Global Immune Health Supplements Market, By Source, By Ingredient Type, By Form, By Age Group, By Distribution Channel, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Food & Beverages

- Report ID: TNR-110-1291

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10105

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Immune health supplements are dietary products designed to support and enhance the body’s immune system. These supplements typically contain a combination of vitamins, minerals, herbs, probiotics, amino acids, and other natural ingredients that are known to boost immune function. They are used to help the body resist infections, reduce the severity of illnesses, and maintain overall health, particularly during times of increased stress or seasonal changes.

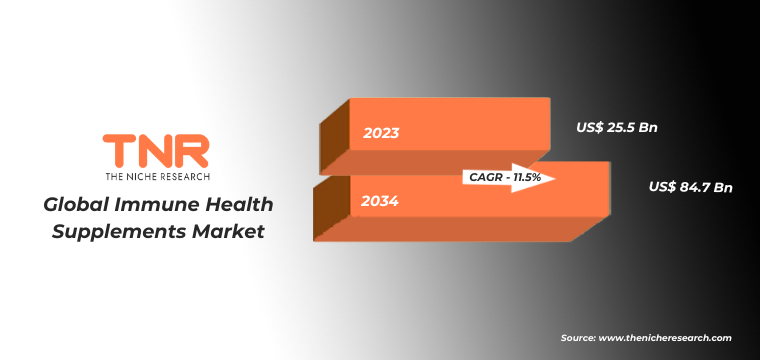

The immune health supplements market is witnessing significant growth as more people seek proactive ways to maintain their health. These supplements are increasingly important in day-to-day life, helping individuals bolster their immune systems against common colds, flu, and other infections. With a growing awareness of health and wellness, consumers are integrating these supplements into their daily routines, either as preventive measures or to enhance recovery from illnesses, thus driving market expansion. In Terms of Revenue, the Global Immune Health Supplements Market was Worth US$ 25.5 Bn in 2023 and is Anticipated to Witness a CAGR of 11.5% During 2024 – 2034.

Main Source of Ingredients Used in Immune Health Supplements:

| INGREDIENT | SOURCE |

| Vitamin and Mineral | · Citrus fruits

· Sunlight Exposure · Egg Yolk · Fish · Fortified Cereals · Others |

| Herbal Supplements | · Echinacea

· Elderberry · Astragalus · Garlic · Ginger · Others |

| Probiotic | · Lactobacillus

· Bifidobacterium · Saccharomyces Boulardii · Streptococcus Thermophilus · Others |

| Amino Acids and Proteins | · L-arginine

· Glutamine · L-cysteine · Lysine · Whey Protein · Others |

| Omega-3 Fatty Acids | · Fish Oil

· Algal Oil · Flaxseeds · Chia Seeds · Walnuts · Others |

Immune Health Supplements Market Dynamic

Growth Driver-

Growing Consumer Awareness of Immune Health

The global immune health supplements market is driven by increasing consumer awareness regarding the importance of maintaining a robust immune system. The rising prevalence of infectious diseases and health concerns has led to a surge in demand for immune-boosting products, particularly in the wake of the COVID-19 pandemic, further fueling market growth.

Challenge-

Regulatory Challenges and Stringent Guidelines

The global immune health supplements market faces significant restraint due to stringent regulatory guidelines and complex approval processes. Variations in regulatory standards across regions can delay product launches and increase compliance costs for manufacturers, limiting the market’s growth potential. This challenge is particularly pronounced in markets with rigorous safety and efficacy requirements for dietary supplements.

Opportunity-

Expansion into Emerging Markets

The global immune health supplements market has a significant growth opportunity in emerging markets. Rising disposable incomes, increasing health consciousness, and expanding retail infrastructure in regions such as Asia-Pacific and Latin America create a favorable environment for market expansion. Companies can tap into these markets to cater to a growing consumer base seeking preventive health solutions.

Trend-

Rising Popularity of Personalized Supplements

A key trend in the global immune health supplements market is the growing demand for personalized supplements. Consumers are increasingly seeking products tailored to their specific health needs and genetic profiles. Advances in biotechnology and data analytics are enabling companies to offer customized solutions, enhancing efficacy and consumer satisfaction, and driving market growth.

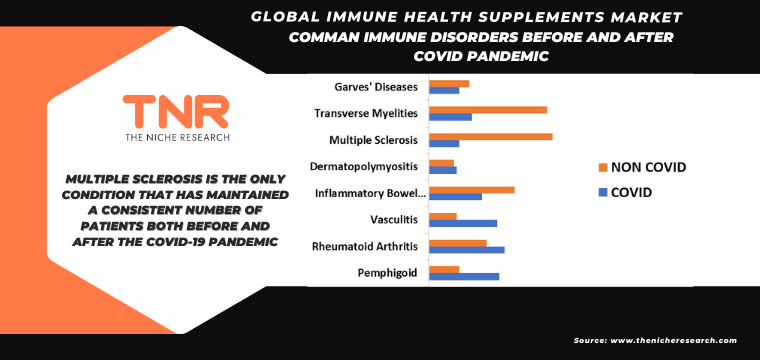

Common Immune Disorders Before and After Covid Pandemic:

Before the COVID-19 pandemic, common immune disorders included autoimmune diseases like rheumatoid arthritis, vasculitis, and multiple sclerosis, as well as immunodeficiencies such as primary immunodeficiency disorders. These conditions often led to chronic inflammation, increased susceptibility to infections, and reduced quality of life.

After the COVID-19 pandemic, there has been a heightened awareness and focus on immune health. The pandemic underscored the importance of a strong immune system, leading to increased interest in preventive measures and immune-boosting supplements. Additionally, the pandemic prompted more research into the long-term effects of COVID-19 on the immune system, revealing potential complications and new insights into immune disorders.

Immune Health Supplements Market Segmentation by Source, Ingredient Type, Form, Age Group, Distribution Channel, Region

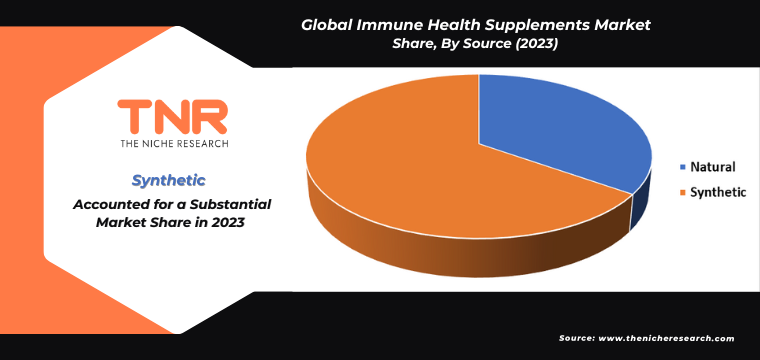

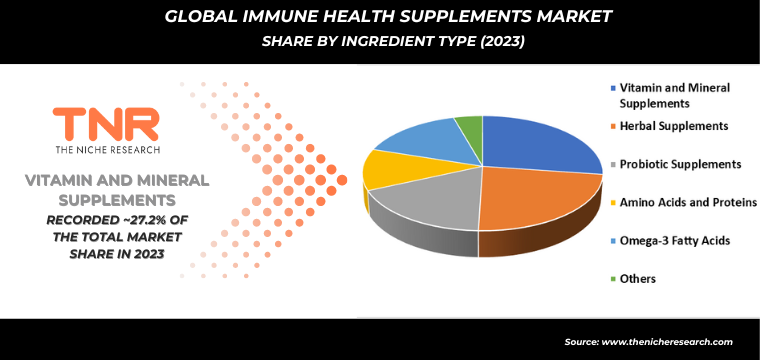

Synthetic supplements segment by product type is set to dominate the immune health supplements market, commanding a substantial revenue share of 65.2% over the forecast period. This dominance is driven by several factors, including the high efficacy, consistent quality, and lower cost of synthetic supplements compared to natural alternatives. Consumers increasingly favor synthetic products due to their scientifically validated formulations and predictable outcomes. Additionally, advancements in technology allow for precise control over ingredient concentrations and enhanced bioavailability, contributing to their growing preference. As the market expands, synthetic supplements are expected to continue leading due to their significant advantages in effectiveness and affordability.

Herbal supplements is anticipated to be the fastest-growing segment in the immune health supplements market, capturing a substantial revenue share of 23.3% over the forecast period. This growth is fueled by increasing consumer demand for natural and organic products. Manufacturers are shifting towards the production of herbal supplements, investing in research to validate their efficacy and improve formulations. This shift reflects a broader trend towards holistic health solutions, driven by consumer preferences for plant-based and traditional remedies. For instance, Solgar launched a new dietary supplement named Immune Support, designed to bolster immune function with a blend of vitamins, minerals, and herbs. Similarly, Nature’s Way introduced Immune Defense, a supplement that also combines vitamins, minerals, and herbal ingredients to enhance immune health.

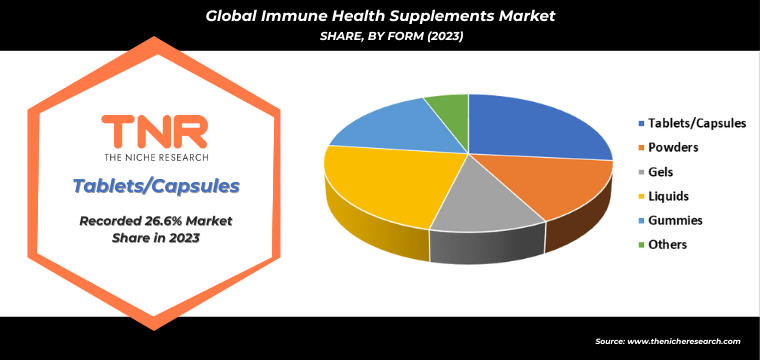

Tablets/capsules segment dominated the immune health supplements market, capturing a significant revenue share of 26.6% over the forecast period. This preference is largely due to the convenience, precise dosage, and longer shelf life that tablets and capsules offer compared to other forms of supplements. Consumers favor these formats for their ease of ingestion, portability, and ability to deliver consistent and measured doses, which enhances adherence to supplementation routines and contributes to their market-leading position. For instance, Amway launched a new line of immune health supplements called Nutrilite Immune+. The line includes gummies, capsules, and powders that contain vitamins, minerals, and herbs that support immune function.

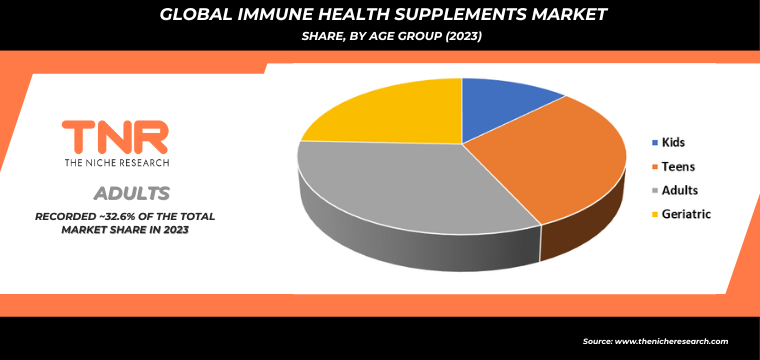

Among various age groups, adults are the primary consumers of immune health supplements. This trend is driven by increased health consciousness and a proactive approach to maintaining wellness as individuals age. Adults often seek supplements to bolster their immune system, manage stress, and enhance overall health. Additionally, busy lifestyles and a greater awareness of preventive health measures contribute to this demographic’s higher consumption rates. As adults become more informed about the benefits of supplements and their role in immune support, the demand within this age group continues to rise, influencing market dynamics significantly.

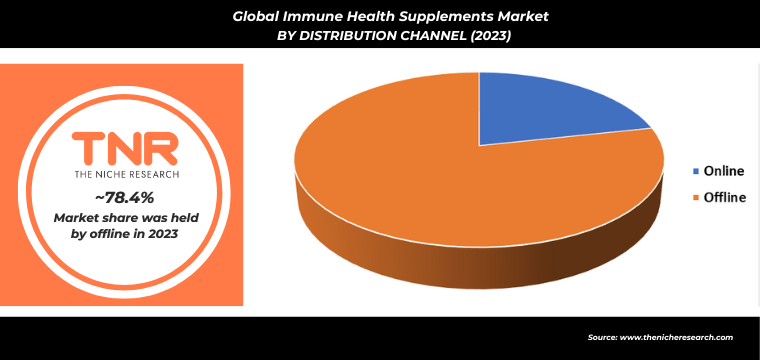

Offline segment by distribution channel dominated the immune health supplements market, accounting for a significant revenue share of 78.4%. This preference is driven by customers’ inclination to purchase supplements in physical stores, where they can receive personalized advice and immediate product access. The tangible shopping experience and the ability to consult with knowledgeable staff contribute to consumers’ comfort and trust, making offline purchases a preferred choice over online shopping for many individuals seeking dietary supplements.

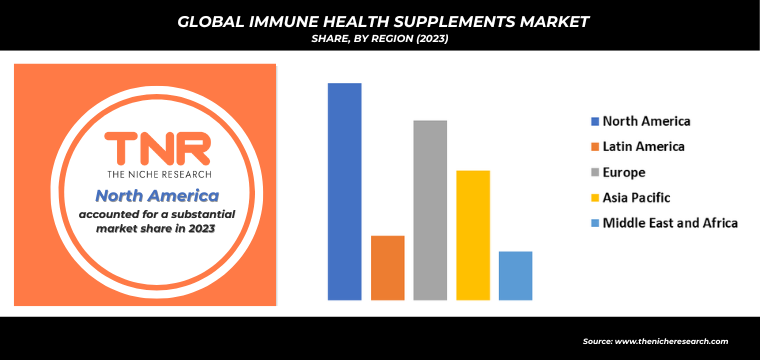

In 2023, North America is anticipated to play a significant role in propelling the growth of the immune health supplements market, contributing approximately 33.9% to its overall expansion. This significant role is due to the region’s advanced healthcare infrastructure, high consumer awareness, and robust demand for immune-boosting products. Additionally, North America hosts a large number of leading supplement manufacturers, making it a key outlet for companies from various countries. The presence of numerous established brands and innovative companies in this market drives competitive dynamics and offers extensive distribution networks, further fueling the region’s dominant position in the global market.

Key Developments

- In October 2021, Aenova launched an innovative softgel capsule formulation designed to deliver probiotics specifically to the gut.

- In April 2020, Royal DSM, a global leader in nutrition, health, and sustainable living, completed its acquisition of Glycom, a top supplier of Human Milk Oligosaccharides (HMOs). This acquisition aims to reinforce DSM’s leadership in Early Life Nutrition and Dietary Supplements.

Major Players in Immune Health Supplements Market

- Amway, Co.

- Bayer AG

- Designs for Health

- Douglas Laboratories

- Garden of Life

- Integrative Therapeutics

- Jarrow Formulas

- Klaire Labs

- Life Extension

- MegaFood

- Metagenics

- Nature’s Way

- Nordic Naturals

- NOW Foods

- Pure Encapsulations

- Solaray

- Standard Process

- The Nature’s Bounty Co.

- Thorne Research

- Xymogen

- Other Industry Participants

Global Immune Health Supplements Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 25.5 Bn |

| Market Size Forecast by 2034 | US$ 84.7 Bn |

| Growth Rate (CAGR) | 11.5% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Source, By Ingredient Type, By Form, By Age Group, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Amway, Co., Bayer AG, Designs for Health, Douglas Laboratories, Garden of Life, Integrative Therapeutics, Jarrow Formulas, Klaire Labs, Life Extension, MegaFood, Metagenics, Nature’s Way, Nordic Naturals, NOW Foods, Pure Encapsulations, Solaray, Standard Processl The Nature’s Bounty Co., Thorne Research, Xymogen |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Immune Health Supplements Market

By Source

- Natural

- Synthetic

By Ingredient Type

- Vitamin and Mineral Supplements

- Herbal Supplements

- Probiotic Supplements

- Amino Acids and Proteins

- Omega-3 Fatty Acids

- Others

By Form

- Tablets/Capsules

- Powders

- Gels

- Liquids

- Gummies

- Others

By Age Group

- Kids

- Teens

- Adults

- Geriatric

By Distribution Channel

- Online

- Offline

- Pharmacies

- Health Food Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Immune Health Supplements Market

By Source

- Natural

- Synthetic

By Ingredient Type

- Vitamin and Mineral Supplements

- Herbal Supplements

- Probiotic Supplements

- Amino Acids and Proteins

- Omega-3 Fatty Acids

- Others

By Form

- Tablets/Capsules

- Powders

- Gels

- Liquids

- Gummies

- Others

By Age Group

- Kids

- Teens

- Adults

- Geriatric

By Distribution Channel

- Online

- Offline

- Pharmacies

- Health Food Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.