Global Aluminum Market, By Aluminum Type, By Product Type, By Series, By End Use Industry, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Construction & Manufacturing

- Report ID: TNR-110-1225

- Number of Pages: 420

- Table/Charts : Yes

- July, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10255

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Aluminum is a lightweight, silvery-white metal known for its versatility and wide range of applications. It is the most abundant metal in the Earth’s crust and the third most abundant element overall, after oxygen and silicon. Aluminum is valued for its low density, high strength-to-weight ratio, corrosion resistance, and excellent conductivity of electricity and heat.

The global aluminum market is witnessing robust growth, driven by rising demand in key industries such as automotive, construction, and packaging. Lightweight and recyclable, aluminum is increasingly preferred for vehicle manufacturing, enhancing fuel efficiency and reducing emissions. In construction, its durability and malleability make it a material of choice for modern architectural designs. The packaging industry values aluminum for its protective properties and sustainability credentials.

Technological advancements in production and recycling processes are enhancing efficiency and cost-effectiveness. Emerging economies, particularly in Asia-Pacific, present significant growth opportunities due to rapid industrialization and urbanization. Strategic investments in R&D and sustainable practices are poised to further bolster the aluminum market’s expansion, making it a lucrative sector for stakeholders. In Terms of Revenue, the Global Aluminum Market was Worth US$ 259.3 Bn in 2023, Anticipated to Witness CAGR of 7.6% During 2024 – 2034.

Trends in the Global Aluminum Market

- Increasing Demand for Lightweight Materials in Automotive Industry: Automakers are increasingly using aluminum to reduce vehicle weight, enhance fuel efficiency, and comply with stringent emission regulations. The shift towards electric vehicles (EVs) further amplifies this trend, as aluminum helps offset the weight of heavy batteries, extending driving range. Advanced manufacturing technologies, such as aluminum casting and extrusion, are enabling the production of complex, high-strength components, facilitating broader adoption. Additionally, the recyclability of aluminum aligns with the automotive industry’s sustainability goals, making it a preferred material. This trend is expected to drive substantial growth in the aluminum market, with ongoing innovations and collaborations between automakers and aluminum producers.

- Expansion in the Construction Sector: The construction sector is experiencing a surge in aluminum demand due to its desirable properties, such as lightweight, durability, and corrosion resistance. Modern architectural designs increasingly incorporate aluminum in building facades, window frames, roofing, and structural components. Its aesthetic appeal and flexibility in design make it a popular choice for contemporary buildings. The trend towards green buildings and sustainable construction practices further boosts aluminum usage, given its recyclability and energy efficiency. Additionally, advancements in aluminum alloy development are enhancing its strength and performance, expanding its applications in high-rise and infrastructure projects. This trend is poised to drive sustained growth in the aluminum market, supported by urbanization and infrastructural development, particularly in emerging economies.

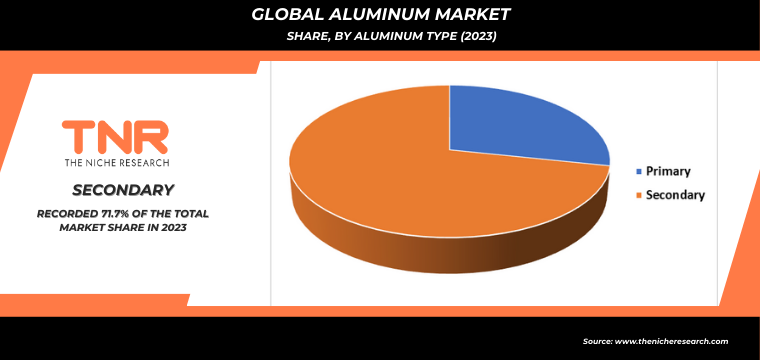

Secondary segment by aluminum type category has emerged as a dominant segment in the global aluminum market due to the increasing emphasis on sustainability and cost-efficiency. Recycled aluminum, also known as secondary aluminum, requires significantly less energy to produce compared to primary aluminum, reducing both production costs and environmental impact. This aligns with global trends towards circular economy practices and stringent environmental regulations. Additionally, the quality of recycled aluminum has improved, making it suitable for a wide range of applications in industries such as automotive, construction, and packaging. The growing availability of scrap aluminum and advancements in recycling technologies further bolster this segment, driving its prominence in the global aluminum market.

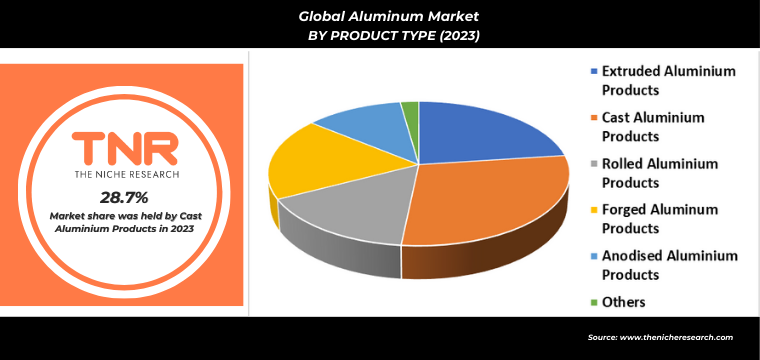

In 2023, extruded aluminium products segment solidified its position as the second-largest product type category within the global aluminum market. This growth is driven by the increasing demand in construction, automotive, and transportation industries. Extruded aluminum products, known for their strength, lightweight, and versatility, are extensively used in architectural applications, vehicle frames, and structural components. The segment’s expansion is further fueled by advancements in extrusion technology, allowing for more complex and precise designs. Additionally, the recyclability of aluminum enhances its appeal, aligning with sustainability goals and regulatory standards, thereby reinforcing the segment’s significant market presence.

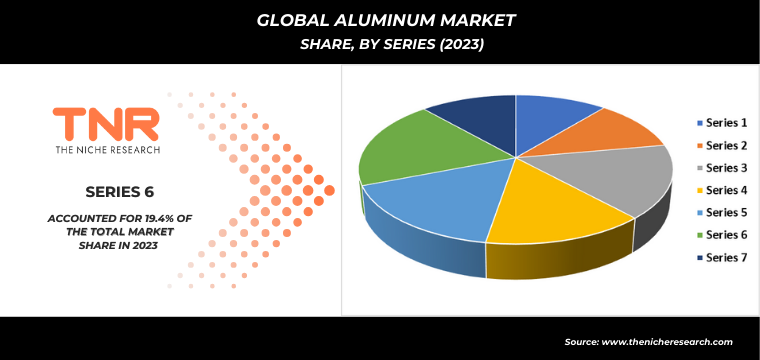

Series 6 segment, categorized by series, has exerted significant dominance over the global aluminum market. This dominance is attributed to its superior properties, such as high strength, excellent corrosion resistance, and good machinability. Comprising primarily aluminum-magnesium-silicon alloys, Series 6 is widely utilized in industries requiring durable and lightweight materials. In the automotive sector, it is favored for manufacturing structural and body components to enhance fuel efficiency and reduce emissions. The construction industry relies on Series 6 for window frames, roofing, and facades due to its aesthetic appeal and longevity. Furthermore, the segment’s growth is supported by technological advancements in alloy processing and increased demand for sustainable, recyclable materials, reinforcing its market leadership.

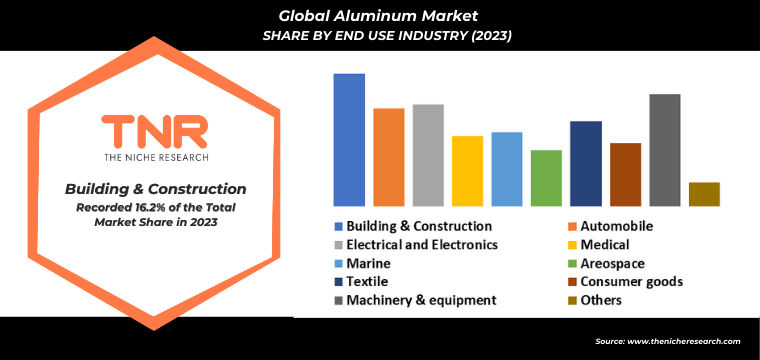

By end use industry, machinery & equipment segment is anticipated to grow fastest over the forecast timeline in global aluminum market. This growth is driven by the increasing demand for lightweight, durable, and corrosion-resistant materials in manufacturing high-performance machinery and equipment. Aluminum’s excellent thermal conductivity and ease of fabrication make it ideal for a variety of applications, from industrial machinery to consumer electronics. Additionally, advancements in aluminum alloy technologies enhance the performance and lifespan of equipment, further fueling demand. As industries continue to innovate and prioritize efficiency, the machinery and equipment segment’s expansion in the aluminum market is set to accelerate.

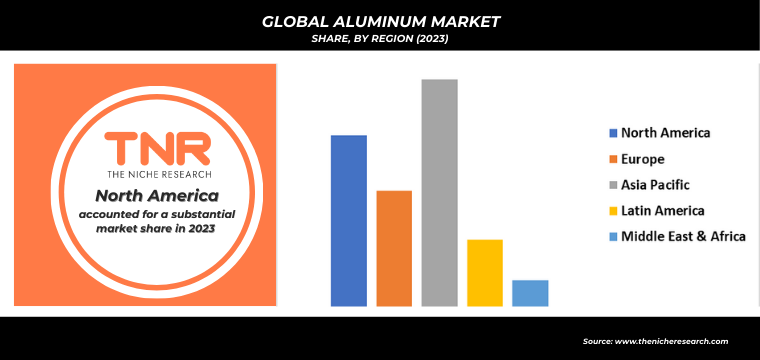

In 2023, Asia Pacific solidified its dominance in the global aluminum market, contributing a revenue share of 36.2%. This commanding presence is attributed to rapid industrialization, urbanization, and robust economic growth across major economies like China and India. The region’s significant demand for aluminum in construction, automotive, and packaging sectors drives this substantial market share. Additionally, Asia Pacific’s advanced manufacturing capabilities and strategic investments in aluminum production and recycling technologies bolster its leading position. The growing emphasis on infrastructure development and sustainable practices further enhances the region’s prominence in the global aluminum market, reinforcing its critical role in industry dynamics.

Competitive Landscape

Some of the players operating in the aluminum market are

- Aluminum Corp. of China Ltd.

- BHP Billiton Ltd.

- Emirates Global Aluminum PJSC

- Hindalco Industries

- Jindal Aluminium Limited

- Norsk Hydro ASA

- Rio Tinto Alcan Inc.

- RUSAL

- United Co.

- Vedanta Resources plc

- Xinfa Group Co. Ltd.

- Other Industry Participants

Global Aluminum Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 259.3 Bn |

| Market Size Forecast by 2034 | US$ 580.5 Bn |

| Growth Rate (CAGR) | 7.6% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Aluminum Type, By Product Type, By Series, By End Use Industry, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Aluminum Corp. of China Ltd., BHP Billiton Ltd., Vedanta Resources plc, Norsk Hydro ASA, United Co., RUSAL, Hindalco Industries, Xinfa Group Co. Ltd., Emirates Global Aluminum PJSC, Rio Tinto Alcan Inc., Jindal Aluminium Limited |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Aluminum Market

By Aluminum Type

- Primary

- Secondary

By Product Type

- Extruded Aluminium Products

- Cast Aluminium Products

- Sand casting

- Die casting

- Rolled Aluminium Products

- Forged Aluminum Products

- Anodized Aluminium Products

- Others

By Series

- Series 1

- Series 2

- Series 3

- Series 4

- Series 5

- Series 6

- Series 7

By End Use Industry

- Building & Construction

- Automobile

- Electrical and Electronics

- Medical

- Marine

- Aerospace

- Textile

- Consumer goods

- Machinery & equipment

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Aluminum Market

By Aluminum Type

- Primary

- Secondary

By Product Type

- Extruded Aluminium Products

- Cast Aluminium Products

- Sand casting

- Die casting

- Rolled Aluminium Products

- Forged Aluminum Products

- Anodized Aluminium Products

- Others

By Series

- Series 1

- Series 2

- Series 3

- Series 4

- Series 5

- Series 6

- Series 7

By End Use Industry

- Building & Construction

- Automobile

- Electrical and Electronics

- Medical

- Marine

- Aerospace

- Textile

- Consumer goods

- Machinery & equipment

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.