

- PPT, Excel

- Cost-Free Report in the Next Update

Single User

- Access to One User on One System

- Read Only File

- Validity 6 Months

- Limited Print,Copy, Paste

- PPT, Excel

- Cost-Free Report in the Next Update

Multi User

- Access to Fiver Users

- PDF File

- Validity 1 Year

- Upto FivePrints

- Cost-Free Report in the Next Update

- PPT, Excel

Enterprise User

- Access to Unlimited Users

- PDF, PPT, Excel

- Unlimited Validity, Prints&Downloads

- 1 Hour Cost-Free & Dedicated Analyst Support

- 10% Cost-Free Customization

- Cost-Free Report Update Twice in a Year

- Recommendations for Business Strategies

- Authorization to Quote TNR, The Niche Research

Library Access

- Online Access to Content Publications

- Access Player Profiles Online

- Get Immediate Access to Newly Added Content

- Acquire 12 PDF Downloads

- Acquire 5 Excel Data Sets

- Gain Access to 290+ PDFs of Company Profiles

- Round-the-clock Email and Phone Assistance

- Dashboard Usage and Trends

- Renewal & Upgrade Assistance

- Assessing Customization Options and Alerts for New Reports

Why TNR The Niche Research?

-

Unwavering Commitment to Excellence

-

Veteran Team of Researchers

-

Accurate and Timely Insights

-

Ethical Practices and Customized Service

-

Uninterrupted Availability Around the Clock