Global Construction 4.0 Market, By Component, By Application, By Technology, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Construction & Manufacturing

- Report ID: TNR-110-1311

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10218

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Construction 4.0 is the digital transformation of the construction industry, driven by technologies like IoT, AI, robotics, and BIM (Building Information Modeling). These innovations improve efficiency, sustainability, and safety across construction projects. For example, in 2024, many companies use AI to predict project delays and optimize resources, while drones conduct site inspections and collect real-time data. Day-to-day construction now involves 3D printing for custom building components, reducing waste and time. IoT sensors are used for monitoring equipment and structural health, ensuring proactive maintenance. Robotics automate repetitive tasks, such as bricklaying and demolition, enhancing productivity.

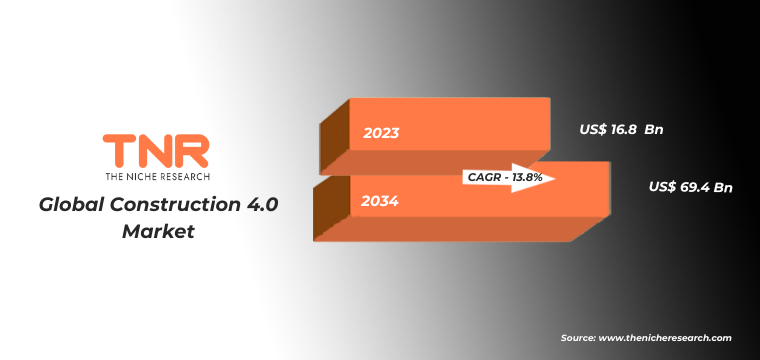

Applications include smart homes, infrastructure projects, and commercial buildings. For instance, prefabrication, guided by BIM, allows for precision in complex projects, like hospitals or bridges, making construction faster and more cost-effective. In Terms of Revenue, the Global Construction 4.0 Market was Worth US$ 16.8 Bn in 2023, Anticipated to Witness CAGR of 13.8% During 2024 – 2034.

| Technology | Application | Description & Examples | Date/Year |

| Internet of Things (IoT) | Site Monitoring & Management | IoT devices monitor real-time conditions such as temperature and equipment performance. For instance, Cisco’s IoT solutions were used in the 2023 Dubai Creek Tower project to track construction equipment and materials. | 2023 |

| Predictive Maintenance | IoT sensors predict equipment failures by analyzing data. In 2022, Caterpillar implemented IoT-based predictive maintenance in its machinery, reducing downtime on construction sites. | 2022 | |

| Artificial Intelligence (AI) & Machine Learning (ML) | Project Planning & Design | AI and ML optimize project designs and forecasts. Autodesk’s 2023 BIM software uses AI to suggest design improvements and predict project outcomes based on historical data. | 2023 |

| Construction Site Safety | AI algorithms analyze site data to predict safety hazards. Bechtel employed AI-driven safety management systems in 2022 to improve safety protocols on large-scale projects. | 2022 | |

| Robotics & Drones | Site Inspection & Surveying | Drones capture aerial data for site inspections. In 2023, Skycatch provided drone surveying solutions for the construction of the Amazon HQ2, offering detailed site mapping. | 2023 |

| Automated Construction Tasks | Robots perform repetitive tasks like bricklaying. Construction Robotics’Masonry Robot, introduced in 2023, automates bricklaying, enhancing construction efficiency. | 2023 | |

| 3D Printing | Building Components | 3D printers create building materials and structures. In 2022, ICON built a 3D-printed house in Austin, Texas, demonstrating the technology’s potential for rapid and cost-effective construction. | 2022 |

| Customized Designs | 3D printing enables customized architectural features. WASP utilized 3D printing in 2023 to construct a unique, sustainable housing prototype in Italy. | 2023 | |

| Blockchain Technology | Supply Chain Management | Blockchain ensures transparency and traceability in supply chains. In 2023, Provenance applied blockchain to track construction materials for the “Cavendish House” project in London, enhancing accountability. | 2023 |

| Contract Management | Smart contracts automate and secure contractual agreements. Sablon introduced blockchain-based smart contracts in 2022 to streamline procurement and project management processes. | 2022 | |

| Augmented Reality (AR) & Virtual Reality (VR) | Design Visualization | AR and VR allow immersive design experiences. HOK Architects used VR in 2023 to visualize and modify the design of the new Microsoft campus before construction began. | 2023 |

| Training & Safety Simulations | VR provides realistic training environments for construction workers. The Construction Industry Training Board (CITB) in the UK introduced VR training modules in 2022 to improve worker skills and safety. | 2022 | |

| Others | Digital Twins | Digital twins create virtual replicas of physical assets for real-time monitoring. In 2023, Siemens used digital twin technology for the construction and management of the “City of the Future” project in Singapore. | 2023 |

| Smart Glasses | Smart glasses enhance on-site communication and data access. DAQRI introduced smart helmets in 2022 for real-time data overlay and hands-free access during construction. | 2022 |

Opportunities in the Global Construction 4.0 Market

- Enhanced Project Monitoring: In 2024, IoT and drones enable real-time monitoring of construction sites. For instance, companies use drones to inspect large projects, reducing human error and increasing site visibility, improving project timelines and safety standards.

- Sustainability in Construction Practices: Construction 4.0 promotes green building by utilizing 3D printing to reduce material waste. In 2023, prefabrication techniques were widely adopted, allowing efficient, sustainable construction of modular homes with minimal environmental impact.

- Improved Worker Safety: Robotics and wearable devices enhance safety by automating hazardous tasks. In 2024, construction firms began using robots for dangerous jobs like demolition, minimizing accidents and protecting workers from high-risk environments.

Trends in the Global Construction 4.0 Market

- Increased Use of 3D Printing: In 2023, 3D printing became more prevalent, with construction firms using it to create building components quickly and sustainably. This technology reduces waste and accelerates project timelines, especially in housing and infrastructure projects.

- Rise of AI-Driven Project Management: AI-driven project management tools gained popularity in 2024, helping construction companies optimize resource allocation and predict delays. For instance, AI platforms forecast labor needs and material usage to streamline project efficiency.

- Expansion of Digital Twin Technology: By 2024, digital twins became essential in construction. These virtual replicas allow real-time monitoring and simulation of construction projects, improving decision-making and reducing errors, especially in large-scale infrastructure developments like smart cities.

Global Construction 4.0 Market Segmental Analysis

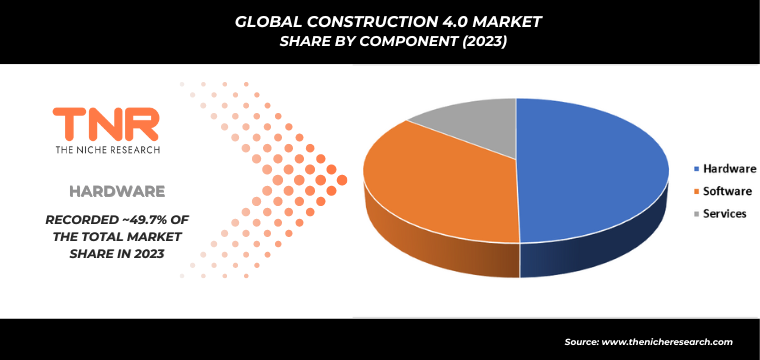

By Component-

Hardware have emerged as the dominant product type in the global construction 4.0 market, accounting for 49.7% of revenue share. This dominance is driven by the increasing adoption of IoT devices, drones, robotics, and 3D printers. For example, in 2023, construction firms widely used drones for site inspections and real-time data collection, improving project efficiency and safety. IoT sensors are being integrated into equipment for monitoring, reducing downtime through predictive maintenance. Robotics, such as autonomous bricklaying machines, automate repetitive tasks, enhancing productivity and lowering labor costs across large-scale construction projects.

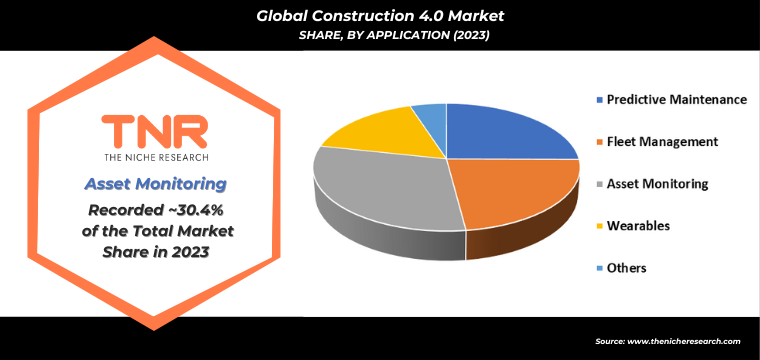

By Application-

In 2023, the predictive maintenance segment secured its position as the second-largest application category in the global construction 4.0 market, with a revenue share of 25.1%. This growth is fueled by the widespread adoption of IoT sensors and AI-driven analytics in construction equipment. For instance, companies are using IoT-enabled machinery to monitor equipment health, preventing unexpected breakdowns and costly downtime. AI systems analyze this data, allowing for timely maintenance before issues escalate. In large infrastructure projects, like smart city developments, predictive maintenance ensures smoother operations, optimizing equipment lifespan and minimizing delays, enhancing overall project efficiency.

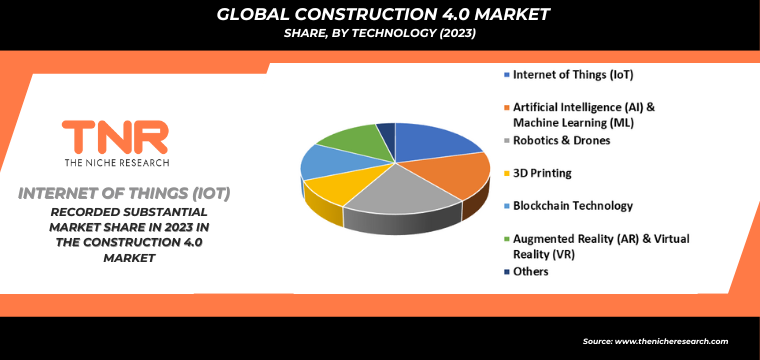

By Technology-

3D Printing segment is projected to be the fastest-growing technology category in the global construction 4.0 market, expected to hold a substantial 10.6% revenue share. In 2024, this technology is being increasingly adopted for rapid construction, reducing material waste and labor costs. For example, 3D printing was used in 2023 to create modular homes and custom-building components, significantly accelerating project timelines. It is especially valuable in large-scale infrastructure projects, allowing for the production of complex structures with precision and minimal waste. This growth highlights the shift toward more sustainable and efficient building practices in the construction industry.

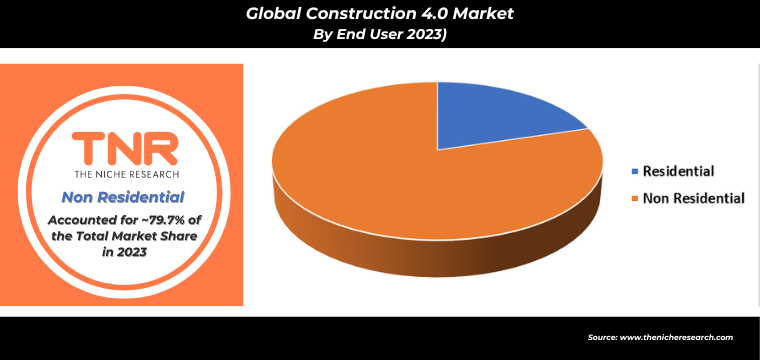

By End User-

Non-residential segment dominated the global construction 4.0 market, with a revenue share of 79.7%. This is driven by the adoption of advanced technologies like AI, IoT, and robotics in large-scale commercial and infrastructure projects. For example, smart office buildings and hospitals, built with automated systems and real-time monitoring, became more prevalent in 2023. These technologies enhance project efficiency, reduce labor costs, and support sustainable construction practices. Major infrastructure developments, including airports and smart cities, also rely on Construction 4.0 technologies to improve project management, boost safety, and deliver projects faster and more cost-effectively.

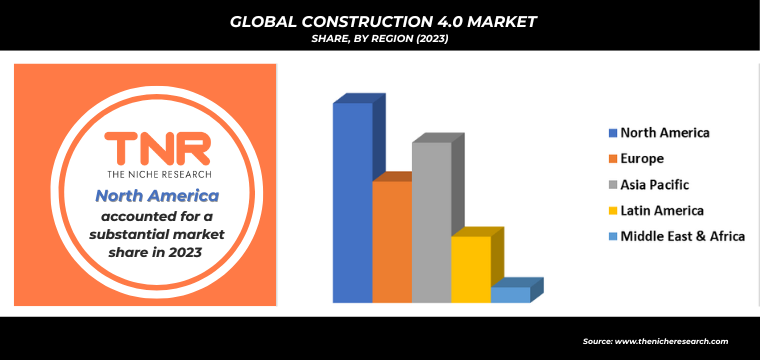

By Region-

In 2023, North America reinforced its leading position in the global construction 4.0 market, capturing a significant revenue share of 35.5%. This dominance is attributed to the region’s early adoption of advanced technologies like AI, IoT, and robotics. For example, major U.S. cities leveraged smart building technologies to enhance infrastructure projects, such as the development of intelligent skyscrapers and automated transportation systems. Canada also contributed to this growth with its focus on sustainable and innovative construction practices. The region’s investment in research and development, coupled with strong regulatory support, has driven the widespread implementation of Construction 4.0 technologies across diverse sectors.

Competitive Landscape

Some of the players operating in the construction 4.0 market are

- ABB Ltd.

- Autodesk Inc

- Brickeye

- CalAmp Corp.

- Hexagon AB

- Hilti Corporation

- Mitsubishi Electric Corporation

- Oracle Corporation

- Topcon Corporation

- Trimble Inc.

- Other Industry Participants

Global Construction 4.0 Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 16.8 Bn |

| Market Size Forecast by 2034 | US$ 69.4 Bn |

| Growth Rate (CAGR) | 13.8% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

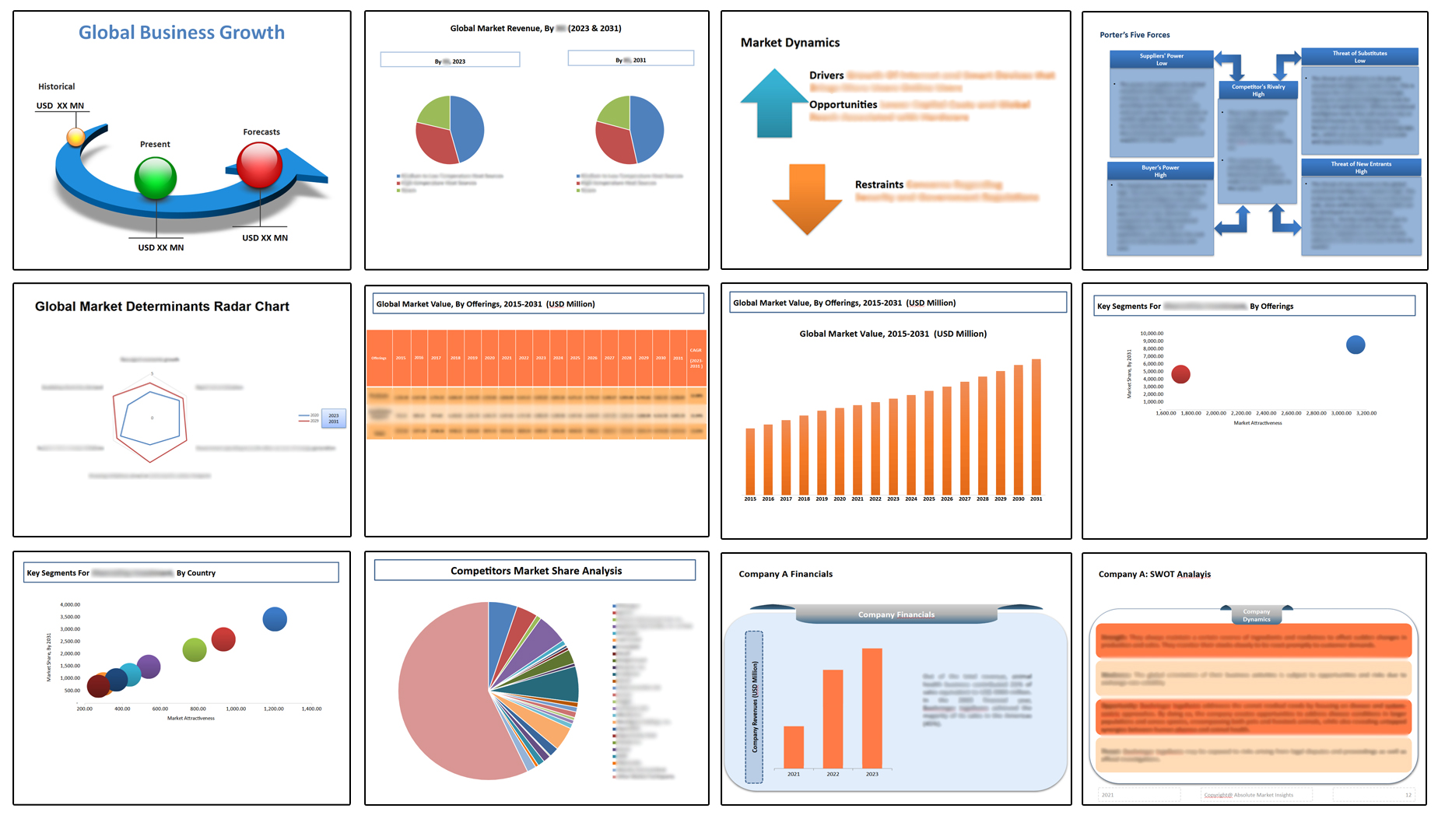

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component, By Application, By Technology, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | ABB Ltd., Autodesk Inc, Brickeye, CalAmp Corp, Hexagon AB, Hilti Corporation, Mitsubishi Electric Corporation, Oracle Corporation, Topcon Corporation, Trimble Inc. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Key Developments:

- In November 2022, Trimble and Hilti Group, renowned for its cutting-edge tools and technology in the commercial construction sector, revealed plans to integrate the Hilti ON!Track asset management system with Trimble Viewpoint Vista, a part of the Trimble Construction One suite. This integration aims to enhance contractors’ ability to track and manage their tools and equipment effectively.

- In 2021, CalAmp announced the launch of its iOn™ fleet and asset management software in the U.K. through its subsidiary, Tracker Network (UK) Limited. This software is designed to accelerate smart decision-making for fleet management.

- In January 2023, Topcon Positioning Systems expanded its compact solutions portfolio with the introduction of the 2D-MC automatic grade control system for compact track loaders. This cost-effective 2D machine control system is intended for installation on select grading attachments, offering improved operational visibility.

Global Construction 4.0 Market

By Component

- Hardware

- Software

- Services

By Application

- Predictive Maintenance

- Fleet Management

- Asset Monitoring

- Wearables

- Others

By Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Robotics & Drones

- 3D Printing

- Blockchain Technology

- Augmented Reality (AR) & Virtual Reality (VR)

- Others

By End User

- Residential

- Non Residential

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Construction 4.0 Market

By Component

- Hardware

- Software

- Services

By Application

- Predictive Maintenance

- Fleet Management

- Asset Monitoring

- Wearables

- Others

By Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Robotics & Drones

- 3D Printing

- Blockchain Technology

- Augmented Reality (AR) & Virtual Reality (VR)

- Others

By End User

- Residential

- Non Residential

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.