Global In Vitro Diagnostics (IVD) Market Insights, Growth, Share, Size: By Offering, By Application, By Clinical Indication, By End Users, By Sales Channel, By Region & Segmental Forecast, 2023-2031, Comparative Analysis and Trends

- Industry: Healthcare

- Report ID: TNR-110-1052

- Number of Pages: 420

- Table/Charts : Yes

- January, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10230

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Global In Vitro Diagnostics (IVD) Market was Valued at USD 117.8 Bn in 2022, Growing at an Estimated CAGR of 4% During 2023 – 2031.

In Vitro Diagnostics (IVD) refers to tests and procedures performed on biological samples (such as blood, urine, tissue) taken from the human body. These tests are conducted outside the body, usually in a laboratory setting, to diagnose diseases, monitor health conditions, and guide treatment decisions. IVD has significantly evolved over time, and its use has become integral to modern healthcare.

The emergence and evolution of in vitro diagnostics (IVD) market has been shaped by centuries of scientific inquiry, technological advancements, and the quest to understand and combat diseases. IVD has become an indispensable part of modern healthcare, aiding in disease diagnosis, monitoring, and personalized treatment approaches.

Global In Vitro Diagnostics (IVD) Market Revenue & Forecast, (US$ Million), 2015 – 2031

The growth of the global in vitro diagnostics (IVD) market has been driven by several key factors. Technological advancements play a crucial role, with companies like Roche Diagnostics innovating automated molecular testing systems such as the cobas platforms, elevating the accuracy and efficiency of diagnostics. The prevalence of chronic diseases like diabetes, cancer, and cardiovascular conditions has fueled the demand for diagnostic tests, prompting companies such as Abbott Laboratories and Siemens Healthineers to develop various tests and platforms tailored to these ailments. Moreover, aging population has led to an increased need for diagnostics targeting age-related diseases, prompting companies like BD and bioMérieux to introduce specialized tests and systems catering to geriatric healthcare needs.

The demand for point-of-care testing (POCT) has surged, prompting companies like Abbott and Quidel to create portable and rapid testing devices that provide immediate results, aligning with the need for quick diagnoses. The COVID-19 pandemic acted as a catalyst, accelerating innovation and demand for diagnostic tests. Companies including Thermo Fisher Scientific, Roche, Abbott, and Qiagen played significant roles in developing and scaling up COVID-19 tests, including PCR and rapid antigen tests, showcasing the industry’s agility and responsiveness in crisis situations.

Advancements in genomics and personalized medicine have led to the development of companion diagnostics, where companies like Foundation Medicine (a Roche company) have crafted tests to identify genetic mutations for targeted cancer therapies. Emerging markets with increasing healthcare expenditure and improving infrastructure have become focal points for growth, prompting companies such as Sysmex Corporation and Ortho Clinical Diagnostics to expand their presence in these regions. Lastly, regulatory changes emphasizing quality standards have pushed companies to invest in research and development, ensuring compliance and obtaining necessary approvals for their diagnostic products. This collective innovation across companies continues to shape and enhance the landscape of diagnostic technologies, addressing evolving healthcare needs on a global scale.

Offerings OutlookSemiautomated systems have significantly contributed for largest market share within the system & instruments category of the in vitro diagnostics (IVD) market. These systems blend human intervention with automated processes, offering a balance between manual and fully automated systems. Their popularity arises from their ability to streamline workflows while retaining some level of user control and flexibility.

Offerings OutlookSemiautomated systems have significantly contributed for largest market share within the system & instruments category of the in vitro diagnostics (IVD) market. These systems blend human intervention with automated processes, offering a balance between manual and fully automated systems. Their popularity arises from their ability to streamline workflows while retaining some level of user control and flexibility.

In various segments of diagnostics such as clinical chemistry, hematology, and coagulation testing, semiautomated systems have been pivotal. They allow for efficient sample processing, reducing human error while enabling laboratory professionals to oversee and verify results. Companies like Sysmex, Beckman Coulter, and Siemens Healthineers have developed semiautomated systems that provide accuracy, reproducibility, and faster turnaround times.

These systems appeal to laboratories of different sizes – from smaller facilities that need some automation to larger labs seeking to complement their fully automated lines. Their adaptability and cost-effectiveness make them a preferred choice for many diagnostic settings. As the industry progresses with a focus on enhancing efficiency and accuracy, semiautomated systems continue to hold a substantial market share in the global in vitro diagnostics (IVD) market due to their ability to strike a balance between manual dexterity and automation in the diagnostic process.

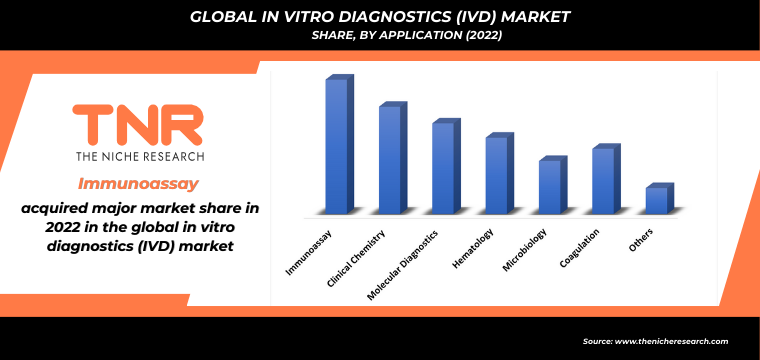

Application OutlookThe dominance of the immunoassay segment in the in vitro diagnostics (IVD) market in 2022 highlights the significance of this diagnostic technique.

Application OutlookThe dominance of the immunoassay segment in the in vitro diagnostics (IVD) market in 2022 highlights the significance of this diagnostic technique.

Immunoassays are crucial in detecting and quantifying specific molecules like hormones, proteins, and antibodies present in biological samples. Their wide application across various medical fields, including infectious diseases, oncology, endocrinology, and autoimmune disorders, contributes to their market dominance. Several factors have propelled the immunoassay segment to the forefront of the vitro diagnostics (IVD) market. The increasing prevalence of chronic and infectious diseases worldwide has led to a growing demand for precise and sensitive diagnostic tools, which immunoassays excel at providing. Companies like Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers have developed advanced immunoassay platforms offering high sensitivity, specificity, and automation, further driving the segment’s dominance.

Clinical Indication Outlook

The infectious diseases segment’s large market share in the in vitro diagnostics (IVD) market is driven by the pressing need for accurate and rapid diagnostic solutions in identifying and managing infectious conditions like HIV, hepatitis, tuberculosis, and emerging pathogens like the SARS-CoV-2 virus responsible for COVID-19. Companies have developed innovative molecular diagnostics, immunoassays, and rapid antigen tests, driving the segment’s prominence.

Regional Outlook North America has historically held a dominant position in the global in vitro diagnostics (IVD) market. The region’s prominence is fueled by various factors, including advanced technological capabilities, substantial healthcare investments, and a competitive landscape of leading companies. The United States and Canada, in particular, have been pivotal in driving innovation and the adoption of sophisticated diagnostic tools. Companies like Abbott Laboratories, Thermo Fisher Scientific, and Roche Diagnostics have established themselves as key players, continuously developing cutting-edge IVD technologies.

Moreover, North America’s significant healthcare spending contributes to the widespread utilization of advanced diagnostics across hospitals, clinics, and research institutions. This financial commitment allows for the incorporation of state-of-the-art IVD solutions into the healthcare system, fostering early disease detection, precision medicine, and improved patient care.

The region’s competitive market environment encourages continuous advancements and the introduction of novel diagnostic solutions, sustaining its leadership in the global in vitro diagnostics (IVD) market landscape. This dominance is expected to persist as North America remains a hub for technological innovation, strategic investments, and a strong emphasis on healthcare excellence.

Competitive Landscape: Global In Vitro Diagnostics (IVD) Market

- Abbott Laboratories

- BD

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- Hoffmann-La Roche Ltd

- Ortho Clinical Diagnostics.

- QIAGEN

- Siemens Healthineers

- STRATEC SE (Diatron MI Zrt)

- Sysmex Europe GmbH.

- Thermo Fisher Scientific

- Other Industry Participants

Global In Vitro Diagnostics (IVD) Market Summary

| Report Specifications | Details |

| Market Revenue in 2022 | US$ 117.8 Bn |

| Market Size Forecast by 2031 | US$ 217.9 Bn |

| Growth Rate (CAGR) | 4% |

| Historic Data | 2015 – 2021 |

| Base Year for Estimation | 2022 |

| Forecast Period | 2023 – 2031 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Offering, By Application, By Clinical Indication, By End Users, By Sales Channel |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Abbott Laboratories, BD, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher., DiaSorin S.p.A., F. Hoffmann-La Roche Ltd, Ortho Clinical Diagnostics., QIAGEN, STRATEC SE (Diatron MI Zrt), Siemens Healthineers, Sysmex Europe GmbH., Thermo Fisher Scientific, Other Market Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global In Vitro Diagnostics (IVD) Market ScopeBy Offering

- Products

- Systems & Instruments

- Fully Automated Systems

- Semi-Automated Systems

- Others

- Assays and Reagents

- Calibrators & Control Materials

- Reagent Kits

- Others

- Systems & Instruments

- Software

- Information/Data Management Software

- Lab Automation Software

- Others

- Services

By Application

- Immunoassay

- Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Microbiology

- Coagulation

- Others

By Clinical Indication

- Infectious Disease

- Hepatitis

- Coronavirus Disease (COVID-19)

- Others

- Oncology

- Diabetes

- Cardiology

- Gynecology and Women’s Health

- Bone Health

- Autoimmune Diseases

- Others

By End Users

- Hospitals

- Emergency Care Centers

- Clinical Diagnostics Laboratories

- Academic & Research Institutions

- Home Care

- Others

By Sales Channel

- Direct

- Indirect

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Coverage & Deliverables

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion

**Exclusive for Multi-User and Enterprise User.

Global In Vitro Diagnostics (IVD) Market Segmentation

Global In Vitro Diagnostics (IVD) Market –Offering Outlook (Revenue, USD Million, 2015 – 2031)

Global In Vitro Diagnostics (IVD) Market – ApplicationOutlook (Revenue, USD Million, 2015 – 2031)

Global In Vitro Diagnostics (IVD) Market – Clinical IndicationOutlook (Revenue, USD Million, 2015 – 2031)

Global In Vitro Diagnostics (IVD) Market – End UsersOutlook (Revenue, USD Million, 2015 – 2031)

Global In Vitro Diagnostics (IVD) Market – Sales ChannelOutlook (Revenue, USD Million, 2015 – 2031)

Global In Vitro Diagnostics (IVD) Market – RegionOutlook (Revenue, USD Million, 2015 – 2031)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.