Global Electric Commercial Vehicle Traction Motor Market: By Power Output, By Motor Type, By Design, By Transmission, By Axel, By Vehicle Type, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Automotive & Transportation

- Report ID: TNR-110-1100

- Number of Pages: 420

- Table/Charts : Yes

- May, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10152

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Electric commercial vehicle traction motors are key components in electric vehicles (EVs) responsible for converting electrical energy into mechanical power to drive the vehicle. These motors are specifically designed for use in commercial vehicles such as trucks, buses, vans, and delivery vehicles.

Traction motors for commercial vehicles are engineered to deliver high torque output to meet the demands of heavy-duty applications. The power output of these motors varies depending on the vehicle size, intended use, and performance requirements. Motors used in commercial vehicles typically have power ratings ranging from tens to hundreds of kilowatts. Efficiency is a critical factor in electric commercial vehicle traction motors to maximize the range and operating efficiency of the vehicle. These motors are designed to minimize energy losses during conversion and transmission, ensuring optimal performance and reducing overall energy consumption.

In terms of revenue, the global Electric Commercial Vehicle Traction Motor market was worth US$ 2.0 Bn in 2023, anticipated to witness CAGR of 31.1% During 2024 – 2034.

Global Electric Commercial Vehicle Traction Motor Market Dynamics

Government Regulations and Emission Standards: Stringent emission regulations and mandates to reduce carbon emissions are driving the adoption of electric commercial vehicles (ECVs) worldwide. Governments are implementing policies to incentivize the use of electric vehicles by offering subsidies, tax credits, and rebates. Regulatory measures such as zero-emission zones and bans on diesel vehicles in urban areas further promote the uptake of electric commercial vehicles, thereby stimulating demand for traction motors.

Technological Advancements: Ongoing advancements in electric vehicle technology, particularly in traction motor design, power electronics, and battery systems, are enhancing the performance, efficiency, and reliability of electric commercial vehicles. Innovations such as high-efficiency motors, advanced powertrain architectures, and integrated drivetrain solutions are driving market growth by enabling ECVs to achieve longer ranges, faster charging times, and higher payload capacities.

Infrastructure Development: The expansion of charging infrastructure is crucial for the widespread adoption of electric commercial vehicles. Governments, utilities, and private companies are investing in the deployment of charging stations along key transportation routes, at logistics hubs, and in urban areas to support the electrification of commercial fleets. The availability of fast-charging infrastructure reduces range anxiety and accelerates the adoption of electric vehicles, thereby boosting the demand for traction motors.

Multi-Speed Drive Transmission Has Gained Popularity in the Recent Years and Has garnered major market share in the Global Electric Commercial Vehicle Traction Motor Market During the Forecast Period (2024 – 2034).

Multi-speed drives allow for better optimization of motor efficiency across a wider range of vehicle speeds and operating conditions. In electric commercial vehicles, especially those used for delivery, logistics, and urban transit, efficient energy use is critical for extending range and reducing operating costs. Demand for multi-speed drives is driven by the need to maximize efficiency and range in electric vehicles operating in diverse driving conditions. Electric commercial vehicles often require varying levels of torque and power output to navigate different road conditions, carry varying payloads, and maintain desired speeds.

Multi-speed drives offer the flexibility to deliver the required torque and power output efficiently at different vehicle speeds. Demand for multi-speed drives is driven by the need to meet performance requirements while maintaining energy efficiency and extending vehicle range. Advances in electric drivetrain technology, including motor design, power electronics, and control algorithms, have made multi-speed drives more feasible and cost-effective for electric commercial vehicles. Continuous innovation in multi-speed drive technology, such as integrated gearbox solutions and advanced control strategies, enhances the performance and efficiency of electric traction motors. Demand for multi-speed drives is driven by technological advancements that make them more reliable, compact, and affordable for commercial vehicle applications

By Power Output 100-200kW had the Highest Share in the Global Electric Commercial Vehicle Traction Motor Market in 2023.

Commercial vehicles operating in urban environments, such as delivery vans, buses, and light-duty trucks, require sufficient power output from traction motors to ensure adequate acceleration, climbing ability, and overall performance. Demand for traction motors in this power range is driven by the need to meet the performance requirements of electric commercial vehicles while maintaining efficiency and reliability.

Electric commercial vehicles with power outputs between 100 and 200 kW typically serve short to medium-haul transportation routes, including intra-city deliveries and urban transit routes. These vehicles require traction motors that strike a balance between power output and energy efficiency to optimize battery range and maximize operating efficiency. Demand for traction motors in this power range is influenced by the need to support electric vehicles with sufficient range while minimizing energy consumption.

Asia-pacific garnered highest market share in electric commercial vehicle traction motor market in 2023.

Growing concerns about air quality, greenhouse gas emissions, and climate change are driving the shift towards cleaner and more sustainable transportation solutions. Electric commercial vehicles offer lower emissions and reduced environmental impact compared to traditional internal combustion engine vehicles. As environmental awareness increases among consumers, businesses, and policymakers in the Asia-Pacific region, there is a rising demand for electric traction motors to power commercial vehicles and contribute to environmental sustainability goals.

Many countries in the Asia-Pacific region have implemented stringent emissions regulations and incentives to promote the adoption of electric vehicles (EVs) and reduce air pollution. Government policies such as subsidies, tax incentives, and emission standards encourage fleet operators and commercial vehicle manufacturers to transition to electric propulsion systems, including traction motors, to comply with regulations and take advantage of financial incentives.

Competitive Landscape: Global Electric Commercial Vehicle Traction Motor Market:

- Allison Transmission, Inc.

- American axle & manufacturing, inc.

- Borwarner inc.

- Dana limited

- Magna International Inc.

- Robert Bosch Gmbh

- Schaeffler AG

- Zf friedrichshafen AG

- Others Industry Participants

Global Electric Commercial Vehicle Traction Motor Market: Key Data Points

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 2.0 Bn |

| Market Size Forecast by 2034 | US$ 11.3 Bn |

| Growth Rate (CAGR) | 31.1% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Power Output, By Motor Type, By Design, By Transmission, By Axel, By Vehicle Type |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Allison Transmission, Inc., American axle & manufacturing, inc., Borwarner inc., Dana limited, Magna International Inc., Robert Bosch Gmbh, Schaeffler AG, Zf friedrichshafen AG, Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Electric Commercial Vehicle Traction Motor Market

By Power Output

- Less Than 100kW

- 100-200kW

- 201-400 kW

- Above 401 kW

By Motor Type

- Permanent Magnet Synchronous Motor (PMSM)

- AC Induction Motor

- DC Traction Motor

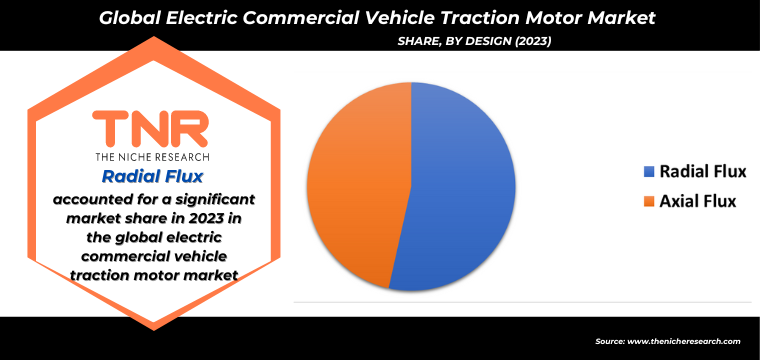

By Design

- Radial Flux

- Axial Flux

By Transmission

- Single Speed Drive

- Multi-speed Drive

By Axel

- Integrated Axle

- Central Drive Unit

By Vehicle Type

- Pickup Trucks

- Medium-Duty and Heavy-Duty Trucks

- Vans

- Buses & Coaches

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Electric Commercial Vehicle Traction Motor Market

By Power Output

- Less Than 100kW

- 100-200kW

- 201-400 kW

- Above 401 kW

By Motor Type

- Permanent Magnet Synchronous Motor (PMSM)

- AC Induction Motor

- DC Traction Motor

By Design

- Radial Flux

- Axial Flux

By Transmission

- Single Speed Drive

- Multi-speed Drive

By Axel

- Integrated Axle

- Central Drive Unit

By Vehicle Type

- Pickup Trucks

- Medium-Duty and Heavy-Duty Trucks

- Vans

- Buses & Coaches

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.