Global Industrial Wearable Devices Market, By Device Type, By Application, By End Use Sector, By Region, & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Construction & Manufacturing

- Report ID: TNR-110-1297

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10146

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Industrial wearable devices are advanced technology solutions designed to enhance worker productivity, safety, and efficiency in various industrial settings. These devices, which include smart helmets, glasses, and wristbands, provide real-time data and analytics to support tasks ranging from maintenance and repair to safety monitoring and training. They often integrate sensors and communication technologies to offer features such as augmented reality, remote assistance, and health monitoring.

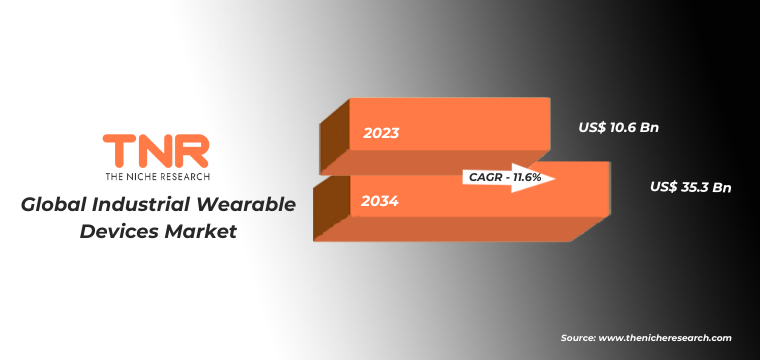

In today’s market, industrial wearables are increasingly crucial as they address key challenges like improving safety, reducing downtime, and optimizing operational efficiency. With industries embracing digital transformation, these wearables are becoming indispensable tools, facilitating better decision-making, enhancing worker capabilities, and ensuring compliance with safety regulations. The market is growing rapidly as businesses recognize their value in streamlining operations and safeguarding their workforce. The Global Industrial Wearable Devices Market Generated Revenue of US$ 10.6 Billion in 2023 and US$ 35.3 Billion in 2034 and is Expected to Grow at a CAGR of 11.6% from 2024 to 2034.

Growth Drivers of Global Industrial Wearable Devices Market

- Technological Advancements: Rapid innovations in sensor technology, connectivity, and data analytics drive the growth of industrial wearables by enabling more precise monitoring, real-time feedback, and enhanced functionality for diverse industrial applications.

- Increased Safety Regulations: Stringent safety regulations in industries like manufacturing and construction boost the demand for wearables, which help monitor workers’ health and safety, ensuring compliance and reducing the risk of workplace accidents.

- Rise of Industry 4.0: The adoption of Industry 4.0 principles accelerates the integration of smart technologies, including wearables, to enhance operational efficiency, streamline processes, and facilitate data-driven decision-making in industrial environments.

- Demand for Improved Productivity: Companies seek to boost productivity through wearable technology that provides real-time insights, remote assistance, and enhanced training, helping workers perform tasks more efficiently and effectively.

- Growth in Remote and Hazardous Work Environments: As remote and hazardous work sites expand, industrial wearables offer crucial support by providing real-time data and communication tools, improving safety and operational efficiency in challenging environments.

Challenges in Global Industrial Wearable Devices Market

- High Initial Costs: The significant upfront investment required for industrial wearable devices can be a barrier for many companies, particularly small and medium-sized enterprises, potentially limiting widespread adoption.

- Data Security Concerns: As wearable devices collect and transmit sensitive data, concerns about data breaches and cybersecurity risks can deter organizations from adopting these technologies, impacting their market growth.

- Compatibility Issues: Integrating wearable devices with existing industrial systems and infrastructure can be challenging, leading to potential compatibility issues that may hinder their effective deployment and use in various operational environments.

- Limited Battery Life: Many industrial wearables face challenges with battery life, which can affect their reliability and functionality during long shifts or extended periods, potentially impacting overall effectiveness.

- User Resistance: Resistance from workers who may be reluctant to adopt new technology due to comfort concerns or fear of increased surveillance can slow down the adoption of industrial wearable devices in the market.

Global Industrial Wearable Devices Properties:

| Device Type | Properties | Capabilities | Applications |

| Smart Glasses | Augmented reality display, lightweight, heads-up display | Real-time data overlay, navigation, hands-free communication | Maintenance support, remote assistance, training, visual inspection |

| Smart Watches | Compact, touch screen, health monitoring sensors | Real-time notifications, GPS tracking, health and activity monitoring | Personal safety, task management, location tracking, health monitoring |

| Smart Helmets | Durable, integrated communication systems, safety features | Communication via mesh network, voice commands, environmental sensors | Construction sites, hazardous environments, team coordination |

| Smart Gloves | Flexible materials, haptic feedback, touch-sensitive | Gesture control, force sensing, real-time feedback | Remote control of machinery, training simulations, dexterous tasks |

| Body Sensors | Lightweight, adhesive or wearable, various sensors | Health monitoring (e.g., heart rate, temperature), activity tracking | Health monitoring, ergonomic studies, real-time biometric data collection |

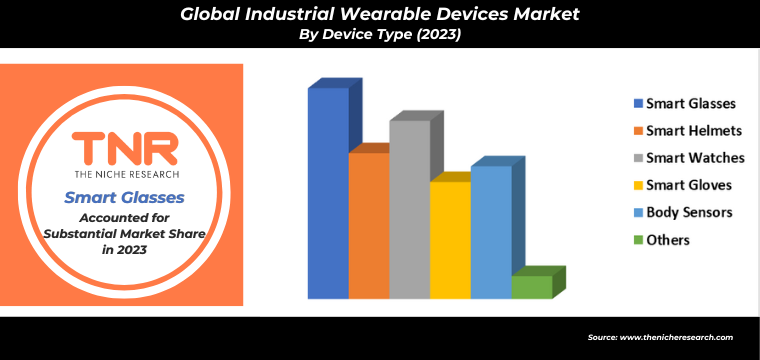

Smart gloves segment is anticipated to experience the fastest growth in the coming years, with a CAGR of 10.1%. This surge is driven by their advanced functionalities, including gesture control, haptic feedback, and force sensing, which significantly enhance operational efficiency and user interaction in various industrial applications. As industries increasingly adopt digital solutions for improved productivity and safety, smart gloves are becoming essential for tasks requiring precision and dexterity. Their ability to integrate with other technologies and provide real-time feedback makes them a valuable tool, contributing to their rapid market expansion.

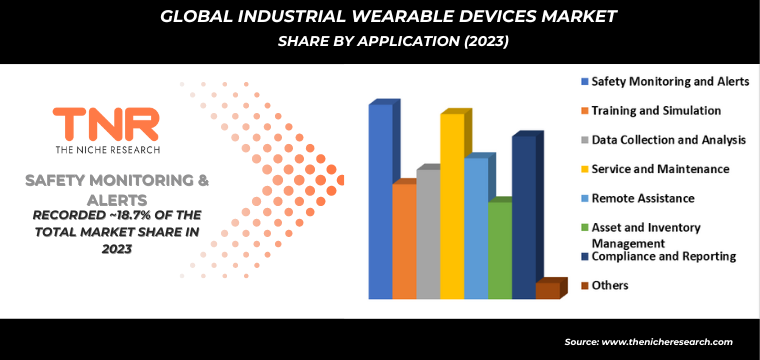

In 2023, service and maintenance segment solidified its position as the second-largest application category within the global industrial wearable devices market with revenue share of 17.8%. This growth reflects the increasing adoption of wearable technology for enhancing maintenance operations and service efficiency. Wearables provide real-time data, remote diagnostics, and hands-free support, which streamline troubleshooting and repair processes. As industries seek to reduce downtime and improve service quality, the demand for wearables in this segment continues to rise, contributing to its significant market position.

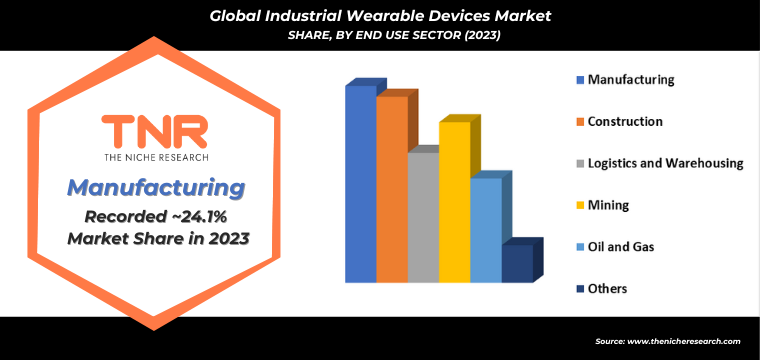

Industrial wearables are predominantly utilized in the manufacturing sector due to their significant benefits in enhancing productivity and safety. These devices, including smart helmets, glasses, and gloves, offer real-time data, augmented reality, and advanced sensors that streamline operations and support complex tasks. They assist in monitoring equipment health, providing remote support, and improving worker safety by detecting hazardous conditions and offering hands-free communication. As manufacturing processes become more automated and data-driven, the adoption of wearables helps optimize performance, reduce downtime, and ensure a safer working environment, making them integral to modern manufacturing operations.

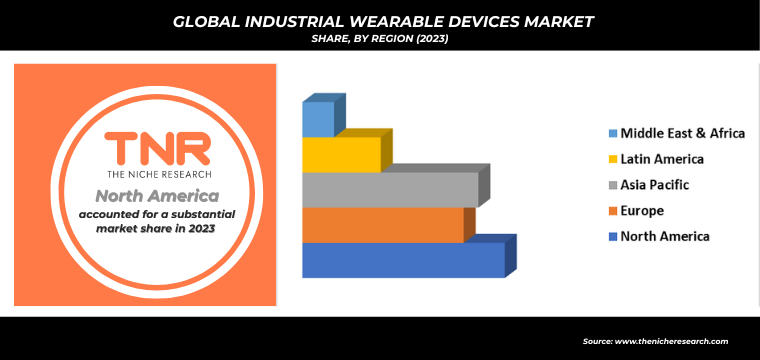

In 2023, Latin America is expected to solidify its dominance in the global industrial wearable devices market, achieving a revenue share of 12.1%. This growth reflects the region’s increasing adoption of advanced wearable technology across various industries. The rise is driven by the need for enhanced operational efficiency, safety, and productivity in sectors such as manufacturing, construction, and logistics. Latin America’s expanding industrial base, coupled with investments in digital transformation, supports this market expansion. As companies in the region embrace smart technologies, the demand for industrial wearables continues to grow, reinforcing Latin America’s significant position in the global market.

Competitive Landscape

Some of the players operating in the industrial wearable devices market are

- Apple Inc.

- AsusTek Computer Inc.

- Fitbit Inc.

- Forcite Helmet Systems Pty Ltd

- Fujitsu Limited

- Fusar Technologies Inc.

- Garmin Ltd.

- Google LLC

- Honeywell International Inc.

- Jawbone Health Hub Inc.

- Microsoft Corporation

- Nand Logic Corp.

- Nexsys Corporation

- Philips N.V

- Samsung Electronics Co., Ltd.

- SAP SE

- Seiko Epson Corporation

- Sony Corporation

- The Eurotech Group

- Vuzix Corporation

- Other Industry Participants

Manufacturers in the industrial wearable devices market are focusing on advancing technology and innovation to stay competitive. Strategies include integrating cutting-edge sensors, improving data analytics, and enhancing connectivity for real-time monitoring. Companies are also investing in ergonomic designs and customizable features to meet diverse industrial needs. Collaborations with tech firms and investments in R&D are driving the development of smarter, more intuitive wearables, aiming to improve worker safety and operational efficiency across various sectors.

- In May 2022, SENA launched its Impulse and Stryker smart helmets in Europe, featuring Sena’s Mesh communication technology. These helmets include a microphone and speakers by Harman Kardon, a magnetic Pogo charging point, voice command capabilities in eight languages, a retractable sun visor, an LED tail light, and integration with voice-activated digital assistants like Siri and Google.

- In May 2018, Honeywell introduced its hands-free, wearable Connected Plant technology aimed at boosting the safety, reliability, and efficiency of industrial tasks for workers both on-site and in the field.

Global Industrial Wearable Devices Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 10.6 Bn |

| Market Size Forecast by 2034 | US$ 35.3 Bn |

| Growth Rate (CAGR) | 11.6% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Device Type, By Application, By End Use Sector, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Apple Inc., AsusTek Computer Inc., Fitbit Inc., Forcite Helmet Systems Pty Ltd, Fujitsu Limited, Fusar Technologies Inc., Garmin Ltd., Google LLC, Honeywell International Inc., Jawbone Health Hub Inc., Microsoft Corporation, Nand Logic Corp., Nexsys Corporation, Philips N.V, Samsung Electronics Co., Ltd., SAP SE, Seiko Epson Corporation, Sony Corporation, The Eurotech Group, Vuzix Corporation |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Industrial Wearable Devices Market

By Device Type

- Smart Glasses

- Smart Helmets

- Smart Watches

- Smart Gloves

- Body Sensors

- Others

By Application

- Safety Monitoring and Alerts

- Training and Simulation

- Data Collection and Analysis

- Service and Maintenance

- Remote Assistance

- Asset and Inventory Management

- Compliance and Reporting

- Others

By End Use Sector

- Manufacturing

- Construction

- Logistics and Warehousing

- Mining

- Oil and Gas

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Industrial Wearable Devices Market

By Device Type

- Smart Glasses

- Smart Helmets

- Smart Watches

- Smart Gloves

- Body Sensors

- Others

By Application

- Safety Monitoring and Alerts

- Training and Simulation

- Data Collection and Analysis

- Service and Maintenance

- Remote Assistance

- Asset and Inventory Management

- Compliance and Reporting

- Others

By End Use Sector

- Manufacturing

- Construction

- Logistics and Warehousing

- Mining

- Oil and Gas

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.