Global Office Furniture Market, By Product Type, By Material, By Distribution Channel, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Consumer Goods

- Report ID: TNR-110-1171

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10152

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

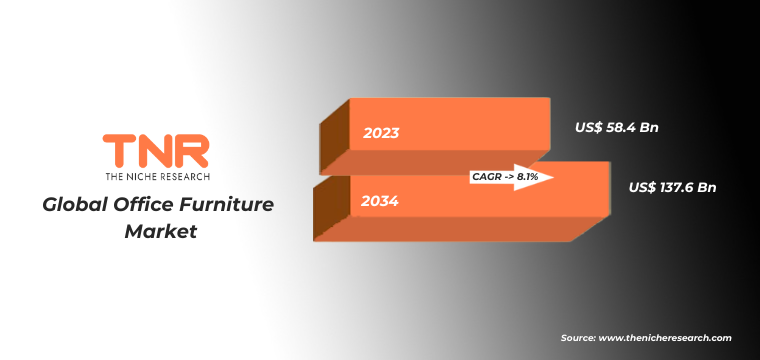

In Terms of Revenue, the Global Office Furniture Market was Worth US$ 58.4 Bn in 2023 and is Anticipated to Witness a CAGR of 8.1% During 2024 – 2034. The global office furniture market is experiencing robust growth, driven by several key factors. The increasing adoption of flexible workspaces and the rise of remote working have spurred demand for ergonomic and multifunctional furniture that enhances productivity and comfort. Technological advancements are also playing a pivotal role, with smart furniture that integrates with digital devices gaining popularity.

Sustainability is a significant trend, as businesses seek eco-friendly options made from recyclable or renewable materials. The shift towards open-plan offices and collaborative workspaces has led to a surge in demand for modular furniture that can be easily reconfigured. The growth of small and medium-sized enterprises (SMEs) in emerging economies is creating new opportunities for market expansion. The post-pandemic era has seen a renewed focus on health and wellness, prompting companies to invest in high-quality, health-oriented office furniture. This confluence of factors and trends indicates a promising future for the office furniture market.

Office Furniture Market Dynamic

Growth Driver-

Increasing Shift Towards Hybrid and Remote Work Models

As more companies adopt flexible work arrangements, there is a rising demand for home office furniture that combines functionality, comfort, and aesthetic appeal. Employees require ergonomic chairs, adjustable desks, and storage solutions to create productive work environments at home. This shift has prompted manufacturers to innovate and expand their product lines to cater to diverse home office needs. Additionally, businesses are investing in redesigning traditional office spaces to support hybrid work, leading to a demand for versatile, modular furniture that can accommodate both in-office and remote employees. This trend is expected to continue driving growth in the office furniture market.

Trends-

Rising Emphasis on Sustainability

Companies are increasingly prioritizing eco-friendly furniture options, driven by growing awareness of environmental impact and corporate social responsibility. This trend manifests in the use of sustainable materials like recycled wood, metal, and biodegradable plastics, as well as in the adoption of green manufacturing processes. Additionally, there’s a growing interest in furniture with a longer lifecycle, promoting durability and reducing waste. Certifications such as LEED and FSC are becoming key considerations for buyers. This shift towards sustainability is not only meeting consumer demand but also helping companies enhance their brand image and meet regulatory requirements, making it a significant trend in the office furniture market.

Challenge-

Fluctuating Costs of Raw Materials

Prices of essential materials such as steel, wood, and foam have been volatile due to supply chain disruptions, trade tariffs, and geopolitical tensions. These fluctuations can significantly impact production costs, making it difficult for manufacturers to maintain stable pricing for their products. Moreover, the shift towards sustainable materials, while beneficial in the long term, often comes with higher initial costs and requires investments in new manufacturing processes. This cost volatility not only affects profit margins but also poses challenges in budget forecasting and financial planning for companies. Navigating these economic uncertainties while meeting customer demand for quality and affordability remains a critical challenge for the industry.

Office Furniture Market Segmentation by Product Type, Material, Distribution Channel, Region

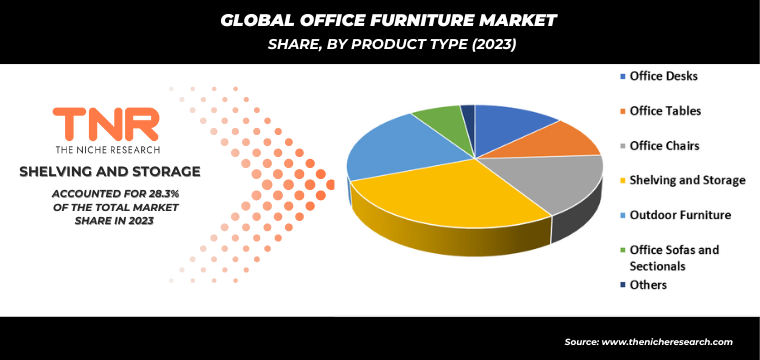

Shelving and storage segment by product type is set to dominate the office furniture market, commanding a substantial revenue share of 28.3% over the forecast period. This dominance is driven by the increasing need for efficient space utilization and organization within modern workplaces. As businesses prioritize decluttered, streamlined environments to enhance productivity and aesthetics, demand for versatile storage solutions is rising. Innovations in modular and multi-functional storage units are also contributing to this trend, allowing for customizable and adaptable office layouts. Furthermore, the growing emphasis on remote work has spurred demand for home office storage options, adding to the segment’s growth. This robust demand underscores the critical role of effective storage solutions in the evolving office furniture landscape.

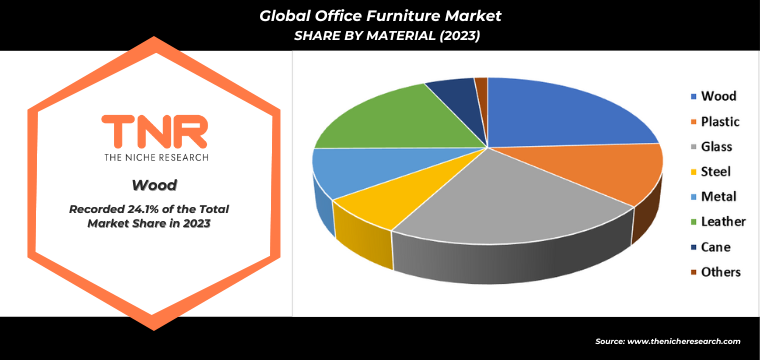

Glass segment is anticipated to be the fastest-growing material in the office furniture market, capturing a substantial revenue share of 21.6% over the forecast period.

This growth is driven by the increasing preference for modern, sleek, and minimalist office designs that incorporate glass elements. Glass furniture, such as desks, conference tables, and partitions, offers a contemporary aesthetic and creates an open, airy atmosphere in the workplace. Additionally, glass is easy to clean and maintain, making it a practical choice for high-traffic areas. The transparency of glass also fosters a sense of openness and collaboration, which is highly valued in modern office environments. As businesses continue to seek stylish and functional furniture solutions, the demand for glass office furniture is set to rise significantly.

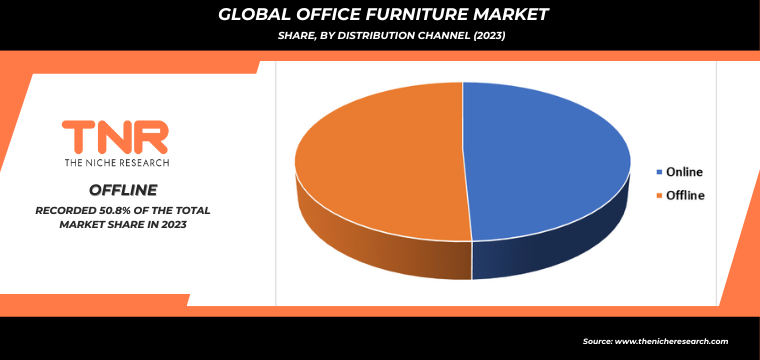

Offline segment by distribution channel dominated the office furniture market, accounting for a significant revenue share of 50.8%. This dominance is attributed to several factors. Customers often prefer purchasing office furniture in physical stores where they can personally evaluate the quality, comfort, and durability of the products. Showrooms and retail outlets provide a tangible shopping experience, allowing buyers to see and test furniture before making a purchase. Additionally, many businesses value the personalized customer service and professional consultations available in-store, which can guide them in selecting the most suitable furniture for their specific needs. The offline segment’s strong performance underscores the continued importance of brick-and-mortar retail in the office furniture market, despite the rise of online shopping.

In 2023, North America is anticipated to play a significant role in propelling the growth of the office furniture market, contributing approximately 38.5% to its overall expansion. This growth is fueled by the region’s robust corporate sector and the increasing trend of flexible and remote work arrangements. As companies invest in modernizing their office spaces to enhance productivity and employee well-being, demand for ergonomic and innovative furniture solutions is rising. The prevalence of start-ups and tech firms, which prioritize dynamic and collaborative work environments, further boosts market growth. Additionally, the focus on sustainability and high-quality materials aligns with North American consumer preferences, reinforcing the region’s substantial impact on the office furniture market’s expansion.

Key Developments

- In November 2023, Godrej Interio, a leading furniture and interior solutions brand in India, opened a new store in Pahala, Bhubaneswar. This expansion aims to strengthen their presence in Odisha and the eastern Indian market.

- In May 2022, Steelcase, Inc. acquired HALCON, a Minnesota-based company specializing in precision-crafted wood furniture for workplaces, enhancing Steelcase’s wood product offerings with superior design and craftsmanship.

- At NeoCon 2022, Haworth Inc. showcased over 20 new furniture products at theMART in Chicago, introducing innovations in seating, social spaces, next-generation work systems, and collaborations with Hushoffice, Pablo Designs, Emeco, and GAN.

Major Players in Office Furniture Market

- 9to5 Seating LLC

- Affordable Interior Systems, Inc.

- AURORA Group

- BERCO DESIGNS

- Fríant

- Global Furniture Group

- Haworth Inc

- Herman Miller Inc

- Inter IKEA Systems B.V.

- Itoki Corporation

- KOKUYO Co. Ltd

- Steelcase Inc

- UCHIDA YOKO GLOBAL LIMITED

- Other Industry Participants

Global Office Furniture Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 58.4 Bn |

| Market Size Forecast by 2034 | US$ 137.6 Bn |

| Growth Rate (CAGR) | 8.1% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product Type, By Material, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | 9to5 Seating LLC, Affordable Interior Systems, Inc., AURORA Group, BERCO DESIGNS, Fríant , Global Furniture Group, Haworth Inc, Herman Miller Inc, Inter IKEA Systems B.V., Itoki Corporation, KOKUYO Co. Ltd, Steelcase Inc, UCHIDA YOKO GLOBAL LIMITED |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Office Furniture Market

By Product Type

- Office Desks

- Office Tables

- Office Chairs

- Shelving and Storage

- Bookcases & Shelves

- Storage Cabinets

- TV Units

- Others

- Outdoor Furniture

- Coffee Tables

- Serving Cart

- Others

- Office Sofas and Sectionals

- Others

By Material

- Wood

- Plywood

- Teak

- Pine

- Cherry

- Maple

- Others

- Plastic

- Glass

- Steel

- Metal

- Leather

- Cane

- Others

By Distribution Channel

- Online

- Manufacturers Website

- E-commerce Website

- Offline

- Retail Stores

- Multi brand store

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Office Furniture Market

By Product Type

- Office Desks

- Office Tables

- Office Chairs

- Shelving and Storage

- Bookcases & Shelves

- Storage Cabinets

- TV Units

- Others

- Outdoor Furniture

- Coffee Tables

- Serving Cart

- Others

- Office Sofas and Sectionals

- Others

By Material

- Wood

- Plywood

- Teak

- Pine

- Cherry

- Maple

- Others

- Plastic

- Glass

- Steel

- Metal

- Leather

- Cane

- Others

By Distribution Channel

- Online

- Manufacturers Website

- E-commerce Website

- Offline

- Retail Stores

- Multi brand store

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.