Global Genotyping Assay Market: By Product and Service, By Technology, By Application, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1175

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10121

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

A genotyping assay is a laboratory method used to analyse genetic variations in an individual’s DNA. It identifies specific alleles or mutations within genes to determine genetic differences that can influence traits, disease susceptibility, and response to treatments. These assays employ advanced technologies like polymerase chain reaction (PCR), next-generation sequencing (NGS), and microarrays to provide detailed genetic profiles. Widely utilized in medical research, personalized medicine, and agriculture, genotyping assays enable the identification of genetic markers associated with various conditions, guiding targeted therapies and improving patient outcomes. Additionally, in agriculture, they assist in breeding programs by pinpointing desirable traits in plants and animals, thereby enhancing productivity and disease resistance.

The rise in personalized medicine is a major driver, as genotyping assays enable the identification of genetic variations that influence an individual’s response to treatments, allowing for tailored and more effective therapeutic interventions. Technological advancements in genotyping, such as next-generation sequencing (NGS) and high-throughput microarray technologies, have made these assays more accurate, faster, and cost-effective, further boosting their adoption. Additionally, the increasing prevalence of genetic disorders and cancers necessitates precise diagnostic tools, driving the demand for genotyping assays. Regulatory support and funding for genetic research from government bodies also play a significant role in propelling the market forward.

Furthermore, the expansion of genotyping applications in agriculture and biotechnology, for purposes such as crop improvement and disease resistance, broadens the scope and demand for these assays across various sectors.

In terms of revenue, the global genotyping assay market was worth US$ 19.2 Bn in 2023, anticipated to witness CAGR of 14.2% during 2024 – 2034.

Global Genotyping Assay Market Dynamics

Technological Advancements: Innovations in genotyping technologies, such as next-generation sequencing (NGS) and microarray analysis, have significantly enhanced the accuracy, speed, and cost-effectiveness of genotyping assays. These advancements enable comprehensive genetic analysis, facilitating better disease understanding and personalized medicine. Improved technologies also allow for high-throughput genotyping, which supports large-scale studies and accelerates research and development in genomics.

Rising Prevalence of Genetic Disorders: The increasing incidence of genetic disorders globally drives the demand for genotyping assays. Early diagnosis and targeted treatment of genetic conditions rely heavily on precise genotyping. As awareness of genetic diseases grows, healthcare providers and patients seek more advanced diagnostic tools, boosting the market for genotyping assays that can identify and analyse genetic mutations accurately.

Growth of Personalized Medicine: Personalized medicine, which tailors’ treatment based on an individual’s genetic profile, significantly boosts the demand for genotyping assays. These assays help identify genetic variations that influence drug response, allowing for customized treatment plans that improve efficacy and reduce adverse effects. As the healthcare industry increasingly adopts personalized approaches, the demand for precise and comprehensive genotyping assays continues to rise.

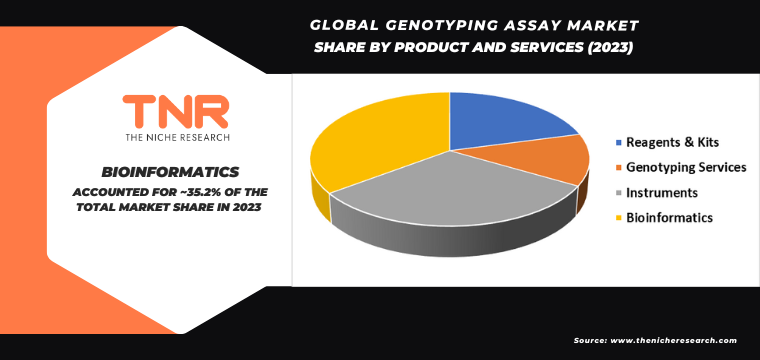

Bioinformatics Segment is Projected as Fastest Growing Segment in the Global Genotyping Assay Market During the Forecast Period (2024 – 2034).

The demand for bioinformatics in genotyping assays is primarily driven by the exponential growth of genetic data and the need for sophisticated tools to analyse and interpret this information. As genotyping assays produce vast amounts of complex data, bioinformatics provides the computational power and algorithms necessary to manage, analyse, and visualize genetic variations. This capability is crucial for advancing personalized medicine, as it enables the identification of genetic markers linked to disease susceptibility and drug response, facilitating the development of targeted therapies.

Additionally, bioinformatics enhances the efficiency and accuracy of genomic research, supporting pharmaceutical and biopharmaceutical companies in drug discovery and development. The integration of artificial intelligence and machine learning in bioinformatics further propels its demand, offering deeper insights and predictive analytics. As the genotyping market expands, the critical role of bioinformatics in transforming raw genetic data into meaningful clinical insights drives its rapid growth and adoption.

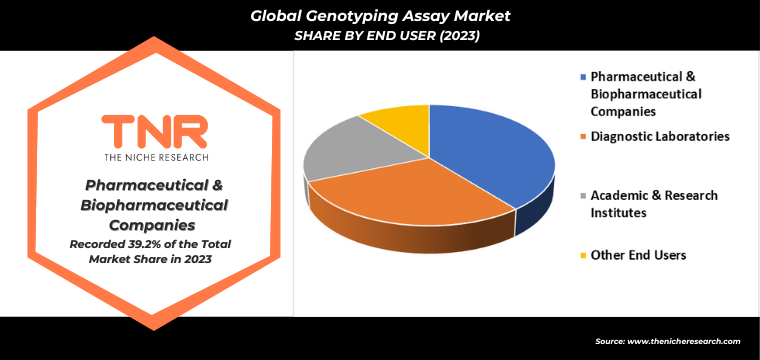

By End User Pharmaceutical and Biopharmaceutical Companies Segment had the Highest Share in the Global Genotyping Assay Market in 2023.

The demand for genotyping assays among pharmaceutical and biopharmaceutical companies is driven by their crucial role in drug development and personalized medicine. These companies increasingly rely on genotyping to identify genetic variations that influence drug response and efficacy, enabling the development of targeted therapies. By utilizing genotyping assays, they can streamline clinical trials through better patient stratification, reducing trial costs and duration. The push towards personalized medicine, where treatments are tailored to an individual’s genetic makeup, further boosts the demand for precise and comprehensive genotyping.

Additionally, regulatory agencies now often require pharmacogenomic data to support drug approval processes, making genotyping assays indispensable for compliance and market entry. As biopharmaceutical innovations continue to advance, the integration of genotyping in research and development processes ensures that new therapies are both effective and safe, driving the ongoing growth and adoption of genotyping technologies in the industry.

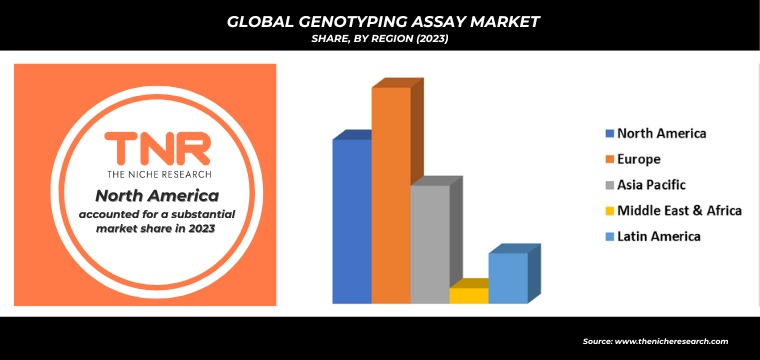

By Region, Europe Dominated the Global Genotyping Assay Market in 2023.

Europe is projected to have one of the major market shares in the global genotyping assay market in 2023. Increasing prevalence of genetic disorders and the rising awareness of personalized medicine, which relies on genotyping to tailor treatments to individual genetic profiles. Advances in genomic research and technology have made genotyping assays more accessible and cost-effective, encouraging their widespread adoption in both clinical and research settings. The European Union’s supportive regulatory framework and funding initiatives for genetic research further bolster this demand. Additionally, the growing use of genotyping in agricultural biotechnology to improve crop resistance and productivity highlights its broad application spectrum.

The integration of genotyping assays in routine medical diagnostics, particularly for cancer and rare diseases, also contributes to their rising demand, reflecting a broader trend towards precision medicine and enhanced patient care across Europe. The European Union’s Horizon 2020 program allocated over EUR 85.5 billion for research and innovation, including substantial funding for genomics and biotechnology, further accelerating the market. Additionally, countries like Germany, the UK, and France are leading in the adoption of genotyping technologies, reflecting their robust healthcare infrastructure and strong emphasis on scientific research. These statistics underscore the dynamic growth and significant potential of the genotyping assay market in Europe.

Competitive Landscape: Global Genotyping Assay Market:

- Agilent Technologies, Inc

- Bio-Rad Laboratories, Inc

- Danaher Corporation

- Eurofins Scientific

- Fluidigm Corporation

- GE Healthcare

- Genewiz, Inc

- Illumina, Inc

- Integrated DNA Technologies, Inc

- Pacific Biosciences of California, Inc

- Perkinelmer, Inc

- Qiagen N.V.

- Roche Diagnostics Limited

- Thermo Fisher Scientific, Inc

- Other Industry Participants

Global Genotyping Assay Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 19.2 Bn |

| Market Size Forecast by 2034 | US$ 82.7 Bn |

| Growth Rate (CAGR) | 14.2% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product and Service, By Technology, By Application, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Agilent Technologies, Inc, Bio-Rad Laboratories, Inc, Danaher Corporation, Eurofins Scientific, Fluidigm Corporation, GE Healthcare, Genewiz, Inc, Illumina, Inc, Integrated DNA Technologies, Inc, Pacific Biosciences of California, Inc, Perkinelmer, Inc, Qiagen N.V., Roche Diagnostics Limited, Thermo Fisher Scientific, Inc |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Genotyping Assay Market

By Product and Services

- Reagents & Kits

- Genotyping Services

- Instruments

- Sequencers and Amplifiers

- Analysers

- Bioinformatics

- Software

- Services

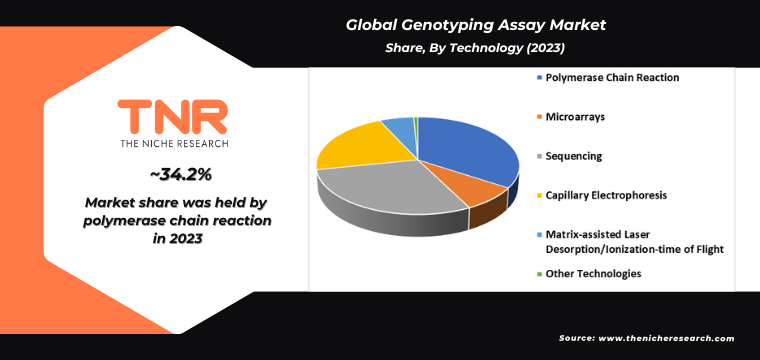

By Technology

- Polymerase Chain Reaction

- Real-Time Polymerase Chain Reaction

- Digital Polymerase Chain Reaction

- Microarrays

- Sequencing

- Next-Generation Sequencing

- Pyrosequencing

- Sanger Sequencing

- Capillary Electrophoresis

- Amplified Fragment Length Polymorphism

- Restriction Fragment Length Polymorphism

- Single-Strand Confirmation Polymorphism

- Matrix-assisted Laser Desorption/Ionization-time of Flight

- Other Technologies

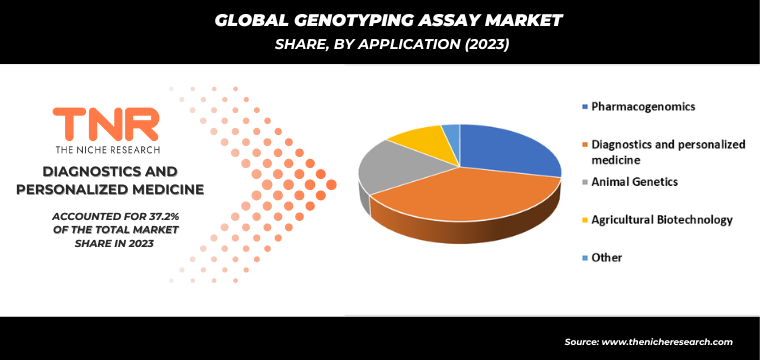

By Application

- Pharmacogenomics

- Diagnostics and personalized medicine

- Animal genetics

- Agricultural Biotechnology

- Other

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Laboratories

- Academic & Research Institutes

- Other End Users

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Genotyping Assay Market

By Product and Services

- Reagents & Kits

- Genotyping Services

- Instruments

- Sequencers and Amplifiers

- Analysers

- Bioinformatics

- Software

- Services

By Technology

- Polymerase Chain Reaction

- Real-Time Polymerase Chain Reaction

- Digital Polymerase Chain Reaction

- Microarrays

- Sequencing

- Next-Generation Sequencing

- Pyrosequencing

- Sanger Sequencing

- Capillary Electrophoresis

- Amplified Fragment Length Polymorphism

- Restriction Fragment Length Polymorphism

- Single-Strand Confirmation Polymorphism

- Matrix-assisted Laser Desorption/Ionization-time of Flight

- Other Technologies

By Application

- Pharmacogenomics

- Diagnostics and personalized medicine

- Animal genetics

- Agricultural Biotechnology

- Other

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Laboratories

- Academic & Research Institutes

- Other End Users

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.