Global Infection Prevention Market By Product Type, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1299

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10060

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Infection prevention refers to a set of practices and procedures aimed at controlling and minimizing the spread of infections, particularly in healthcare settings but also in other industries like food processing, pharmaceuticals, and public spaces. These practices are designed to prevent harmful microorganisms, such as bacteria, viruses, and fungi, from spreading to patients, healthcare workers, and the public. Infection prevention involves the use of various tools and strategies, including hand hygiene, sterilization of equipment, the use of personal protective equipment (PPE), disinfection of surfaces, and vaccination programs.

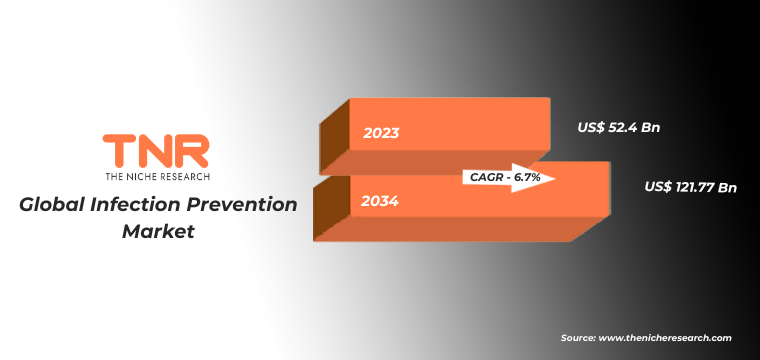

The global infection prevention market, valued at $52.4 billion in 2023, is expected to grow at a CAGR of 6.7% from 2024 to 2030, reaching $121.77 billion by 2034. This growth is fueled by rising healthcare-associated infections (HAIs), increasing demand for disinfection and sterilization products, and advancements in infection prevention technologies. The market has evolved significantly, expanding beyond hospitals and healthcare settings to industries such as life sciences, pharmaceuticals, and food processing.

Why Is Infection Prevention Required?

Reducing Healthcare-Associated Infections (HAIs): One of the primary reasons infection prevention is critical is to reduce the occurrence of healthcare-associated infections (HAIs). These are infections that patients acquire during their stay in healthcare facilities, such as hospitals or clinics

Protecting Vulnerable Populations: Infection prevention is especially crucial for protecting vulnerable populations, such as immunocompromised patients, the elderly, newborns, and those undergoing surgeries or invasive procedures. These individuals are at higher risk of developing infections, which can severely impact their recovery and overall health.

Preventing Disease Outbreaks: Effective infection prevention is essential for controlling and preventing the spread of contagious diseases, such as influenza, tuberculosis, and COVID-19. Outbreaks of these diseases in healthcare settings or public spaces can lead to widespread illness and strain on healthcare systems. Infection prevention measures like isolation protocols, quarantine, and vaccination help curb such outbreaks.

Complying with Regulatory Standards: Infection prevention is often mandated by regulatory bodies like the World Health Organization (WHO), the Centers for Disease Control and Prevention (CDC), and regional authorities. Healthcare institutions and industries must comply with stringent infection control guidelines to maintain their licenses and avoid legal consequences. Failure to comply can lead to penalties, lawsuits, or the loss of accreditation.

Reducing Economic Costs: Infections acquired in healthcare settings can significantly increase the cost of treatment, not only for patients but also for healthcare providers. Extended hospital stays, additional treatments, and the potential for litigation due to preventable infections can strain hospital resources. Infection prevention helps reduce these costs by minimizing infection-related complications and improving patient outcomes.

Global Infection Prevention Market Segmental Insights

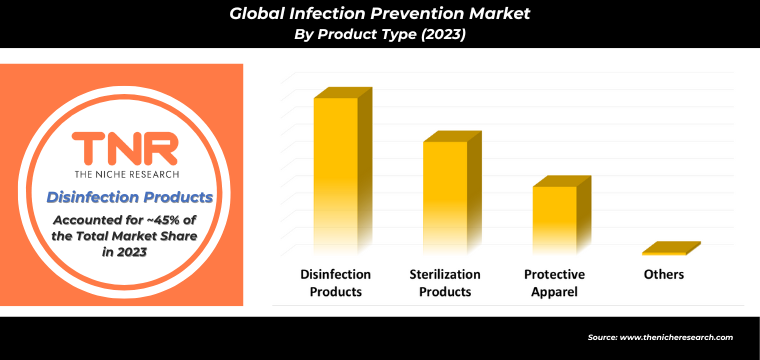

Disinfection products play a pivotal role in the global infection prevention market, commanding an impressive 45% of the overall market share in 2023. This dominance reflects their crucial function in controlling the spread of infections across various sectors. The heightened awareness of hygiene and infection control, especially following the COVID-19 pandemic, has driven significant demand for these products. The pandemic underscored the importance of effective disinfection practices, leading to increased consumption of surface disinfectants, hand sanitizers, and other disinfection consumables.

The COVID-19 pandemic has significantly amplified global focus on infection prevention, driving up the use of disinfection products. For instance, global sales of hand sanitizers surged from $2.7 billion in 2019 to $3.6 billion in 2020, reflecting an urgent need for personal hygiene solutions. This trend continues as businesses, healthcare facilities, and public spaces maintain stringent hygiene practices to curb infection spread.

A study published in the Journal of Hospital Infection found that adherence to proper surface disinfection protocols could reduce bacterial contamination by up to 80%, demonstrating the effectiveness of these products in maintaining a clean environment. Additionally, advancements in disinfection technologies, such as robotic UV disinfection systems developed by companies like Xenex Disinfection Services, offer innovative solutions for rapid and thorough disinfection, further contributing to market growth.

Non-healthcare industries also drive the demand for disinfection products. The food processing and pharmaceutical sectors require rigorous disinfection protocols to ensure product safety and comply with regulatory standards. The Global Food Safety Initiative (GFSI) emphasizes the importance of disinfection in preventing contamination and protecting consumer health. Similarly, in the pharmaceutical industry, disinfection products are crucial for cleanroom sterilization and equipment maintenance. As these industries expand, particularly in emerging markets, the demand for disinfection solutions continues to rise, contributing to the overall market share of disinfection products.

The statistical landscape of disinfection products underscores their market dominance. Surface disinfectants alone represent a substantial segment, with a market value of approximately $8.2 billion in 2023. Hand sanitizers continue to be a significant market driver, with expectations for the global hand sanitizer market to reach $6.7 billion by 2027, growing at a 6.2% CAGR.

On the other hand, washer-disinfectors under the disinfection equipment category, used to clean medical instruments, are expected to grow at a 7.3% CAGR from 2024 to 2034 due to increasing demand from healthcare facilities. For example, Belimed AG and Getinge AB are leaders in manufacturing advanced washer-disinfectors with energy-efficient systems.

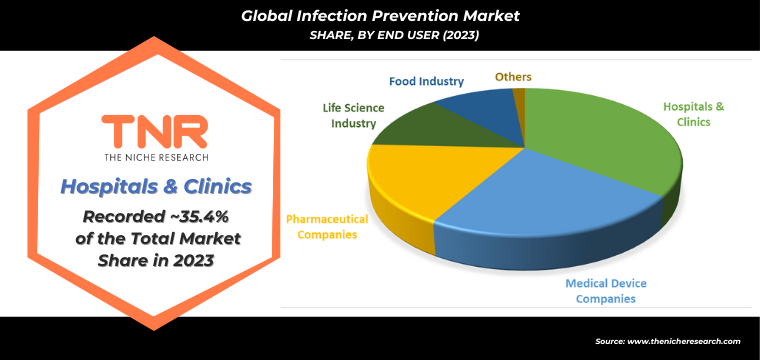

Hospitals and clinics are pivotal players in the global infection prevention market, accounting for approximately 35% of the total market revenue in 2023. Hospitals, in particular, are high-risk environments where the spread of infections can have severe consequences. For instance, healthcare-associated infections (HAIs) affect about 1 in 31 hospital patients in the U.S., as reported by the Centers for Disease Control and Prevention (CDC). The financial impact of these infections is significant, with estimates suggesting that HAIs cost the U.S. healthcare system incurs annual costs ranging from $28 billion to $45 billion. To mitigate these risks, hospitals and clinics invest heavily in disinfection and sterilization products. For example, STERIS Corporation provides advanced sterilization equipment, including autoclaves and UV-ray disinfectors, which are crucial for ensuring that surgical instruments and other medical tools are free from microorganisms. Clinics, although smaller, also utilize significant amounts of infection prevention products to ensure a safe environment for routine procedures and patient care. The adoption of hand sanitizers, such as those produced by GOJO Industries, and personal protective equipment (PPE) in clinics reflects the ongoing commitment to maintaining high hygiene standards. The substantial revenue share of hospitals and clinics in the infection prevention market highlights their critical need for these products to manage infection risks and ensure patient safety effectively.

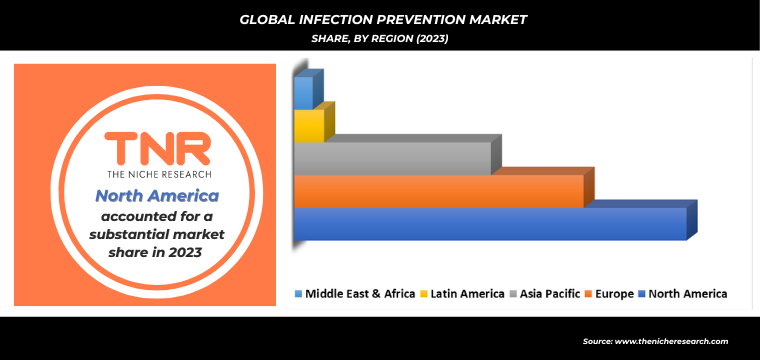

Regional Insights: Global Infection Prevention Market

In 2023, North America emerged as the dominant region in the global infection prevention market, commanding a substantial revenue share of over 36%. This dominance reflects the region’s advanced healthcare infrastructure, robust regulatory environment, and high awareness of infection control practices. The extensive investment in healthcare facilities and the increasing focus on combating healthcare-associated infections (HAIs) have contributed to North America’s leading position in the market.

A significant driver of this dominance is the substantial healthcare expenditure in the United States and Canada. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending reached approximately $4.3 trillion in 2023, with a significant portion allocated to infection prevention and control. This high level of investment supports the widespread use of advanced disinfection and sterilization products. United States dominance in the infection prevention market is exemplified by the extensive use of advanced infection control products and technologies across various sectors. For instance, in healthcare settings, major hospitals and health systems such as Mayo Clinic and Cleveland Clinic rely heavily on infection prevention products to ensure patient safety and reduce the risk of healthcare-associated infections (HAIs). These institutions utilize a range of disinfection and sterilization solutions, including Ecolab’s OxyCide Daily Disinfectant Cleaner for surface disinfection and STERIS Corporation’s sterilizers for medical equipment, to maintain stringent hygiene standards.

In addition to healthcare and personal hygiene, the food processing industry in the U.S. demonstrates the importance of infection prevention market. The Food Safety and Inspection Service (FSIS) enforces strict disinfection and sanitation protocols to ensure the safety of food products. Companies like Tyson Foods implement comprehensive cleaning and disinfection procedures in their processing facilities to comply with FSIS guidelines and protect consumer health. This commitment to infection prevention underscores the broader application of disinfection products beyond healthcare settings.

Key companies operating in the global infection prevention market are:

- 3M Company

- Advanced Sterilization Products

- Belimed AG

- Cantel Medical Corporation

- Ecolab

- Getinge AB

- MATACHANA GROUP

- Medivators Inc

- Midmark Corporation.

- MMM Group

- Schülke & Mayr GmbH

- Sotera Health LLC

- STERIS plc.

- Other Industry Participants

Global Infection Prevention Market: Key Highlights

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 52.4 Bn |

| Market Size Forecast by 2034 | US$ 121.77 Bn |

| Growth Rate (CAGR) | 6.7% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product Type, By End User |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | 3M Company, Advanced Sterilization Products, Belimed AG, Cantel Medical Corporation, Ecolab, Getinge AB, MATACHANA GROUP, Medivators Inc, Midmark Corporation., MMM Group, Schülke & Mayr GmbH, Sotera Health LLC, STERIS plc., Other Industry Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com |

Global Infection Prevention Market

By Product Type

- Disinfection Products

- Disinfection Consumables

- Surface disinfectants

- Hand sanitizers

- Surgical disinfectants

- Environmental disinfectants

- Others

- Disinfection Equipment

- Washer-Disinfectors

- Flusher Disinfectors

- UV-Ray Disinfectors

- Ultrasonic Cleaners

- Other Cleaning and Disinfection Equipment

- Sterilization Products

- Sterilization equipment

- Heat Sterilization Equipment

- Low-Temperature Sterilization

- Radiation Sterilization

- Filtration Sterilization

- Other Equipment

- Sterilization consumables and accessories

- Sterilization Indicators

- Chemical Indicators

- Biological Indicators

- Packaging Accessories

- Sterilization Indicators

- Protective Apparel

- Gloves

- Masks

- Gowns

- Face shields

- Protective eyewear

- Others

- Others

- Sterilization equipment

- Disinfection Consumables

By End User

- Hospitals & Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Life Science Industry

- Food Industry

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Global Infection Prevention Market: Report Layout

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Infection Prevention Market

By Product Type

- Disinfection Products

- Disinfection Consumables

- Surface disinfectants

- Hand sanitizers

- Surgical disinfectants

- Environmental disinfectants

- Others

- Disinfection Equipment

- Washer-Disinfectors

- Flusher Disinfectors

- UV-Ray Disinfectors

- Ultrasonic Cleaners

- Other Cleaning and Disinfection Equipment

- Sterilization Products

- Sterilization equipment

- Heat Sterilization Equipment

- Low-Temperature Sterilization

- Radiation Sterilization

- Filtration Sterilization

- Other Equipment

- Sterilization consumables and accessories

- Sterilization Indicators

- Chemical Indicators

- Biological Indicators

- Packaging Accessories

- Sterilization Indicators

- Protective Apparel

- Gloves

- Masks

- Gowns

- Face shields

- Protective eyewear

- Others

- Others

- Sterilization equipment

- Disinfection Consumables

By End User

- Hospitals & Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Life Science Industry

- Food Industry

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.