Global Distributed Cloud Market, By Service Type, By Application, By Deployment Model, By Organization Size, By Industry Vertical, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Technology

- Report ID: TNR-110-1211

- Number of Pages: 420

- Table/Charts : Yes

- July, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10126

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

The distributed cloud market represents a transformative shift in cloud computing, extending cloud capabilities to multiple locations while maintaining centralized management. This model enhances data sovereignty, compliance, and latency reduction, catering to a diverse range of industries from finance to healthcare. With enterprises increasingly adopting hybrid and multi-cloud strategies, the demand for distributed cloud solutions is poised for substantial growth. Major players in the market include Google Cloud, Microsoft Azure, and Amazon Web Services, all of which are innovating to offer more robust and secure distributed cloud infrastructures.

Key trends driving the distributed cloud market include the rise of edge computing, 5G proliferation, and the growing emphasis on data privacy and compliance. Opportunities abound in sectors requiring real-time data processing and low-latency applications, such as IoT, autonomous vehicles, and smart cities. The integration of AI and machine learning with distributed cloud environments is another burgeoning area, offering enhanced data analytics and operational efficiencies.

Innovations in edge computing and 5G technology significantly enhance the capabilities of distributed cloud solutions. Increasing regulations around data sovereignty and privacy push enterprises towards adopting distributed cloud models. Businesses are attracted to the scalable nature of distributed cloud solutions, which allow for seamless expansion and adaptation to varying workloads. Distributed cloud solutions often lead to cost savings through optimized resource utilization and reduced data transfer expenses.

In Terms of Revenue, the Global Distributed Cloud Market was Worth US$ 3.2 Bn in 2023, Anticipated to Witness CAGR of 20.4% During 2024 – 2034.

Trends in the Global Distributed Cloud Market

- Edge Computing Integration: By processing data closer to the source, edge computing reduces latency and improves performance for real-time applications. This trend is particularly relevant for industries such as IoT, autonomous vehicles, and smart cities, where immediate data processing is crucial. As 5G networks expand, enabling faster and more reliable connections, the synergy between edge computing and distributed cloud solutions will drive innovation and efficiency, offering enhanced capabilities for decentralized data processing and management.

- Emphasis on Data Privacy and Compliance: With increasing regulatory scrutiny on data privacy and sovereignty, businesses are turning to distributed cloud solutions to ensure compliance. Distributed cloud environments allow data to be stored and processed within specific geographic boundaries, aligning with local regulations and standards. This trend is especially prominent in sectors like finance and healthcare, where data sensitivity is paramount. By adopting distributed cloud models, organizations can better manage compliance risks, protect sensitive information, and meet the growing demands for transparency and accountability in data handling.

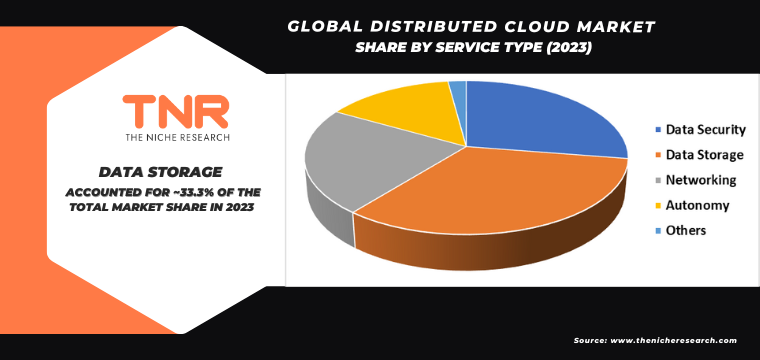

Data Storage by service type category has emerged as a dominant segment in the global distributed cloud market. This prominence is driven by the exponential growth in data generation across various industries. Businesses require scalable, secure, and efficient storage solutions to manage vast amounts of data, and distributed cloud storage meets these needs effectively. By decentralizing data storage, companies can enhance data accessibility, reduce latency, and improve disaster recovery capabilities. Compliance with data sovereignty regulations is more manageable with distributed storage solutions, as data can be stored within specific geographic regions. As organizations increasingly prioritize data-driven decision-making, the demand for robust distributed cloud storage services continues to surge, solidifying its market dominance.

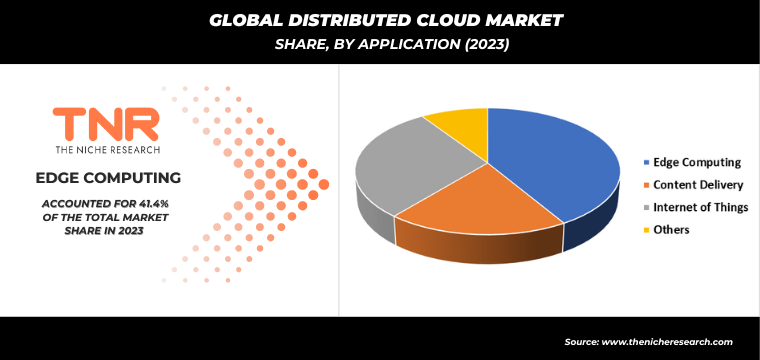

In 2023, internet of things segment solidified its position as the second-largest application category within the global distributed cloud market. This growth is fueled by the widespread adoption of IoT devices across various industries, from manufacturing and healthcare to smart homes and cities. Distributed cloud solutions provide the necessary infrastructure to manage the vast amounts of data generated by IoT devices, offering low-latency processing and real-time analytics. The integration of distributed cloud with IoT enhances operational efficiency, enables predictive maintenance, and supports advanced applications like autonomous systems. As the IoT ecosystem continues to expand, the demand for robust distributed cloud services to support these applications will drive further market growth.

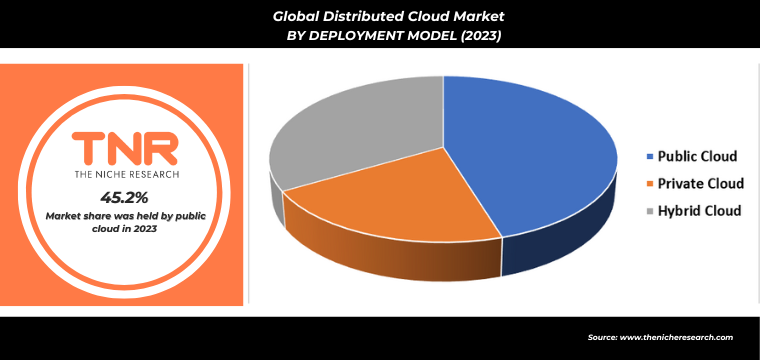

Public cloud segment by deployment model dominated the global distributed cloud market with a revenue share of 45.3% in 2023. This dominance is attributed to the public cloud’s scalability, cost-efficiency, and flexibility, making it an attractive option for businesses of all sizes. Public cloud providers like Amazon Web Services, Microsoft Azure, and Google Cloud offer extensive services and infrastructure, enabling companies to quickly deploy and manage applications without significant upfront investments. The public cloud’s robust security features and compliance certifications appeal to enterprises seeking reliable and secure cloud solutions. As digital transformation accelerates across industries, the public cloud segment’s significant market share underscores its critical role in the evolving cloud landscape.

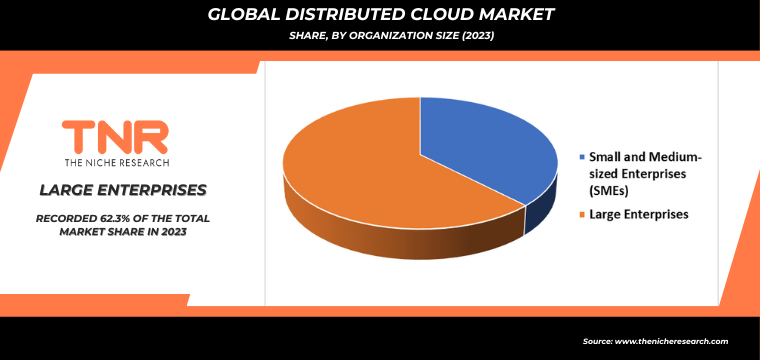

By organization size, small and medium-sized enterprises (SMEs) anticipated as the fastest growing segment in the global distributed cloud market. This growth is driven by SMEs increasingly adopting distributed cloud solutions to enhance their operational efficiency, scalability, and competitiveness. Distributed cloud services offer SMEs the flexibility to manage workloads across multiple locations without the need for substantial capital investment in IT infrastructure. The pay-as-you-go pricing models make these solutions financially accessible to smaller businesses. SMEs benefit from improved data security, compliance, and reduced latency, enabling them to compete effectively in the digital economy. As these enterprises continue to embrace digital transformation, their demand for distributed cloud solutions is set to surge, driving rapid market growth.

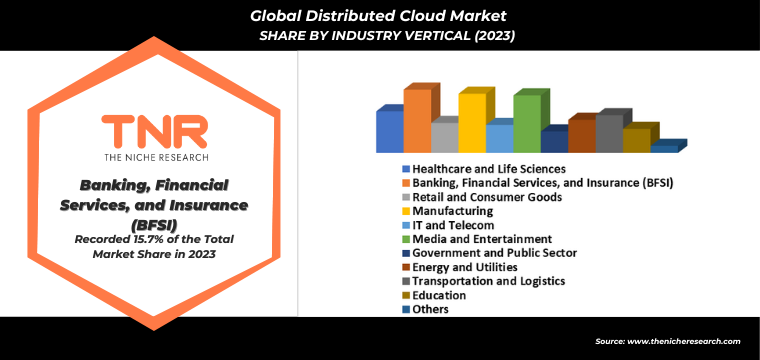

Banking, financial services, and insurance (BFSI) by industry vertical dominated the global distributed cloud market. This dominance is driven by the industry’s need for secure, scalable, and compliant cloud solutions to manage vast amounts of sensitive data. Distributed cloud architectures enable BFSI organizations to enhance data sovereignty, improve disaster recovery, and ensure compliance with stringent regulatory requirements. Additionally, the adoption of distributed cloud services supports advanced analytics, real-time transaction processing, and enhanced customer experiences. As the BFSI sector continues to prioritize digital transformation and cybersecurity, the demand for robust distributed cloud solutions remains strong, solidifying its leading position in the market. This trend underscores the critical role of distributed cloud technology in the financial industry’s evolution.

In 2023, Middle East & Africa contributed a revenue share of 3.2% in the global distributed cloud market. This growth is driven by increasing investments in digital infrastructure and the rapid adoption of cloud technologies across various sectors, including telecommunications, finance, and healthcare. Governments and enterprises in the MEA region are prioritizing digital transformation initiatives to enhance economic development and improve public services. Expansion of smart city projects and the implementation of 5G networks are boosting demand for distributed cloud solutions. As businesses in the region seek to improve operational efficiency and data security, the MEA’s role in the distributed cloud market is set to grow further.

Competitive Landscape

Some of the players operating in the distributed cloud market are

- Alibaba Cloud

- Amazon Web Services (AWS)

- Baidu Cloud

- CenturyLink (Lumen Technologies)

- Cisco Systems

- Dell Technologies

- Fujitsu

- Google Cloud Platform (GCP)

- Hewlett Packard Enterprise (HPE)

- Huawei Cloud

- IBM Cloud

- Microsoft Azure

- Nutanix

- Oracle Cloud

- Rackspace Technology

- Red Hat (IBM)

- Salesforce

- SAP

- Tencent Cloud

- VMware

- Other Industry Participants

Global Distributed Cloud Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 3.2 Bn |

| Market Size Forecast by 2034 | US$ 24.7 Bn |

| Growth Rate (CAGR) | 20.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Service Type, By Application, By Deployment Model, By Organization Size, By Industry Vertical, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Alibaba Cloud, Amazon Web Services (AWS), Baidu Cloud, CenturyLink (Lumen Technologies), Cisco Systems, Dell Technologies, Fujitsu, Google Cloud Platform (GCP), Hewlett Packard Enterprise (HPE), Huawei Cloud, IBM Cloud, Microsoft Azure, Nutanix, Oracle Cloud, Rackspace Technology, Red Hat (IBM), Salesforce, SAP, Tencent Cloud, VMware |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Distributed Cloud Market

By Service Type

- Data Security

- Data Storage

- Networking

- Autonomy

- Others

By Application

- Edge Computing

- Content Delivery

- Internet of Things

- Others

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Healthcare and Life Sciences

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Manufacturing

- IT and Telecom

- Media and Entertainment

- Government and Public Sector

- Energy and Utilities

- Transportation and Logistics

- Education

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Distributed Cloud Market

By Service Type

- Data Security

- Data Storage

- Networking

- Autonomy

- Others

By Application

- Edge Computing

- Content Delivery

- Internet of Things

- Others

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Healthcare and Life Sciences

- Banking, Financial Services, and Insurance (BFSI)

- Retail and Consumer Goods

- Manufacturing

- IT and Telecom

- Media and Entertainment

- Government and Public Sector

- Energy and Utilities

- Transportation and Logistics

- Education

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.