Global Pharmaceutical Tubes Market, By Material Type, By Application, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1209

- Number of Pages: 420

- Table/Charts : Yes

- July, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10097

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Pharmaceutical tubes are essential packaging solutions used to store and dispense various pharmaceutical products such as ointments, creams, gels, and other semi-solid formulations. These tubes are typically made from materials like aluminum, plastic, or laminate, ensuring they are secure, lightweight, and capable of preserving the integrity and efficacy of the contents. The pharmaceutical tubes market is experiencing robust growth driven by several factors. Increasing pharmaceutical production worldwide necessitates efficient and secure packaging solutions. Market trends include the adoption of sustainable materials and advanced technologies like smart packaging for better product monitoring. Opportunities lie in emerging markets with expanding healthcare infrastructures and rising consumer demand for convenient medication delivery systems.

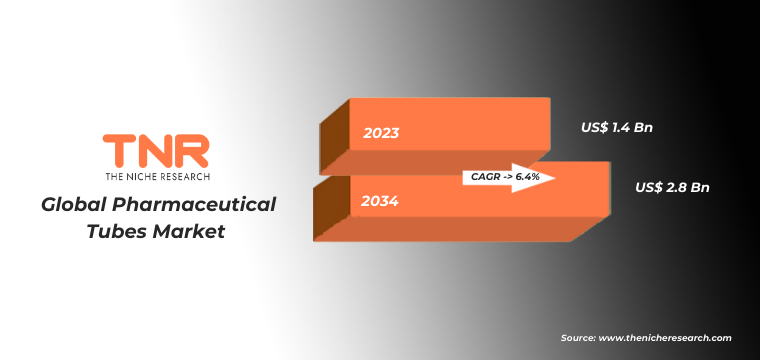

Growth drivers include innovations in tube design that enhance usability and safety, regulatory pressures favouring sustainable packaging solutions, and evolving consumer preferences towards easy-to-use pharmaceutical products. As the market continues to evolve, collaborations between pharmaceutical companies and packaging manufacturers are crucial for driving innovation and meeting market demands effectively. In Terms of Revenue, the Global Pharmaceutical Tubes Market was Worth US$ 1.4 Bn in 2023, Anticipated to Witness CAGR of 6.4% During 2024 – 2034.

Trends in the Global Pharmaceutical Tubes Market

- Technological Advancements in Packaging: The pharmaceutical tubes market is witnessing significant advancements in packaging technology aimed at enhancing product safety, usability, and consumer convenience. Innovations include the integration of smart packaging solutions such as RFID tags and NFC (Near Field Communication) technology. These technologies enable real-time tracking of product usage, temperature monitoring, and expiration date alerts, ensuring product integrity throughout the supply chain. Such advancements not only improve operational efficiency but also bolster consumer trust by providing transparent and secure packaging solutions.

- Customization and Personalization: There is a growing trend towards customization and personalization of pharmaceutical tubes to cater to diverse consumer preferences and market demands. Manufacturers are increasingly offering bespoke packaging solutions that align with specific medication needs, dosage requirements, and user demographics. This trend is driven by the rising demand for patient-centric healthcare solutions and personalized medicine. Customized tubes may feature ergonomic designs, user-friendly dispensing mechanisms, and specialized labeling to enhance brand differentiation and consumer satisfaction. By offering tailored packaging options, companies can effectively address niche markets, optimize inventory management, and strengthen brand loyalty in the competitive pharmaceutical packaging landscape.

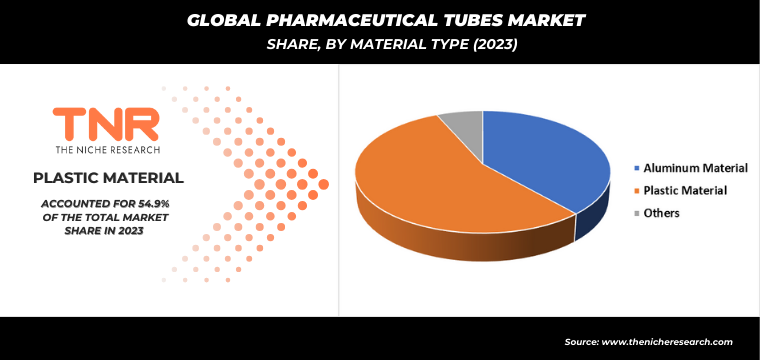

Plastic by material type category has emerged as a dominant segment in the global pharmaceutical tubes market, its versatility, cost-effectiveness, and performance characteristics.

Polyethylene (PE) and polypropylene (PP) are among the commonly used plastics in pharmaceutical tube manufacturing. These materials offer excellent barrier properties against moisture, gases, and contaminants, ensuring the integrity and stability of pharmaceutical products throughout their shelf life. Plastic tubes are lightweight, durable, and easily moldable, allowing for various shapes and sizes to meet specific packaging requirements.

They are also compatible with a wide range of formulations, including creams, gels, and ointments, making them ideal for pharmaceutical applications. Furthermore, advancements in plastic technology have led to innovations such as recyclable and biodegradable plastics, addressing sustainability concerns in packaging. With increasing pharmaceutical production and demand for convenient, hygienic packaging solutions, the dominance of plastic in the pharmaceutical tubes market is expected to continue, driven by its adaptability to evolving industry needs and consumer preferences.

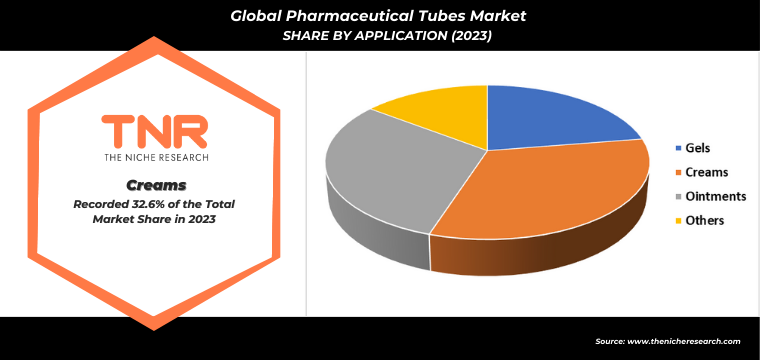

In 2023, ointments segment solidified its position as the second-largest application category within the global pharmaceutical tubes market.

This growth is driven by increasing consumer demand for dermatological treatments and skincare products globally. Ointments, including creams and gels, require secure and hygienic packaging to maintain their efficacy and shelf life, making pharmaceutical tubes an ideal choice. Key factors contributing to the segment’s growth include advancements in dermatological formulations, rising awareness about skincare, and a growing aging population seeking treatment for skin-related conditions.

Pharmaceutical tubes offer advantages such as precise dosing, ease of application, and protection against contamination, meeting the stringent requirements of pharmaceutical packaging standards. As the market continues to expand, innovations in tube design, such as child-resistant closures and tamper-evident features, are further enhancing the segment’s appeal. This solidification underscores the importance of reliable and functional packaging solutions in the pharmaceutical industry, catering to the evolving needs and preferences of consumers seeking effective skincare treatments.

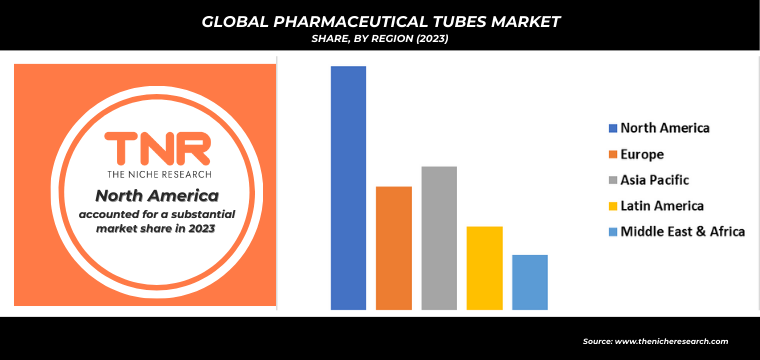

In 2023, Middle East & Africa contributed a revenue share of 8.5% in the global pharmaceutical tubes market.

This growth reflects increasing healthcare investments, expanding pharmaceutical manufacturing capabilities, and rising consumer demand for medication packaging solutions in the region. Several factors have contributed to this market share, including the region’s growing population, increasing chronic disease prevalence, and improvements in healthcare infrastructure. Pharmaceutical tubes play a crucial role in delivering and storing medications such as ointments, creams, and gels, ensuring product safety and efficacy.

Additionally, regulatory advancements and a shift towards adopting international quality standards have bolstered demand for high-quality packaging solutions in the Middle East & Africa. As pharmaceutical companies in the region continue to expand their product offerings and distribution networks, the demand for pharmaceutical tubes is expected to further increase, driving market growth and enhancing access to essential healthcare products across diverse demographic and geographic segments.

Competitive Landscape

Some of the players operating in the pharmaceutical tubes market are

- Albea Group

- ALLTUB

- Almin Extrusion

- Antilla Propack

- BRK Packwell Private

- CCL Industries

- EPL LIMITED

- Hoffmann Neopac

- Huhtamaki

- MONTEBELLO PACKAGING

- Neelam Global

- Prutha Packaging

- Romaco Group

- Unette Corporation

- Other Industry Participants

Global Pharmaceutical Tubes Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 1.4 Bn |

| Market Size Forecast by 2034 | US$ 2.8 Bn |

| Growth Rate (CAGR) | 6.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Material Type, By Application, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Albea Group, ALLTUB, Almin Extrusion, Antilla Propack, BRK Packwell Private, CCL Industries, EPL LIMITED, Hoffmann Neopac, Huhtamaki, MONTEBELLO PACKAGING, Neelam Global, Prutha Packaging, Romaco Group, Unette Corporation |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Pharmaceutical Tubes Market

By Material Type

- Aluminum Material

- Plastic Material

- Polypropylene

- Polyethylene

- Others

By Application

- Gels

- Creams

- Ointments

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Pharmaceutical Tubes Market

By Material Type

- Aluminum Material

- Plastic Material

- Polypropylene

- Polyethylene

- Others

By Application

- Gels

- Creams

- Ointments

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.