Global NDT and Inspection Market By Services, By Technique, By Industry Vertical, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Construction & Manufacturing

- Report ID: TNR-110-1112

- Number of Pages: 420

- Table/Charts : Yes

- May, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10194

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

The non-destructive testing (NDT) and inspection market encompasses a range of techniques used to evaluate the properties of materials, components, and systems without causing damage. This sector caters to industries like manufacturing, aerospace, oil and gas, and construction, ensuring product integrity, safety, and regulatory compliance. The market is driven by factors such as stringent safety regulations, growing awareness regarding quality control, and the need to extend the lifespan of aging infrastructure. Technological advancements like digitalization, robotics, and AI are enhancing inspection efficiency and accuracy, further propelling market growth. With an increasing emphasis on preventive maintenance and quality assurance, the NDT and inspection market continue to expand globally.

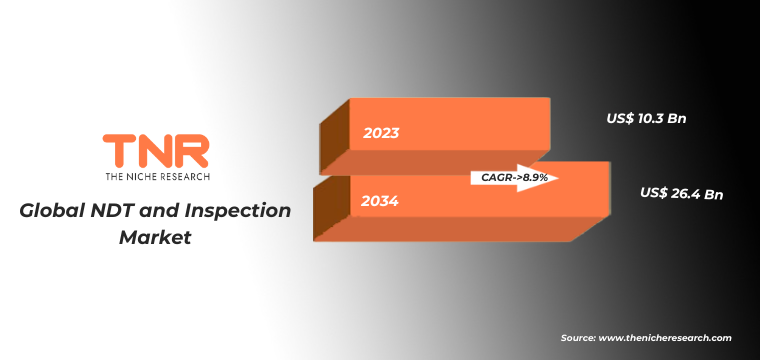

In terms of revenue, the global NDT and inspection market was worth US$ 10.3 Bn in 2023, anticipated to witness a CAGR of 8.9% During 2024 – 2034.

Trends in the Global NDT and Inspection Market

Advancements in Non-Destructive Testing (NDT) Technology- The global NDT and inspection market are witnessing a surge in technological innovations aimed at enhancing inspection accuracy, efficiency, and safety across industries such as aerospace, oil and gas, and manufacturing. Trends include the integration of artificial intelligence and machine learning algorithms for predictive maintenance, the development of portable and wireless inspection devices for remote and challenging environments, and the adoption of advanced imaging techniques like computed tomography (CT) scanning and phased array ultrasonics.

Shift Towards Digitalization and Automation- As industries strive for increased productivity and reduced downtime, there’s a notable trend towards digitalization and automation in NDT and inspection processes. This includes the implementation of IoT-enabled sensors for continuous monitoring, the use of robotics for inspection in hazardous or hard-to-reach areas, and the development of cloud-based platforms for data storage, analysis, and collaboration. The integration of digital twin technology is also gaining momentum, allowing for real-time simulation and predictive maintenance based on NDT inspection data.

Global NDT and Inspection Market Revenue & Forecast, (US$ Million), 2016 – 2034

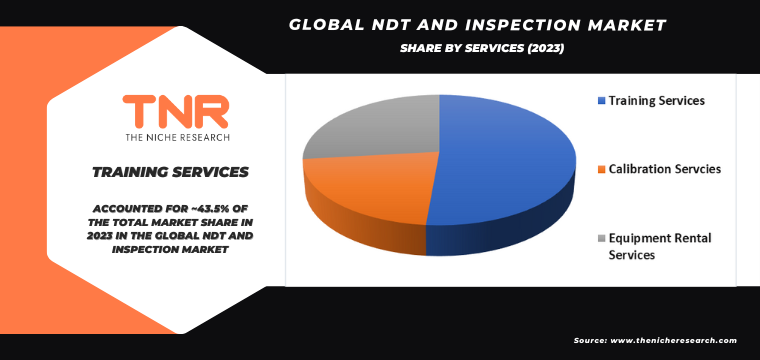

Equipment rental services have emerged as a pivotal segment within the global NDT and inspection market, poised for remarkable growth in the forecast period. This trend reflects a strategic shift among businesses towards more cost-effective and flexible solutions. Renting NDT and inspection equipment offers numerous advantages, including reduced upfront costs, access to state-of-the-art technology without large investments, and the flexibility to scale operations according to project needs. Moreover, in industries with fluctuating demand or seasonal variations, equipment rental provides a practical solution to optimize resource utilization. As companies prioritize operational efficiency and cost-effectiveness, the demand for equipment rental services in the NDT and Inspection sector is expected to soar, driving significant market expansion and fostering a dynamic business landscape.

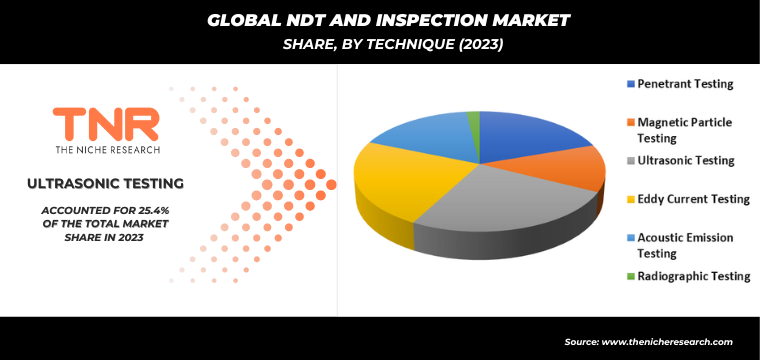

Ultrasonic testing (UT) emerged as the dominant technique within the global NDT and inspection market in 2023, commanding a substantial revenue share of 25.4%.

This methodology utilizes high-frequency sound waves to detect flaws, measure thickness, and assess material properties with unparalleled precision. Its widespread adoption can be attributed to its versatility, capable of inspecting a wide range of materials, including metals, plastics, and composites, across various industries such as manufacturing, aerospace, and automotive. UT’s ability to detect both surface and subsurface defects, coupled with advancements in equipment and software, has propelled its prominence in non-destructive testing applications. As industries prioritize quality assurance and stringent regulatory compliance, Ultrasonic testing continues to spearhead innovation and drive the growth of the NDT and Inspection market on a global scale.

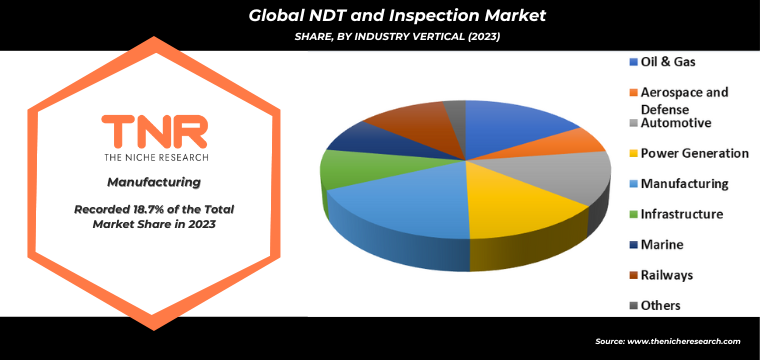

Manufacturing segment emerged as the primary driver of the global NDT and inspection market in 2023, boasting the highest share.

This sector’s prominence underscores the critical role of non-destructive testing and inspection in ensuring product quality, safety, and compliance within manufacturing processes. With increasingly stringent quality standards and regulatory requirements, manufacturers across diverse industries rely heavily on NDT techniques to identify defects, verify material integrity, and maintain operational efficiency. From automotive and aerospace to electronics and consumer goods, the manufacturing segment encompasses a broad spectrum of industries where NDT plays a pivotal role in preventing costly product failures and minimizing risks. As manufacturers prioritize quality control and seek to optimize production processes, the demand for NDT and inspection services within the manufacturing segment continues to drive market growth and innovation.

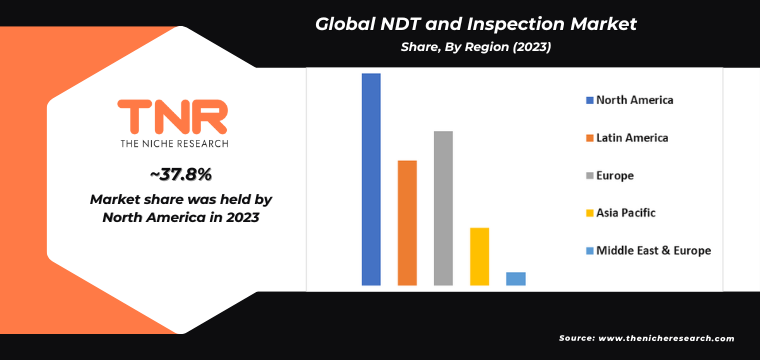

North America asserted its dominance in the global NDT and inspection market in 2023, emerging as the leading regional contributor.

This prominence can be attributed to several factors, including the region’s robust industrial infrastructure, stringent regulatory frameworks, and advanced technological capabilities. With key industries such as aerospace, automotive, oil and gas, and manufacturing driving demand, North America remains at the forefront of NDT and inspection services adoption. The region’s proactive approach towards enhancing safety standards and quality assurance further amplifies the significance of non-destructive testing methods. The presence of major NDT equipment manufacturers, research institutions, and skilled workforce bolsters North America’s leadership in this sector. As industries continue to prioritize efficiency, safety, and compliance, North America is poised to maintain its dominance in the global NDT and inspection market landscape.

Competitive Landscape

Major players in the market are actively engaging in strategic collaborations, and expanding into promising regions globally. Some of the players operating in the NDT and inspection market are

- Acuren

- Bureau Veritas

- Cetim

- Fischer Technologies Inc.

- Intertek Group plc

- Mistras Group, Inc

- MME Group

- Previan Technologies

- SGS S.A.

- Sonatest

- TWI Ltd

- Zetec Inc.

- Other Industry Participants

Global NDT and Inspection Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 10.3 Bn |

| Market Size Forecast by 2034 | US$ 26.4 Bn |

| Growth Rate (CAGR) | 8.9% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Services, By Technique, By Industry Vertical, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Acuren, Bureau Veritas, Cetim , Fischer Technologies Inc., Intertek Group plc, Mistras Group, Inc, MME Group, Previan Technologies, SGS S.A., Sonatest, TWI Ltd, Zetec Inc. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global NDT and Inspection Market

By Services

- Training Services

- Calibration Services

- Equipment Rental Services

By Technique

- Penetrant Testing

- Magnetic Particle Testing

- Ultrasonic Testing

- Eddy Current Testing

- Acoustic Emission Testing

- Radiographic Testing

By Industry Vertical

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Aerospace and Defense

- Automotive

- Power Generation

- Nuclear

- Renewable

- Conventional

- Manufacturing

- Infrastructure

- Marine

- Railways

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global NDT and Inspection Market

By Services

- Training Services

- Calibration Services

- Equipment Rental Services

By Technique

- Penetrant Testing

- Magnetic Particle Testing

- Ultrasonic Testing

- Eddy Current Testing

- Acoustic Emission Testing

- Radiographic Testing

By Industry Vertical

- Oil & Gas

- Upstream

- Midstream

- Downstream

- Aerospace and Defense

- Automotive

- Power Generation

- Nuclear

- Renewable

- Conventional

- Manufacturing

- Infrastructure

- Marine

- Railways

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.