Global Bioengineering Technology Market, By Product Type, By End Use Sector, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1332

- Number of Pages: 420

- Table/Charts : Yes

- October, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10035

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Bioengineering technology integrates biological principles with engineering tools to develop innovative solutions in medicine, agriculture, and environmental science. This technology encompasses the design of medical devices, biomaterials, tissue engineering, and genetic modification. For instance, CRISPR gene editing technology, introduced in 2012, allows precise modifications in DNA, revolutionizing disease treatment by 2020. Another example is 3D bioprinting, which by 2019, enabled the creation of human tissues and organs, offering hope for organ transplantation.

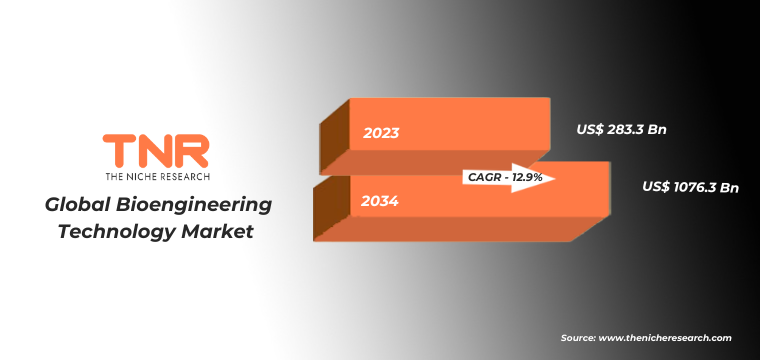

In agriculture, bioengineering enhances crop resilience, such as the development of genetically modified (GM) crops in the early 2000s, improving yield and resistance to pests. Environmental applications include bio-remediation techniques, used in the 2010 BP oil spill to clean up ecosystems. Benefits include enhanced healthcare, increased food production, and sustainable environmental practices, driving growth in the bioengineering technology market. “In Terms of Revenue, the Global Bioengineering Technology Market was Worth US$ 283.3 Bn in 2023, Anticipated to Witness CAGR of 12.9% During 2024 – 2034.”

Global Bioengineering Technology Market Dynamics:

Growth Drivers in the Global Bioengineering Technology Market

- Technological Advancements in Gene Editing: The rise of gene-editing technologies, particularly CRISPR-Cas9, has been a major growth driver since its introduction in 2012. By 2020, its application in genetic diseases like sickle cell anemia opened new possibilities in personalized medicine. These advancements enable precise genome modifications, accelerating medical and agricultural innovation.

- Increased Demand for Biopharmaceuticals: The growing need for biologics, including monoclonal antibodies and vaccines, has fueled bioengineering technology. For instance, by 2021, bioengineered vaccines like Pfizer-BioNTech’s COVID-19 vaccine demonstrated the market’s reliance on innovative biopharmaceuticals. This demand promotes bioengineering advancements in drug development, cell therapies, and precision medicine.

- Rising Focus on Sustainable Agriculture: Bioengineering has transformed agriculture by developing genetically modified (GM) crops. For example, Bt cotton, introduced in the late 1990s, significantly reduced pesticide use. By 2020, advancements in drought-resistant crops have further driven global demand for bioengineering, ensuring food security and sustainable farming practices worldwide.

Restraints in the Global Bioengineering Technology Market

- Ethical Concerns and Regulatory Hurdles: Ethical debates around gene-editing, especially technologies like CRISPR-Cas9, have slowed market growth. Since its introduction in 2012, concerns over genetic manipulation, especially in human embryos, led to strict regulations in many countries by 2020, limiting research and commercial applications in bioengineering.

- High Research and Development Costs: The bioengineering technology market faces high R&D expenses, particularly in biopharmaceuticals and advanced medical devices. For example, the development of 3D bioprinting for organ creation, which gained traction in 2019, demands significant capital investment, making it difficult for small and mid-sized firms to compete.

- Limited Public Acceptance of GM Products: Despite bioengineering breakthroughs, public resistance to genetically modified (GM) crops remain a restraint. Since GM crops like Bt corn were introduced in the early 2000s, skepticism regarding their long-term health and environmental effects persists. By 2023, this hesitation continued to impact adoption rates globally.

Global Bioengineering Technology Market Segmental Analysis

By Product Type

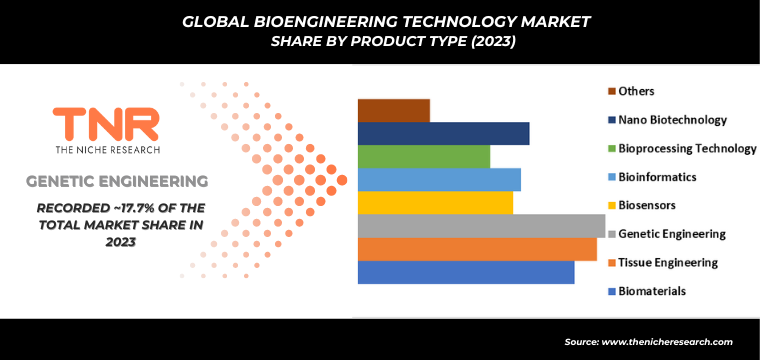

Genetic engineering segment dominate the global bioengineering technology market, contributing 17.7% to revenue share due to its groundbreaking applications in healthcare, agriculture, and biotechnology. Since CRISPR-Cas9’s introduction in 2012, genetic engineering has enabled precise modifications, revolutionizing disease treatment. By 2020, CRISPR was used to treat inherited disorders like sickle cell anemia. In agriculture, genetically modified (GM) crops like Bt corn, developed in the early 2000s, increased crop yields and pest resistance. Genetic engineering also advanced the development of bioengineered vaccines, such as the Pfizer-BioNTech COVID-19 vaccine in 2021, showcasing the segment’s pivotal role in combating global health challenges and driving market growth.

By End Use Sector

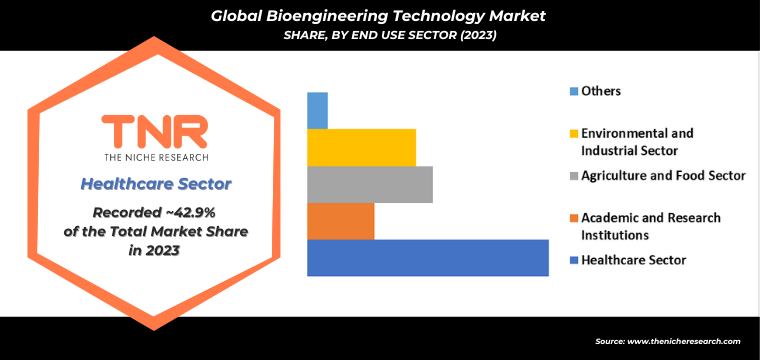

In 2023, the agriculture and food sector segment accounted for 43.7% of the global bioengineering technology market, becoming the second-largest end use sector category. This growth is driven by innovations such as CRISPR-edited crops, which enhance yield and disease resistance. For example, in 2022, Corteva Agriscience introduced drought-tolerant wheat, significantly boosting productivity in arid regions. Additionally, Impossible Foods leveraged bioengineering in 2021 to develop plant-based meat alternatives, meeting rising consumer demand for sustainable protein sources. Advances in precision agriculture, like Monsanto’s gene-edited soybeans launched in 2023, further optimize crop performance and sustainability. These developments highlight the sector’s crucial role in ensuring food security and driving market expansion through cutting-edge bioengineering solutions.

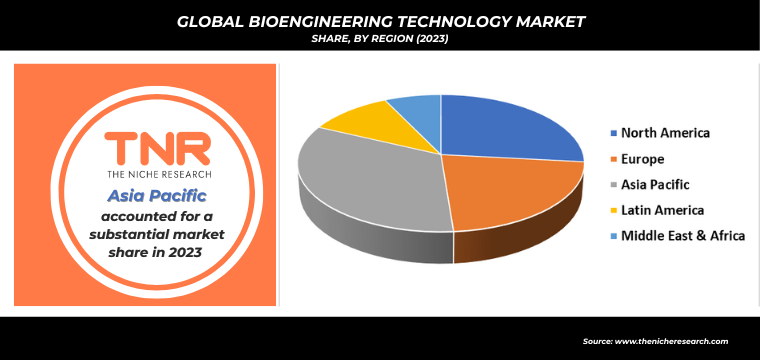

By Region

In 2023, North America reinforced its second leading position in the global bioengineering technology market, capturing a significant revenue share of 26.7%. This growth is attributed to advancements in biopharmaceuticals and agriculture. The U.S., for instance, saw significant expansion in gene therapy applications, such as the FDA approval of Zolgensma for spinal muscular atrophy in 2019, driving healthcare innovations. In agriculture, CRISPR-edited crops gained traction, with companies like Bayer launching herbicide-tolerant crops in 2022. Additionally, the region’s strong investment in bio-based materials and sustainable food production, as seen with Impossible Foods’ plant-based meats in 2021, contributed to its robust presence in the global bioengineering landscape.

Competitive Landscape

Some of the players operating in the bioengineering technology market are

- Agilent Technologies

- Amgen

- Becton Dickinson (BD)

- Bio-Rad Laboratories

- CRISPR Therapeutics

- Ginkgo Bioworks

- Illumina

- Intuitive Surgical

- Synthetic Genomics Vaccines Inc

- Thermo Fisher Scientific

- Other Industry Participants

Global Bioengineering Technology Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 283.3 Bn |

| Market Size Forecast by 2034 | US$ 1076.3 Bn |

| Growth Rate (CAGR) | 12.9% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product Type, By End Use Sector, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Agilent Technologies, Amgen, Becton Dickinson (BD), Bio-Rad Laboratories, CRISPR Therapeutics, Ginkgo Bioworks, Illumina, Intuitive Surgical, Synthetic Genomics Vaccines Inc, Thermo Fisher Scientific |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Bioengineering Technology Market

By Product Type

- Biomaterials

- Tissue Engineering

- Genetic Engineering

- Biosensors

- Bioinformatics

- Bioprocessing Technology

- Nano Biotechnology

- Others

By End Use Sector

- Healthcare Sector

- Academic and Research Institutions

- Agriculture and Food Sector

- Environmental and Industrial Sector

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Bioengineering Technology Market

By Product Type

- Biomaterials

- Tissue Engineering

- Genetic Engineering

- Biosensors

- Bioinformatics

- Bioprocessing Technology

- Nano Biotechnology

- Others

By End Use Sector

- Healthcare Sector

- Academic and Research Institutions

- Agriculture and Food Sector

- Environmental and Industrial Sector

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.