Global Digital Agriculture Market, By Component Type, By Deployment, By Connectivity Type, By Technology, By Application, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Agriculture

- Report ID: TNR-110-1325

- Number of Pages: 420

- Table/Charts : Yes

- October, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10045

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Digital agriculture refers to the integration of advanced technologies like artificial intelligence (AI), Internet of Things (IoT), and data analytics into farming practices. The global digital agriculture market is gaining momentum as it enhances productivity, sustainability, and efficiency in agriculture. Farmers use digital tools to monitor soil health, control irrigation systems, and predict crop yields through real-time data. For instance, precision farming uses GPS technology to guide tractors and optimize the use of fertilizers and water.

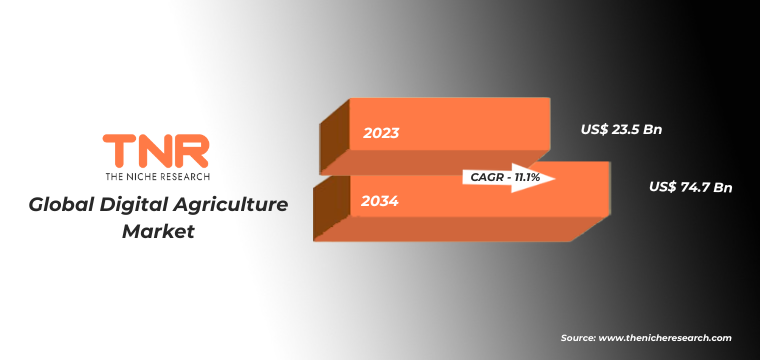

Farmers use digital agriculture tools such as drones for crop monitoring and soil health assessments. For instance, in 2022, precision agriculture platforms like Climate FieldView enabled farmers to analyze real-time data, improving decision-making processes. Furthermore, mobile apps help farmers manage irrigation schedules and pest control, ensuring better resource allocation and enhanced yields. Overall, digital agriculture is revolutionizing farming by providing actionable insights and promoting sustainable practices. “In Terms of Revenue, the Global Digital Agriculture Market was Worth US$ 23.5 Bn in 2023, Anticipated to Witness CAGR of 11.1% During 2024 – 2034.”

| Technology | Applications/Use Cases | Examples | Date/Year |

| AI/ML/NLP | Crop Disease Detection: AI algorithms analyze images of crops to identify diseases early, allowing farmers to take preventive measures. | Plantix: An AI-powered app that enables farmers to detect plant diseases using images taken with their smartphones. | Launched in 2015 |

| Yield Prediction: Machine learning models predict crop yields based on historical data, weather patterns, and soil conditions. | IBM Watson Decision Platform: Provides predictive analytics for crop yield forecasting, allowing farmers to make informed decisions. | Introduced in 2019 | |

| Precision Agriculture: AI helps optimize planting schedules and resource allocation, enhancing efficiency and reducing waste. | Blue River Technology: Uses computer vision and machine learning for precision spraying of herbicides. | Acquired by John Deere in 2017 | |

| Natural Language Processing: NLP is used in chatbots and virtual assistants to provide farmers with timely advice and information. | AgriBot: A chatbot that answers farmers’ queries regarding crop management and weather updates using NLP techniques. | Launched in 2020 | |

| IoT | Smart Irrigation Systems: IoT sensors monitor soil moisture levels and automate irrigation, conserving water and improving crop yield. | CropX: An IoT soil sensor that provides real-time data on soil moisture and nutrient levels, enabling precise irrigation. | Established in 2015 |

| Livestock Monitoring: Wearable IoT devices track the health and location of livestock, improving management and reducing losses. | Cowlar: An IoT-enabled collar that monitors the health and activity levels of cattle, providing insights to farmers. | Launched in 2016 | |

| Climate Monitoring: IoT weather stations collect data on climate conditions, helping farmers make informed decisions about crop management. | WeatherSTEM: An IoT-based weather station that provides real-time weather data for agricultural planning. | Active since 2016 | |

| Blockchain | Supply Chain Transparency: Blockchain ensures traceability of agricultural products from farm to table, enhancing consumer trust. | Provenance: A blockchain platform that allows consumers to trace the origins of food products, ensuring authenticity and ethical sourcing. | Launched in 2017 |

| Smart Contracts: Automated contracts on the blockchain facilitate secure transactions between farmers, suppliers, and retailers. | AgriDigital: A platform using blockchain for supply chain finance, allowing farmers to manage transactions and contracts digitally. | Launched in 2016 | |

| Farmers’ Data Ownership: Blockchain enables farmers to maintain control over their data, ensuring privacy and security. | AgriChain: A blockchain-based platform that allows farmers to own and share their agricultural data while receiving compensation. | Introduced in 2019 | |

| Big Data & Analytics | Weather Prediction: Advanced analytics and modeling techniques improve weather forecasts, helping farmers prepare for adverse conditions. | DTN WeatherRisk: Provides farmers with localized weather analytics and alerts to mitigate the impacts of extreme weather on their crops. | Active since 2018 |

| Others | Drones for Crop Monitoring: Drones equipped with cameras and sensors collect aerial data, enabling precise monitoring of crop health and soil conditions. | DJI Phantom 4 RTK: A drone used for mapping and surveying agricultural fields to assess crop health and optimize resource use. | Released in 2018 |

| Robotic Harvesting: Robots equipped with AI and computer vision harvest crops autonomously, reducing labor costs and improving efficiency. | FFRobotics: Developed a robotic harvesting solution for picking fruits like apples and citrus, enhancing harvesting efficiency. | Introduced in 2019 |

Growth Drivers in the Global Digital Agriculture Market

- Increased Demand for Food Production: The global population is expected to reach 7 billion by 2050, driving the need for innovative agricultural practices. Digital agriculture enhances crop yields through precision farming, enabling farmers to optimize resources. For instance, in 2021, companies like Trimble reported a 15% increase in crop yields using their data-driven solutions.

- Advancements in Technology: The rapid evolution of technologies such as IoT, AI, and big data analytics is transforming farming practices. In 2022, John Deere introduced its fully autonomous tractor, showcasing how technology can streamline operations. Such innovations enhance efficiency, reduce labor costs, and allow farmers to make data-driven decisions for better productivity.

Restraints in the Global Digital Agriculture Market

- High Initial Investment: The adoption of digital agriculture technologies often requires significant upfront investment in equipment and software. For example, farmers may need to spend over $100,000 on precision farming systems, which can deter smaller operations. In 2023, a survey found that 60% of farmers cited costs as a major barrier to adoption.

- Limited Internet Connectivity: In many rural areas, insufficient internet access hampers the implementation of digital agriculture solutions. For instance, in 2022, a report indicated that nearly 30% of U.S. farmers lacked reliable internet, limiting their ability to utilize cloud-based platforms and real-time data for effective decision-making.

Global Digital Agriculture Market Segmental Analysis:

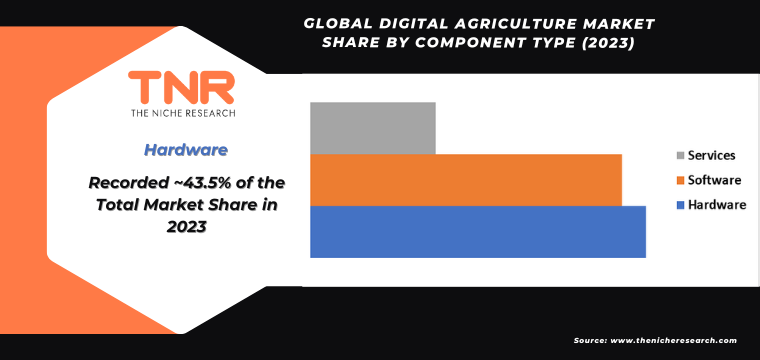

Hardware has emerged as the dominant source in the global digital agriculture market, accounting for 43.5% of revenue share. Key examples include advanced sensors and drones, which enable farmers to monitor crop health and optimize resource usage effectively. Companies like DJI have developed agricultural drones that can map fields and assess plant health, while soil sensors from manufacturers like Ag Leader help analyze moisture levels in real-time, driving better irrigation practices and increasing overall productivity on farms.

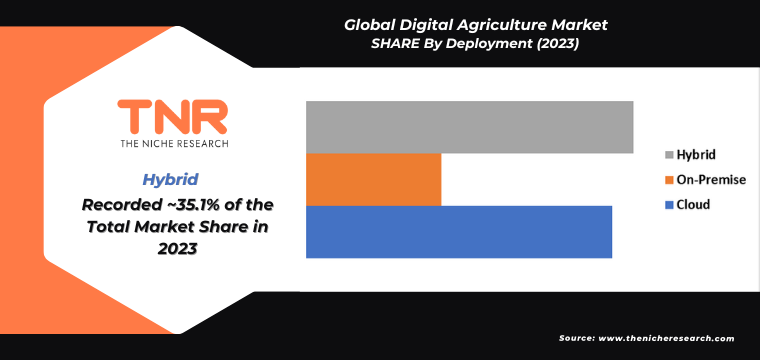

In 2023, the cloud segment secured its position as the second-largest deployment category in the global digital agriculture market, with a revenue share of 20.6%. Cloud-based platforms, such as Trimble Ag Software, enable farmers to store and analyze vast amounts of agricultural data, enhancing decision-making processes. For example, cloud solutions facilitate precision farming by integrating data from various sources like satellite imagery and IoT devices, allowing farmers to monitor crop conditions and manage resources efficiently. This technology has empowered farmers to increase productivity and reduce operational costs while adapting to climate variability effectively.

Wireless connectivity dominated the global digital agriculture market, with a revenue share of 76.4% in 2023. This surge is driven by the widespread adoption of IoT devices, which require seamless connectivity for effective data transmission. For instance, companies like Raven Industries offer wireless solutions for real-time monitoring of crop health and soil conditions. Additionally, wireless technology enables farmers to use mobile applications for remote management of irrigation systems, enhancing efficiency and promoting data-driven decision-making to optimize yields and resource utilization.

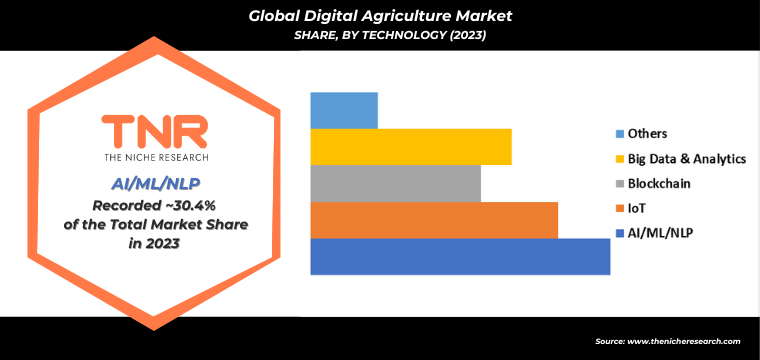

Big data & analytics technology is anticipated as third largest segment in the global digital agriculture market capturing a revenue share of 20.4% in 2023. This growth is fueled by the need for data-driven insights to enhance agricultural productivity. For instance, companies like Climate Corporation leverage advanced analytics to provide farmers with actionable insights regarding weather patterns and soil health, enabling them to make informed decisions. Additionally, analytics platforms such as Granular help farmers optimize their operations by analyzing historical data, which aids in improving yield forecasts and resource management strategies effectively.

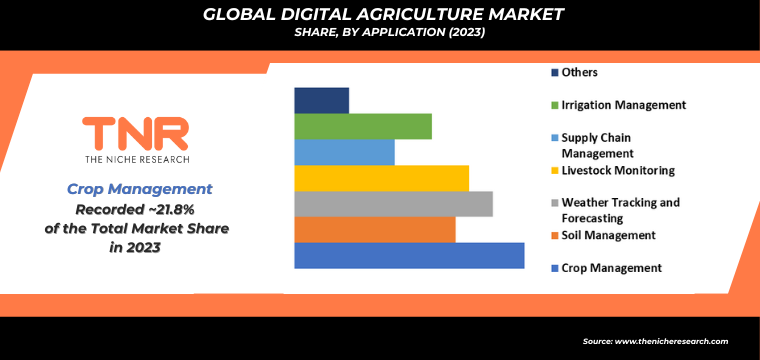

Crop management as application dominated the global digital agriculture market, with a substantial revenue of 21.8% in 2023. This is largely attributed to the increasing need for efficient farming practices. Tools like precision agriculture software from companies such as Ag Leader allow farmers to monitor crop health and optimize planting schedules. Additionally, solutions like IBM’s Watson Decision Platform provide real-time data analytics to enhance decision-making. These technologies empower farmers to increase yields while minimizing resource use and environmental impact.

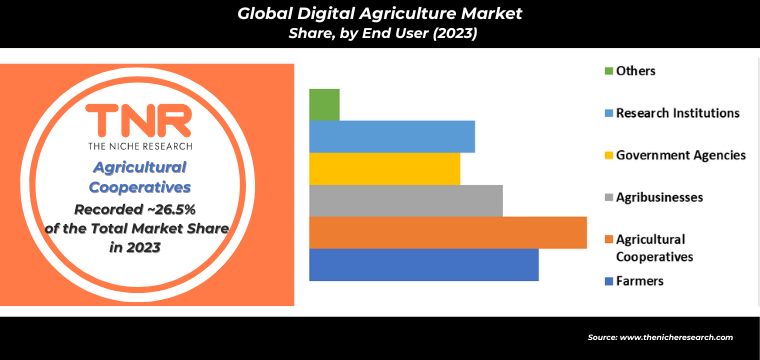

Farmers segment is projected to be the fastest-growing end user category in the global digital agriculture market, expected to hold a substantial 21.9% revenue share. This growth is driven by increasing adoption of technology among farmers seeking to enhance productivity and sustainability. For instance, farmers are increasingly using mobile apps like FarmLogs to track field activities and analyze crop performance. Additionally, precision farming tools from companies like AG Leader are helping farmers optimize resource usage, resulting in improved yields and reduced costs while adapting to climate challenges.

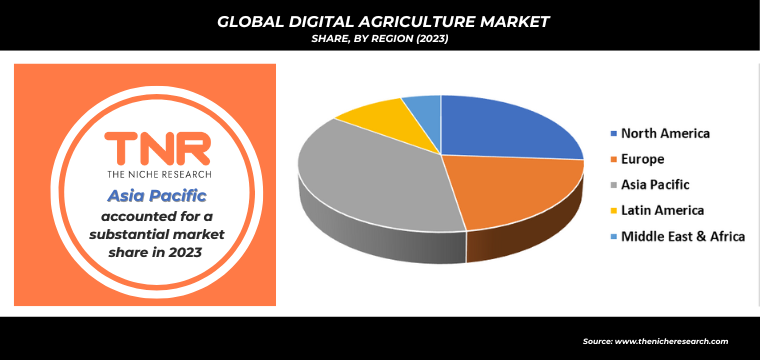

In 2023, North America reinforced its second leading position in the global digital agriculture market, capturing a significant revenue share of 23.6%. This growth is driven by advancements in agricultural technology and widespread adoption of precision farming techniques. For instance, companies like Trimble and John Deere are leading the charge by providing innovative solutions such as GPS-guided equipment and data analytics platforms. Additionally, initiatives supporting sustainable farming practices, such as the USDA’s Precision Agriculture Initiative, have further boosted technology adoption among North American farmers.

Competitive Landscape

Some of the players operating in the digital agriculture market are

- AGCO Corporation

- AgEagle Aerial Systems

- Bayer AG

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Hexagon AB

- IBM Corporation

- Kubota Corporation

- Topcon Corporation

- Trimble

- Other Industry Participants

Global Digital Agriculture Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 23.5 Bn |

| Market Size Forecast by 2034 | US$ 74.7 Bn |

| Growth Rate (CAGR) | 11.1% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component Type, By Deployment, By Connectivity Type, By Technology, By Application, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | AGCO Corporation, AgEagle Aerial Systems, Bayer AG, CLAAS KGaA mbH, CNH Industrial N.V., Deere & Company, Hexagon AB, IBM Corporation, Kubota Corporation, Topcon Corporation, Trimble |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Digital Agriculture Market

By Component Type

- Hardware

- Software

- Services

- Professional

- Managed

By Deployment

- Cloud

- On-Premise

- Hybrid

By Connectivity Type

- Wired

- Wireless

By Technology

- AI/ML/NLP

- IoT

- Blockchain

- Big Data & Analytics

- Others

By Application

- Crop Management

- Soil Management

- Weather Tracking and Forecasting

- Livestock Monitoring

- Supply Chain Management

- Irrigation Management

- Others

By End User

- Farmers

- Agricultural Cooperatives

- Agribusinesses

- Government Agencies

- Research Institutions

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Digital Agriculture Market

By Component Type

- Hardware

- Software

- Services

- Professional

- Managed

By Deployment

- Cloud

- On-Premise

- Hybrid

By Connectivity Type

- Wired

- Wireless

By Technology

- AI/ML/NLP

- IoT

- Blockchain

- Big Data & Analytics

- Others

By Application

- Crop Management

- Soil Management

- Weather Tracking and Forecasting

- Livestock Monitoring

- Supply Chain Management

- Irrigation Management

- Others

By End User

- Farmers

- Agricultural Cooperatives

- Agribusinesses

- Government Agencies

- Research Institutions

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.