Global Drug Screening Market: By Product and Service, By Sample Type, By Drug Type, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1141

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10139

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Drug screening is a process used to detect the presence of illicit substances or prescription medications in an individual’s system. This procedure is commonly employed in various settings, including workplaces, medical facilities, legal and correctional institutions, and sports organizations. The primary goal of drug screening is to ensure safety, compliance with regulations, and to promote health and productivity. Techniques such as urine, blood, saliva, and hair tests are utilized to identify substances like opioids, amphetamines, cannabinoids, and other controlled drugs. The results of these tests help employers, healthcare providers, and law enforcement officials make informed decisions regarding employment, medical treatment, legal proceedings, and athletic eligibility, contributing to a safer and more responsible society.

The demand for drug screening is propelled by several critical factors, including increasing substance abuse rates and the need for maintaining safety in workplaces, healthcare, and public environments. Employers, particularly in industries where safety is paramount, such as transportation, construction, and healthcare, implement drug screening to ensure a safe and productive workforce and to comply with stringent regulatory requirements. The ongoing opioid crisis has further intensified the necessity for comprehensive drug testing programs to identify and manage substance abuse effectively.

Technological advancements in drug testing, offering more accurate and rapid results, have also enhanced the appeal and adoption of these services. Additionally, legal mandates for drug testing in scenarios such as parole, probation, and pre-employment screenings are significant drivers. The integration of drug screening into routine medical evaluations and rehabilitation programs underscores its vital role in promoting public health and safety, further fueling its demand globally.

In terms of revenue, the global drug screening market was worth US$ 9.5 Bn in 2023, anticipated to witness CAGR of 17.2% during 2024 – 2034.

Global Drug Screening Market Dynamics

Increasing Substance Abuse: The rising prevalence of substance abuse globally has necessitated more rigorous drug screening programs to ensure public safety and health. Governments and regulatory bodies have implemented strict guidelines and mandates for drug testing, particularly in safety-sensitive industries like transportation, aviation, and defense, to prevent accidents and ensure safety.

Workplace Safety: Employers across various sectors are increasingly adopting drug screening programs to maintain a safe and productive work environment, reduce workplace accidents, and enhance overall productivity. Innovations in drug testing technologies, such as more accurate, non-invasive, and rapid testing methods, are boosting the efficiency and reliability of drug screening processes.

Legalization of Cannabis: The legalization of cannabis in several regions has led to increased demand for comprehensive drug testing to monitor and manage its use, especially in workplaces and law enforcement. The expansion of the healthcare sector, including pain management and rehabilitation programs, has driven the demand for drug screening to monitor prescription drug use and prevent abuse.

Awareness and Education: Growing awareness about the adverse effects of drug abuse and the importance of drug screening in mitigating these effects has fueled market growth. Insurance companies often require drug testing for policy issuance and claims, thereby increasing the demand for drug screening services.

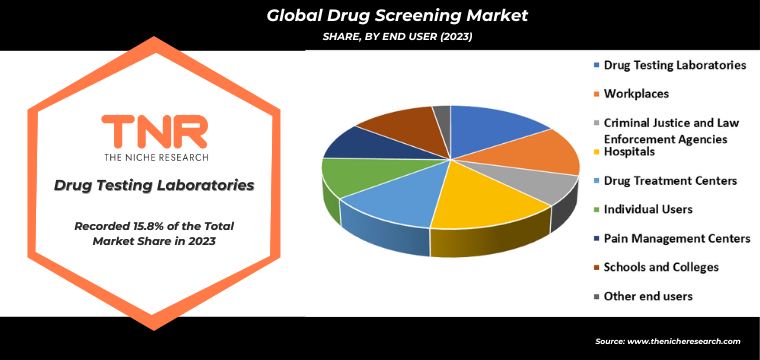

Drug Testing Laboratories Segment Has Garnered Major Market Share in the Global Drug Screening Market During the Forecast Period (2024 – 2034).

The demand for drug testing laboratories in drug screening is driven by an increasing need for accurate, reliable, and comprehensive substance abuse testing across various sectors. Employers, particularly in safety-sensitive industries such as transportation, healthcare, and manufacturing, are under heightened pressure to ensure workplace safety and regulatory compliance, fuelling the need for professional drug testing services. The growing prevalence of substance abuse, exacerbated by the opioid crisis, necessitates robust screening measures to identify and mitigate drug use effectively.

Furthermore, advancements in testing technologies, including more sophisticated detection methods and faster turnaround times, have enhanced the capabilities of drug testing laboratories, making them indispensable in both occupational and clinical settings. Legal and medical frameworks are also increasingly integrating drug screening protocols, further driving demand for specialized laboratories equipped to handle diverse testing needs. This surge reflects a broader societal commitment to maintaining public health and safety through rigorous and reliable drug screening practices.

By Sample Type Urine Sample Segment had the Highest Share in the Global Drug Screening Market in 2023.

The demand for urine sample-based drug screening is primarily driven by its widespread acceptance as a reliable, non-invasive, and cost-effective method for detecting substance abuse. Employers across various sectors, especially those in safety-critical industries like transportation, construction, and healthcare, are increasingly adopting urine drug tests to maintain workplace safety and comply with stringent regulatory standards. Additionally, the growing prevalence of substance abuse, including the opioid epidemic, has necessitated more rigorous screening processes to identify and address drug use effectively.

Urine drug tests are favored for their ability to detect a wide range of substances over a considerable detection window, making them a preferred choice for pre-employment, random, and post-incident testing. Advances in testing technology have further enhanced the accuracy and speed of urine drug screenings, driving their adoption in both occupational and clinical settings. This trend underscores the ongoing commitment to public health and safety through effective substance abuse monitoring.

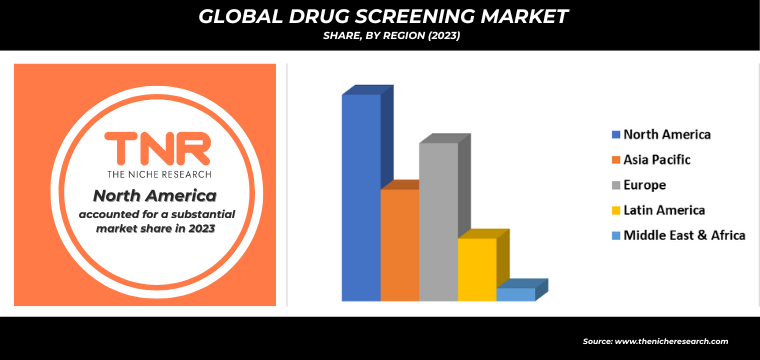

North America, by Region Dominated the Global Drug Screening Market in 2023.

The demand for drug screening in North America is driven by several key factors, including stringent regulatory requirements, a rising emphasis on workplace safety, and the increasing prevalence of substance abuse. Employers across various industries, particularly in safety-sensitive sectors such as transportation, construction, and healthcare, are implementing robust drug screening programs to ensure a safe and productive work environment. Additionally, the opioid crisis has heightened awareness and necessitated more comprehensive drug testing policies.

Advances in drug screening technologies, such as more accurate and faster testing methods, are also contributing to the growing demand. Furthermore, legal and healthcare systems are increasingly incorporating drug screening as a standard procedure in pain management and rehabilitation programs. These combined elements underscore the expanding necessity for drug screening services and solutions across North America, reflecting broader societal and regulatory trends towards maintaining public health and safety.

Competitive Landscape: Global Drug Screening Market:

- Express Diagnostics Int’l, Inc.

- Bio-Rad Laboratories Inc.

- Biomedical Diagnostics

- Danaher

- Synergy Health plc.

- Agilent Technologies

- Shimadzu Medical Pvt. Ltd.

- Alere Inc.

- Premier Biotech, Inc.

- Psychemedics Corporation

- Siemens Healthineers Private Limited

- American Bio Medica Corporation

- Sciteck, Inc.

- ACM Global Laboratories.

- Other Industry Participants

Global Drug Screening Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 9.5 Bn |

| Market Size Forecast by 2034 | US$ 54.4 Bn |

| Growth Rate (CAGR) | 17.2% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

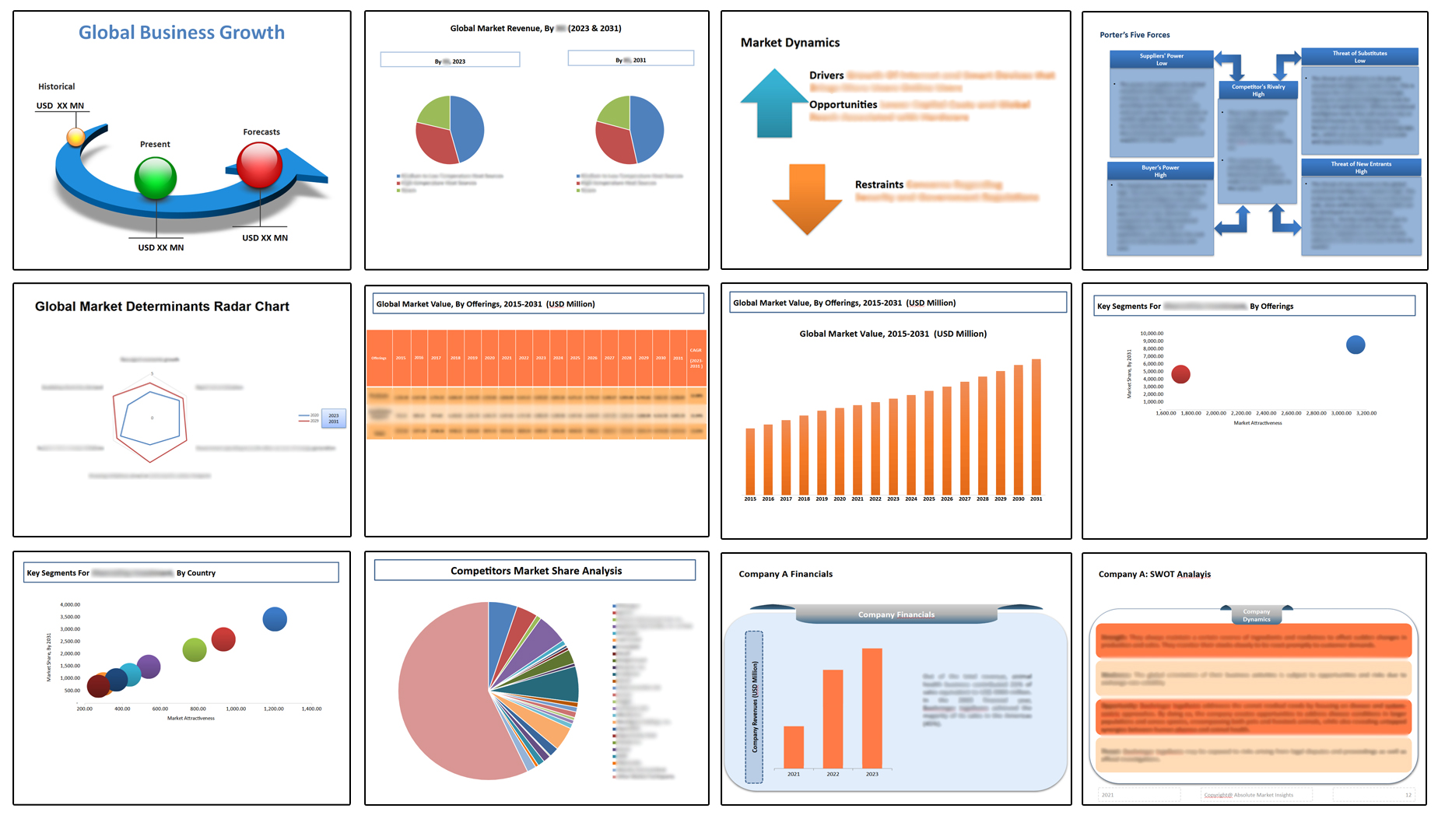

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product and Service, By Sample Type, By Drug Type, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Express Diagnostics Int’l, Inc., Bio-Rad Laboratories Inc., Biomedical Diagnostics, Danaher, Synergy Health plc., Agilent Technologies, Shimadzu Medical Pvt. Ltd., Alere Inc., Premier Biotech, Inc., Psychemedics Corporation, Siemens Healthineers Private Limited, American Bio Medica Corporation, Sciteck, Inc., ACM Global Laboratories. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Drug Screening Market

By Product and Service

- Drug Screening Product

- Analytical Instruments

- Type

- Breathalyzers

- Fuel Cell Breathalyzer

- Semiconductor Breathalyzer

- Other Breathalyzers

- Immunoassay Analyzer

- Chromatography Instruments

- Breathalyzers

- Modality

- Handheld

- Benchtop

- Rapid Testing Devices

- Urine Testing Devices

- Drug Testing Cups

- Dip Cards

- Drug Testing Cassettes

- Oral Fluid Testing Devices

- Consumables

- Assay Kits

- Sample Collection Devices

- Calibrators & Controls

- Other Consumables

- Drug Screening Services

- Laboratory Testing Services

- On-site services

- Urine Testing Devices

- Type

- Analytical Instruments

By Sample Type

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Other Samples

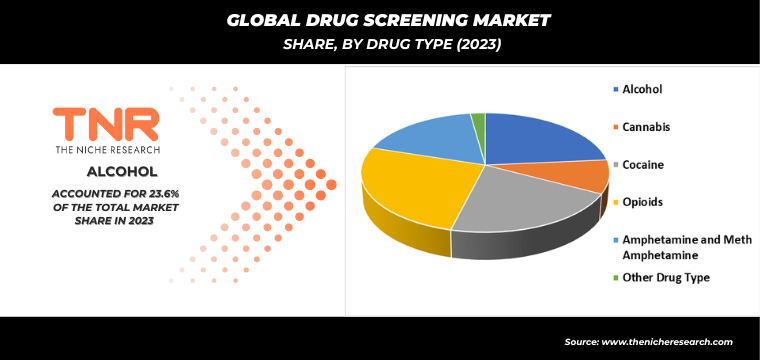

By Drug Type

- Alcohol

- Cannabis

- Cocaine

- Opioids

- Amphetamine and Meth Amphetamine

- Other Drug Type

By End User

- Drug Testing Laboratories

- Workplaces

- Criminal Justice and Law Enforcement Agencies

- Hospitals

- Drug Treatment Centers

- Individual Users

- Pain Management Centers

- Schools and Colleges

- Other end users

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Drug Screening Market

By Product and Service

- Drug Screening Product

- Analytical Instruments

- Type

- Breathalyzers

- Fuel Cell Breathalyzer

- Semiconductor Breathalyzer

- Other Breathalyzers

- Immunoassay Analyzer

- Chromatography Instruments

- Breathalyzers

- Modality

- Handheld

- Benchtop

- Rapid Testing Devices

- Urine Testing Devices

- Drug Testing Cups

- Dip Cards

- Drug Testing Cassettes

- Oral Fluid Testing Devices

- Consumables

- Assay Kits

- Sample Collection Devices

- Calibrators & Controls

- Other Consumables

- Drug Screening Services

- Laboratory Testing Services

- On-site services

- Urine Testing Devices

- Type

- Analytical Instruments

By Sample Type

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Other Samples

By Drug Type

- Alcohol

- Cannabis

- Cocaine

- Opioids

- Amphetamine and Meth Amphetamine

- Other Drug Type

By End User

- Drug Testing Laboratories

- Workplaces

- Criminal Justice and Law Enforcement Agencies

- Hospitals

- Drug Treatment Centers

- Individual Users

- Pain Management Centers

- Schools and Colleges

- Other end users

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.