Global Cyber Insurance Market By Offerings, By Coverage, By Organization Size, By End-user & By Region:Comparative Analysis, Trends and Forecast, Segmental Analysis, 2015 – 2031

- Industry: BFSI

- Report ID: TNR-110-999

- Number of Pages: 420

- Table/Charts : Yes

- October, 2023

- Base Year : 2024

- No. of Companies : 11+

- No. of Countries : 29

- Views : 10594

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

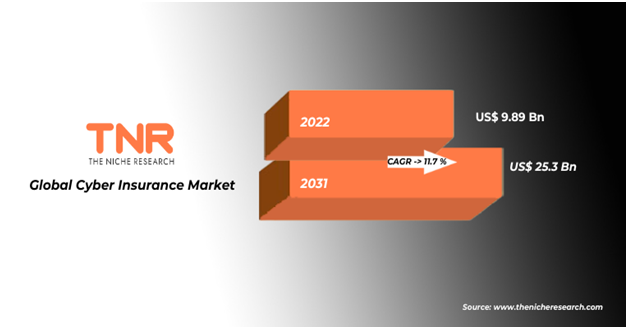

Global Cyber Insurance Market was valued at US$ 9.89Billion in 2022, Anticipated to Gain CAGR of11.7% From 2023- 2031

Cyber insurance, also known as cyber liability insurance or cyber risk insurance, is a type of insurance designed to protect businesses and individuals against the financial losses and liabilities that can result from cyberattacks, data breaches, and other cyber-related incidents. As our world becomes increasingly digital and interconnected, the risks associated with cyber incidents have grown significantly, making cyber insurance an important consideration for many organizations.

In addition, this type of insurance allows the companies to cover any costs associated with the remediation process, such as paying for the investigation, legal services, crisis communication, and refunds to customers. Organizations around the globe are seeing a rapid transition towards the remote or hybrid workforces leading to the immensely widened digital attack surfaces. The remote workplaces have enabled threat actors to efficiently target businesses with ransomware or other attacks.

Global Cyber Insurance Market Revenue & Forecast, (US$ Million), 2015 – 2031

Pandemic Impact Analysis: Global Cyber Insurance Market

The COVID-19 pandemic caused the significant decline in international flows such as trade, international travel, and foreign direct investment. This also led to a profound impact on the global cyber insurancemarket. Companies around the globe started accelerating their digital transformation, leading to the demand for enhanced cybersecurity.

For instance, in June 2020 Swissinfo.ch based on databyNational Cyber Security Center (NCSC)reported about 350 cases of cyber-attackswhich includefraudulent web sites, phishing, and direct attacks on companies in Switzerland in April, compared to the norm of 100-150 cases. Insurance companies, payment institutions, and credit unions are the most affected industries in COVID-19 pandemic. Cyber insurance played an important role in mitigating the business risk of a cyber-attack. The policies helped corporate policyholders to save millions of dollars resulting from a data breach.

Growth of the cyber insurance market is driven by rising number of cyber-attacks. The cyber insurance policy helps organizations pay for financial losses that may incur in an event of a data breach or cyber-attack. If a data breach occurs, the organization may need to take immediate actions, such as investigating the breach, notifying affected individuals, providing credit monitoring services, and managing public relations.

A cyber insurance policy can cover these expenses.If the organization’s cyber incident results in a third party suffering financial losses, a cyber insurance policy may cover the costs of legal defense and any settlements or judgments.Additionally, the high risk of data loss is further contributing to growth of the cyber insurance market. In addition, expanded remote work arrangements have enabled the businesses to consider modifying their cyber policies for addressing the emerging risks.

As the integration of digital technologies become more important for businesses, the probability of data breaches and cyber-attacksalso increased. However, the companies are also working towards integration of artificial intelligence and other emerging technologies to modernize the cyber insurance market. AI is helping the cyber insurers to process applications, evaluate and score cyber risks, and understand the cyber security capabilities of their clients.

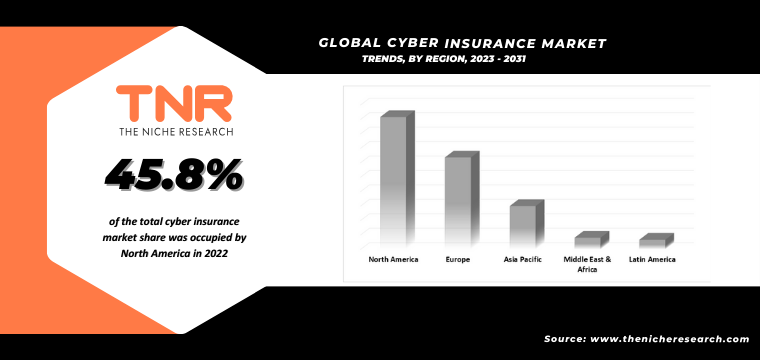

On the basis of region, North America region dominated the global cyber insurance market. Growth of the market in this region is attributed to growing number of cyber-attacks and presence of leading technology companies. Benefits from advanced infrastructure coupled with the widespread implementation of cyber technology has further contributed to growth of the market in this region. Increasing number of organizations in the region are aiming to integrate cyber insurance into their cyber risk management strategy, further contributing to growth of the cyber insurance market.

Competitive Landscape

The competitive landscape in the cyber insurance market is evolving rapidly, with both traditional insurance companies and specialized cyber insurance providers entering the space. Many established insurance companies have started offering cyber insurance as part of their portfolio. These companies leverage their existing relationships with businesses and expertise in risk assessment and underwriting to provide cyber insurance coverage. The emergence of technology-driven insurance startups, often referred to as “insurtechs,” has brought innovation to the cyber insurance market. These startups may use advanced data analytics and risk assessment techniques to offer more customized coverage.

Global Cyber Insurance Market Snapshot

| Report Specifications | Details |

| Market Revenue in 2022 | US$ 9.89 Billion |

| Market Size Forecast by 2031 | US$ 25.2 Billion |

| Growth Rate (CAGR) | 11.7% |

| Historic Data | 2015 – 2021 |

| Base Year for Estimation | 2022 |

| Forecast Period | 2023 – 2031 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Offerings, By Coverage, By Organization Size, By End User |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Allianz Global Corporate & Specialty, American International Group Inc., Aon PLC, Berkshire Hathaway Inc., Bin Insurer Holding LLC, Lockton Companies Inc., Munich Re Group, SecurityScorecard Inc., The Chubb Corporation, XL Group Ltd, Zurich Insurance Co. Ltd, Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808-703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Cyber Insurance Market Segmentation

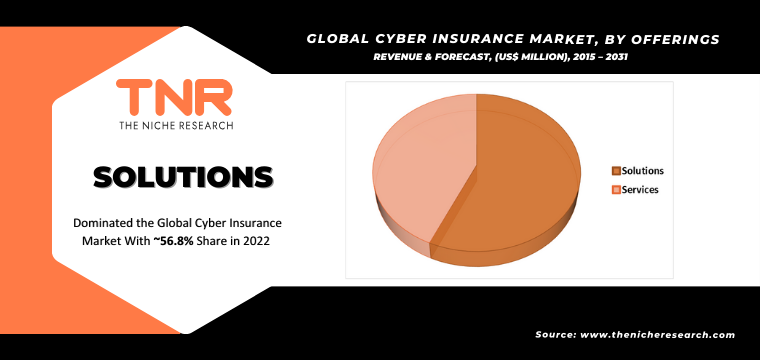

By Offerings

- Solutions

- Standalone

- Tailored

- Services

- Consulting/Advisory

- Security Awareness Training

- Others

By Coverage

- First Party Coverage

- Third PartyLiability Coverage

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End User

- Healthcare

- Retail

- Banking, Financial Services and Insurance (BFSI)

- IT &Telecom

- Manufacturing

- Government

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Cyber Insurance Market Segmentation

By Offerings

- Solutions

- Standalone

- Tailored

- Services

- Consulting/Advisory

- Security Awareness Training

- Others

By Coverage

- First Party Coverage

- Third Party Liability Coverage

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End User

- Healthcare

- Retail

- Banking, Financial Services and Insurance (BFSI)

- IT &Telecom

- Manufacturing

- Government

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

**Note: The report covers cross-segmentation analysis by region further into countries

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.