Global Oleochemicals Market, By Source, By Type, By Application, By Region & Segmental Insights Trends and Forecast, By Value (US$ Bn), By Volume (in Tonnes) 2024 – 2034

- Industry: Chemicals & Materials

- Report ID: TNR-110-1313

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10145

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Oleochemicals are chemical compounds derived from natural oils and fats, typically sourced from plants and animals. They serve as eco-friendly alternatives to petrochemicals and play a vital role in various sectors. In personal care and cosmetics, oleochemicals like fatty acids and glycerol are used in soaps, lotions, and creams for their moisturizing properties.

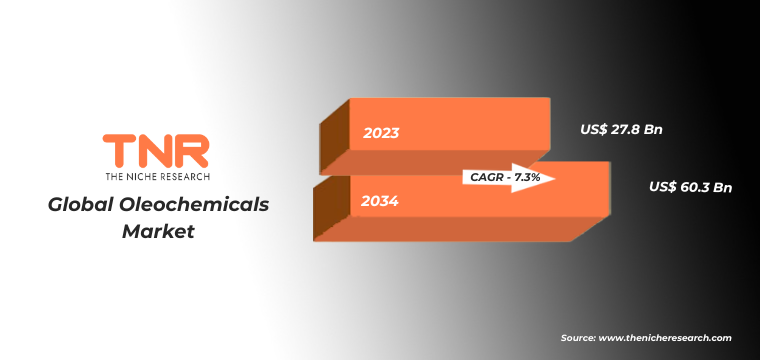

In food and beverages, they act as emulsifiers and preservatives. For example, glycerol is used in food processing as a sweetener and solvent. In pharmaceuticals, fatty acids are critical for drug delivery systems and active ingredients. In 2019, oleochemicals became integral to bioplastics, helping reduce reliance on petroleum-based plastics. Additionally, in agriculture, they are used in making biodegradable pesticides and herbicides, promoting sustainable farming practices. Their environmental advantages and versatility drive their growing importance across industries. “In Terms of Revenue, the Global Oleochemicals Market was Worth US$ 27.8 Bn in 2023, Anticipated to Witness CAGR of 7.3% During 2024 – 2034.”

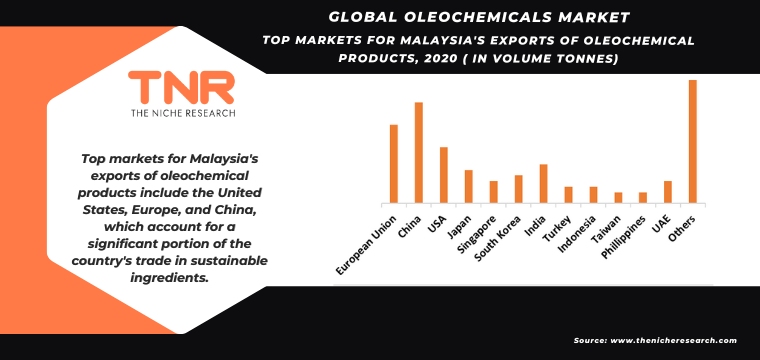

Top Markets For Malaysia’s Exports Of Oleochemical Products:

Malaysia’s top export markets for oleochemical products included China, the European Union, and India. These regions drive demand for oleochemicals in personal care, detergents, and biodiesel. For instance, Malaysia exported substantial amounts of palm-based oleochemicals to China for use in cosmetics and cleaning agents. Similarly, Indian manufacturers imported Malaysian oleochemicals for soaps and lubricants, reinforcing Malaysia’s status as a leading global supplier in the oleochemicals industry.

Oleochemical Export:

According to “Malaysian Palm Oil Board & Department of Statistics” in 2022, total exports of oleochemical products dropped by 5.14%, reaching 2.73 million tonnes compared to 2.88 million tonnes in 2021. Despite this volume decline, the export value saw a substantial rise of 31.1%, amounting to RM 22,875 million. Oleochemical exports contributed 17.6% to the total revenue from palm oil product exports in 2022.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | Diff (%) |

| Total Exports (‘000 tonnes) | 3 091 | 3 280 | 3 086 | 2 882 | 2 734 | -5.14 |

| Export Value (RM million) | 19 119 | 18 121 | 16 500 | 26 802 | 33 614 | 31.1 |

Opportunities in the Global Oleochemicals Market

- Expansion of Bio-based Personal Care Products: The global oleochemicals market offers significant growth potential in the bio-based personal care industry. As consumers increasingly shift towards natural, eco-friendly products, oleochemicals derived from plant oils, such as palm and coconut oil, have become key ingredients in cosmetics, soaps, and lotions. Companies like Unilever, which launched its Love Beauty and Planet brand in 2018, leverage oleochemicals to develop sustainable personal care products. This demand is expected to rise as consumers prioritize environmental impact and ingredient transparency, further driving the adoption of oleochemicals in the personal care sector through 2024 and beyond.

- Growing Demand in Biodegradable Packaging: With the global push for reducing plastic waste, oleochemicals are gaining traction in the development of biodegradable packaging solutions. For example, in 2021, BASF and Lactips collaborated to create water-soluble films using oleochemical-derived materials. These films are used in applications like packaging for detergents and cleaning products. Oleochemicals, derived from natural fats and oils, present an environmentally friendly alternative to conventional plastics. This opportunity is poised to expand, especially as governments globally, such as in the European Union, implement stricter regulations on single-use plastics by 2030.

Global Oleochemicals Market Segmental Analysis-

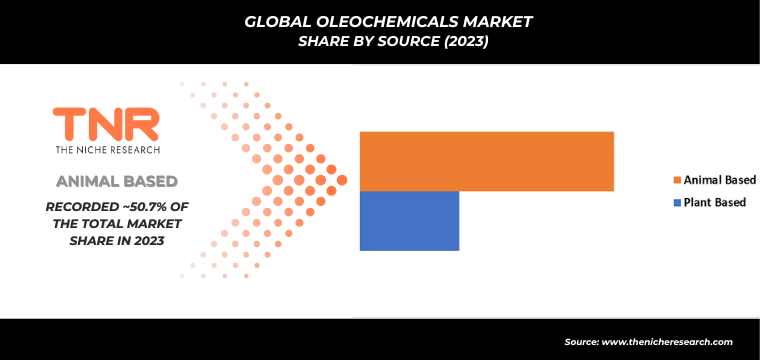

Animal based oleochemicals dominated the global market with revenue share of 50.7% in 2023. These oleochemicals are primarily derived from animal fats, such as tallow, and are widely used in industries like soap manufacturing, lubricants, and biodiesel. For example, in 2021, Emery Oleochemicals expanded its animal-based tallow production for biodiesel, catering to the rising demand for renewable energy sources. The soap industry has also benefited from animal-based oleochemicals, with companies like Procter & Gamble using tallow in various products. As the demand for eco-friendly and sustainable alternatives increases, animal-based oleochemicals continue to play a crucial role across multiple sectors.

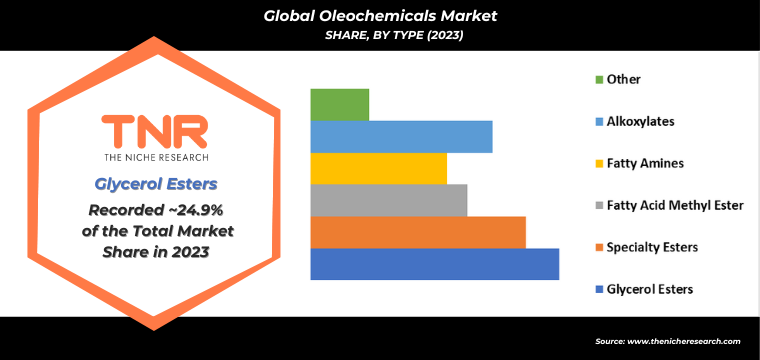

By type, specialty esters are supposed to grow fastest in the global oleochemicals market capturing a revenue share of 21.6% in 2023. Specialty esters, used for their superior emulsifying and lubricating properties, are gaining traction in industries such as cosmetics, lubricants, and plastics. For example, Croda International introduced Priolube esters in 2021, targeting eco-friendly lubricant formulations. These esters, derived from renewable oleochemical sources, are also used in personal care products due to their skin-conditioning benefits. As companies seek greener, high-performance alternatives for various applications, the demand for specialty esters is expected to expand further, driving innovation in multiple industries.

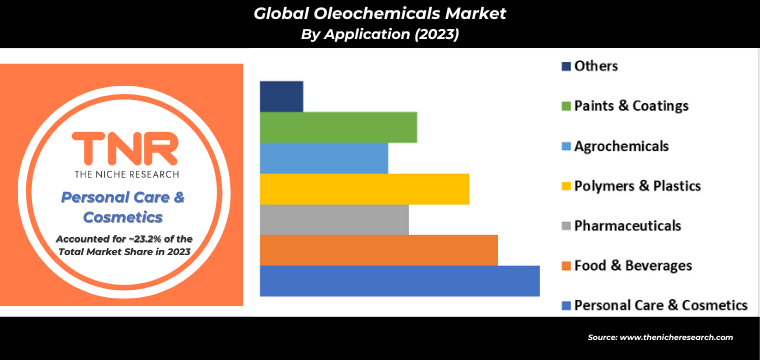

Oleochemicals are widely used in personal care & cosmetics as emulsifiers, emollients, and surfactants, contributing to the segment’s dominance with a 23.2% revenue share in 2023. These ingredients, derived from natural oils and fats, enhance product texture and moisturization. For example, in 2022, BASF launched a bio-based oleochemical ingredient for skin care, improving formulation sustainability. Companies like L’Oréal and Unilever also use oleochemicals in lotions, shampoos, and soaps for their mildness and biodegradability. As consumers increasingly demand eco-friendly and sustainable products, the personal care sector continues to drive growth in the oleochemicals market globally.

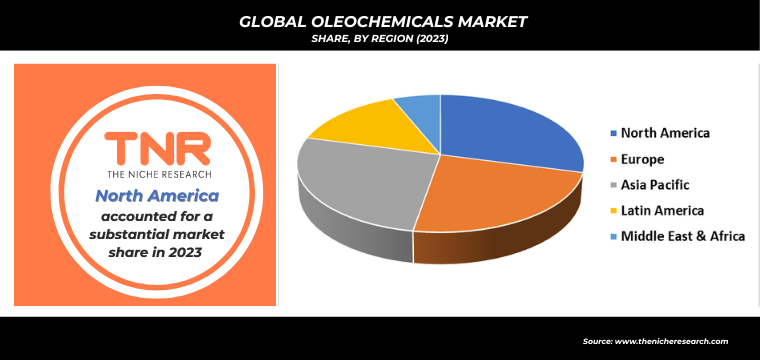

In 2023, North America strengthened its position in the global oleochemicals market, accounting for a revenue share of 29.1%. The region’s dominance is driven by its robust industrial base, increasing demand for bio-based products, and advancements in renewable chemical technologies. For example, in 2022, Cargill expanded its oleochemical production capacity in the U.S., supplying industries such as personal care, food, and biodiesel. Additionally, companies like Procter & Gamble and Clariant are utilizing oleochemicals in sustainable product lines. As North American regulations continue to encourage eco-friendly practices, the region remains a key player in the global oleochemicals landscape.

Competitive Landscape

Some of the players operating in the oleochemicals market are

- Cargill, Incorporated

- Corbion N.V

- Ecogreen Oleochemicals

- Emery Oleochemicals

- Evonik Industries AG

- Evyap

- Godrej Industries

- IOI Corporation Berhad

- JNJ Oleochemicals, Incorporated

- Kao Chemicals Global

- KLK OLEO

- Oleon NV

- Pepmaco Manufacturing Corporation

- Philippine International Dev.

- Sakamoto Yakuhin Kogyo Co., Ltd.

- Stepan Company

- Vantage Specialty Chemicals, Inc.

- Wilmar International Ltd.

- Other Industry Participants

Global Oleochemicals Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 27.8 Bn |

| Market Size Forecast by 2034 | US$ 60.3 Bn |

| Growth Rate (CAGR) | 7.3% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

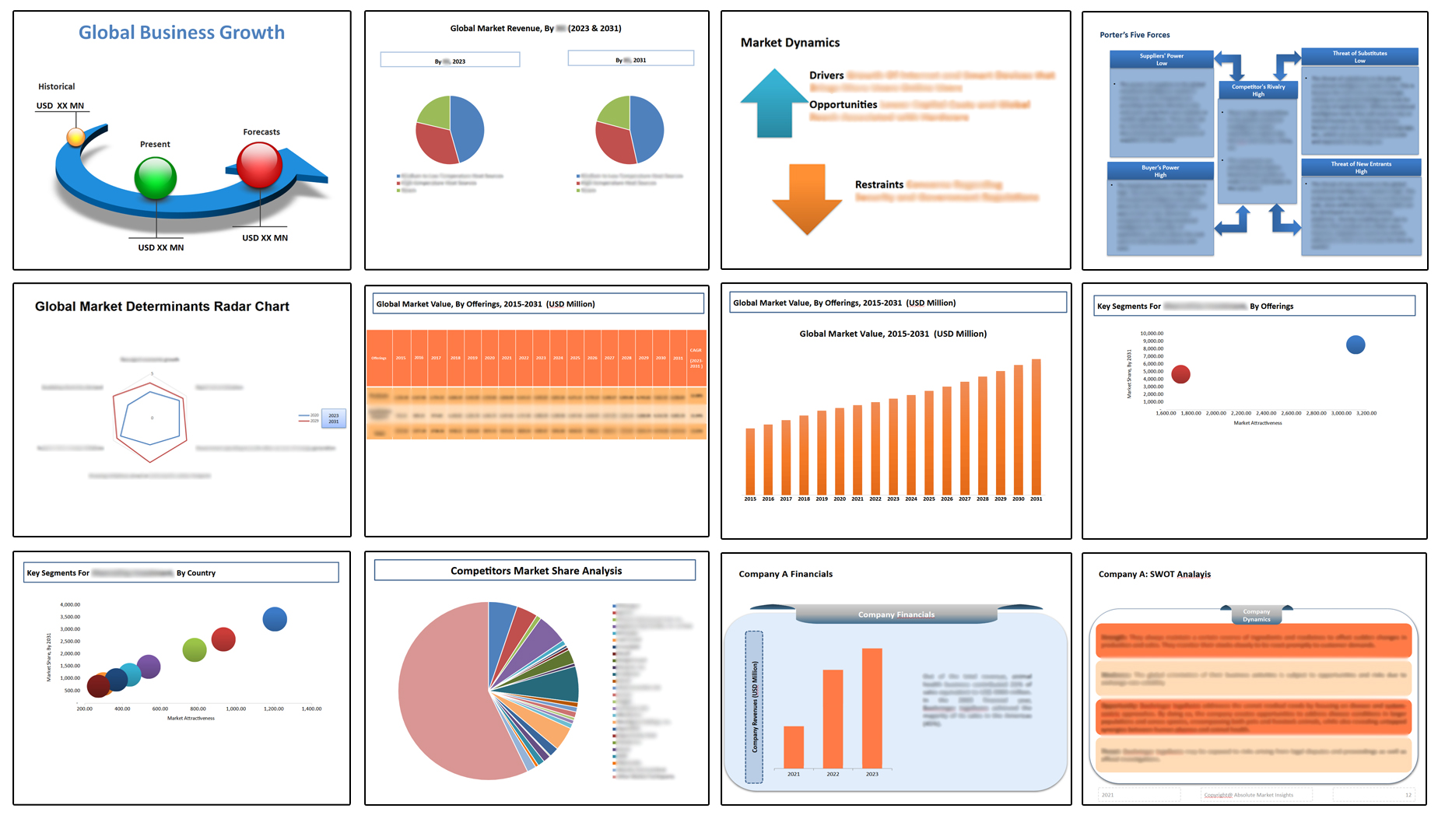

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Source, By Type, By Application, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Cargill, Incorporated, Corbion N.V, Ecogreen Oleochemicals, Emery Oleochemicals, Evonik Industries AG, Evyap, Godrej Industries, IOI Corporation Berhad, JNJ Oleochemicals, Incorporated, Kao Chemicals Global, KLK OLEO, Oleon NV, Pepmaco Manufacturing Corporation, Philippine International Dev., Sakamoto Yakuhin Kogyo Co., Ltd., Stepan Company, Vantage Specialty Chemicals, Inc., Wilmar International Ltd. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Oleochemicals Market

By Source

- Plant Based

- Animal Based

By Type

- Glycerol Esters

- Specialty Esters

- Fatty Acid Methyl Ester

- Fatty Amines

- Alkoxylates

- Others

By Application

- Personal Care & Cosmetics

- Food & Beverages

- Pharmaceuticals

- Polymers & Plastics

- Agrochemicals

- Paints & Coatings

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Oleochemicals Market

By Source

- Plant Based

- Animal Based

By Type

- Glycerol Esters

- Specialty Esters

- Fatty Acid Methyl Ester

- Fatty Amines

- Alkoxylates

- Others

By Application

- Personal Care & Cosmetics

- Food & Beverages

- Pharmaceuticals

- Polymers & Plastics

- Agrochemicals

- Paints & Coatings

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.