Global Electronic Warfare Market Insights, Growth, Share, Size: By Component, By Platform, By Offering, By Region & Segmental Forecast, 2024-2034, Comparative Analysis and Trends

- Industry: Aerospace & Defense

- Report ID: TNR-110-1075

- Number of Pages: 420

- Table/Charts : Yes

- April, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10198

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Global Electronic Warfare Market Insights, Growth, Share, Size: By Component, By Platform, By Offering, By Region & Segmental Forecast, 2024-2034, Comparative Analysis and Trends

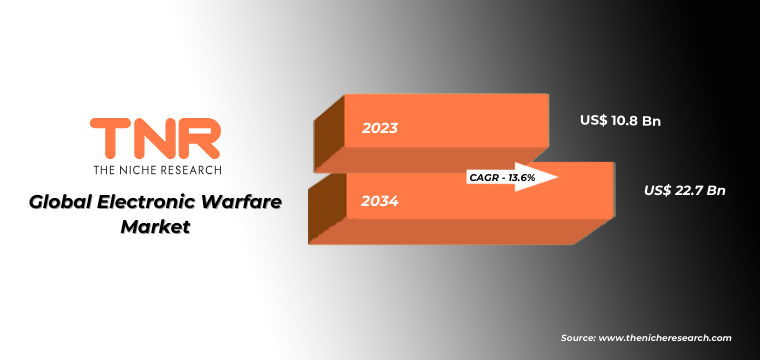

Global Electronic Warfare Market was Valued at US$ 10.8 Bn in 2023, Growing at an Estimated CAGR of 13.6% During 2024 – 2034.

Electronic Warfare (EW) involves the use of electromagnetic spectrum (EMS) to control the spectrum, attack an enemy, or impede enemy assaults via the spectrum. EW can be employed from air, sea, land, and space by manned and unmanned systems, and can target humans, communication systems, radars, or other assets. It is a crucial component of modern warfare, providing capabilities for reconnaissance and electronic countermeasures.

The global electronic warfare market is experiencing significant growth driven by technological advancements, increasing threats from electronic warfare, and military modernization programs. Technological progress has led to the development of sophisticated EW systems capable of countering evolving threats, while the escalating use of electronic warfare by adversaries has heightened the demand for advanced EW solutions. Additionally, countries are focusing on modernizing their military capabilities, including upgrading their EW systems, to maintain a competitive edge in the defense landscape.

However, the market faces challenges such as high costs associated with development and deployment, technological complexity, regulatory constraints, and cybersecurity concerns. Despite these challenges, there are opportunities for growth in the rapid adoption of unmanned systems, demand for software-defined EW systems, collaborative development programs, and emerging markets.

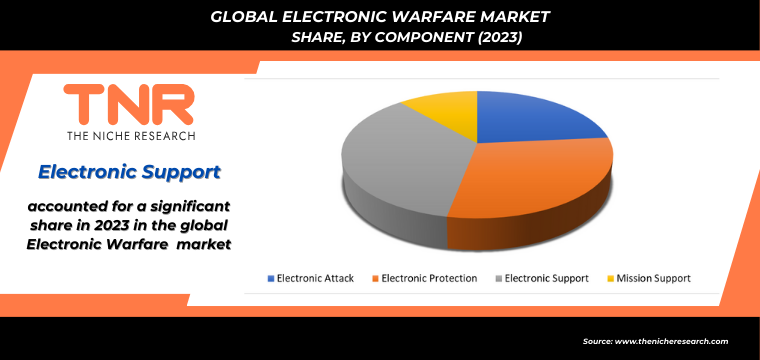

Global Electronic Warfare Market Component Outlook

Electronic Attack (EA): It involves using electromagnetic energy, directed energy, or anti-radiation weapons to attack enemy assets such as communication systems, radars, and electronic warfare systems. For example, The United States employs EA capabilities extensively across its military branches. For instance, the U.S. Navy’s EA-18G Growler aircraft is designed for electronic attack missions, providing a vital capability to disrupt and degrade enemy electronic systems.

Electronic Protection (EP): It involves implementing measures to protect friendly electronic systems from enemy attacks, interference, or detection. For example, Israel’s military forces employ advanced electronic protection measures to safeguard their communication and radar systems against potential threats in the region.

Electronic Support (ES): Actions to search for, intercept, identify, and locate sources of radiated electromagnetic energy for threat recognition and intelligence gathering is been catered under electronic support. Electronic support category accounted for a major market share in the global electronic warfare market in 2023. Russia’s military employs advanced ES capabilities, utilizing SIGINT equipment to intercept and analyze foreign military communications, providing valuable intelligence for strategic planning.

Mission Support: It involves the logistical and operational support necessary for effective EW operations, including planning, coordination, and intelligence analysis. The mission support segment plays a crucial role in enhancing the effectiveness of EW operations. For instance, United Kingdom’s Royal Air Force (RAF) employs comprehensive mission support systems and training programs to ensure its personnel are well-equipped and trained for EW missions.

In 2023, the electronic warfare market experienced significant growth, driven by advancements in various devices and systems.

This category includes various hardware and systems essential for conducting electronic warfare operations, such as radars, jammers, antennas, and integrated electronic warfare suites. One of the primary reasons for the significant market share is the increasing investment by countries in modernizing their military capabilities to address emerging threats in electronic warfare environments.

As potential adversaries continue to develop and deploy advanced electronic warfare systems, there is a growing need for countries to upgrade their EW equipment to maintain a competitive edge on the battlefield. Countries like the United States, Russia, China, and European nations have been at the forefront of investing in advanced electronic warfare equipment. For instance, the U.S. Department of Defense has been allocating significant budgets for the development and procurement of next-generation EW systems, including advanced jammers, radar systems, and integrated EW suites, to ensure superiority in electronic warfare capabilities.

Additionally, the integration of advanced technologies such as artificial intelligence (AI), machine learning, and quantum computing into electronic warfare equipment has also contributed to the growth of the equipment category in the global electronic warfare market. These technologies enable more sophisticated and autonomous EW operations, enhancing the effectiveness and efficiency of electronic warfare systems in detecting, identifying, and countering electronic threats.

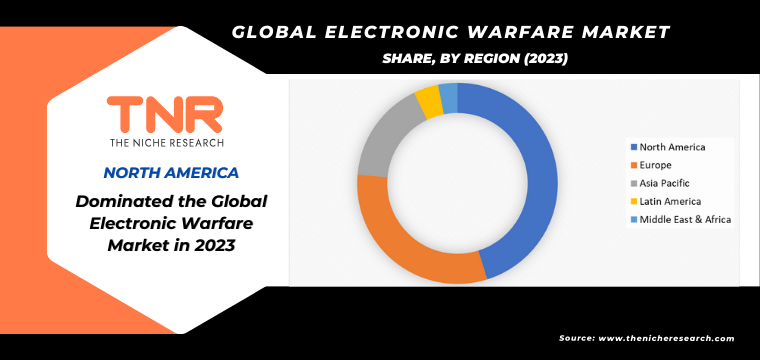

In 2023, North America, led by the United States, continued to dominate the global electronic warfare market, accounting for a significant share of ~43.7%. North America’s robust demand for advanced EW capabilities contributed significantly to this market size. The United States Department of Defense (DoD) allocated an impressive budget exceeding USD 10 billion for EW-related initiatives in 2023. This substantial investment underscored the region’s strategic focus on maintaining technological superiority in the face of evolving electronic threats. Furthermore, North America’s leadership in EW was reinforced by its technological advancements, operational requirements, and collaborative partnerships, positioning the region as a key player in shaping the future of electronic warfare market on the global stage.

Competitive Landscape: Global Electronic Warfare Market

- BAE Systems plc

- Elbit Systems Ltd.

- General Dynamics Corporation

- HENSOLDT

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo SpA

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- SAAB AB

- Thales Group

- Other Market Participants

Global Electronic Warfare Market

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 10.8 Bn |

| Market Size Forecast by 2034 | US$ 22.7 Bn |

| Growth Rate (CAGR) | 13.6% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component, By Platform, By Offering |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | BAE Systems plc, Elbit Systems Ltd., General Dynamics Corporation, HENSOLDT, Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Leonardo SpA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Thales Group, Other Market Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Electronic Warfare Market Scope

By Component

- Electronic Attack

- Electronic Protection

- Electronic Support

- Mission Support

By Platform

- Ground-Based

- Naval

- Air Based

- Cyber

By Offering

- Solutions

- Devices/Systems

-

- Advanced Threat Infrared Countermeasures (ATIRCM)

- Antennas / Antenna Arrays

- Anti-Jam Electronic Protection Systems

- Anti-Radiation Missiles (ARM)

- Common Missile Warning Systems (CMWS)

- Countermeasures Dispenser Systems (CMDS)

- Digital Electronic Warfare Systems (DEWS)

- Directed Energy Weapons

- Directional Infrared Countermeasures (DIRCM)

- Electronic Warfare Self-Protection (EWSP) Suites

- Electromagnetic Shielding / Hardening

- Emissions Control (EMCON) Systems

- Geospatial Location and Exploitation Systems

- Identification Friend or Foe (IFF) Systems

- Infrared (IR) Missile Warning System

- Passive Active Warning Survivability Systems

- Radar Warning Receiver (RWR) / Laser Warning Receiver (LWR)

- Radio Frequency Countermeasures (RFCM)

- Resilience-in-Depth Cyber Systems

- Signal Jammers

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Electronic Warfare Market Scope

By Component

- Electronic Attack

- Electronic Protection

- Electronic Support

- Mission Support

By Platform

- Ground-Based

- Naval

- Air Based

- Cyber

By Offering

- Solutions

- Devices/Systems

-

- Advanced Threat Infrared Countermeasures (ATIRCM)

- Antennas / Antenna Arrays

- Anti-Jam Electronic Protection Systems

- Anti-Radiation Missiles (ARM)

- Common Missile Warning Systems (CMWS)

- Countermeasures Dispenser Systems (CMDS)

- Digital Electronic Warfare Systems (DEWS)

- Directed Energy Weapons

- Directional Infrared Countermeasures (DIRCM)

- Electronic Warfare Self-Protection (EWSP) Suites

- Electromagnetic Shielding / Hardening

- Emissions Control (EMCON) Systems

- Geospatial Location and Exploitation Systems

- Identification Friend or Foe (IFF) Systems

- Infrared (IR) Missile Warning System

- Passive Active Warning Survivability Systems

- Radar Warning Receiver (RWR) / Laser Warning Receiver (LWR)

- Radio Frequency Countermeasures (RFCM)

- Resilience-in-Depth Cyber Systems

- Signal Jammers

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.