Global Physical Security Market By Component, By Industry Vertical, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Automotive & Transportation

- Report ID: TNR-110-1268

- Number of Pages: 420

- Table/Charts : Yes

- August, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10050

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

The physical security market encompasses measures and technologies designed to protect physical assets, people, and information from unauthorized access, damage, or theft. This market includes surveillance systems, access control solutions, alarm systems, and barriers.

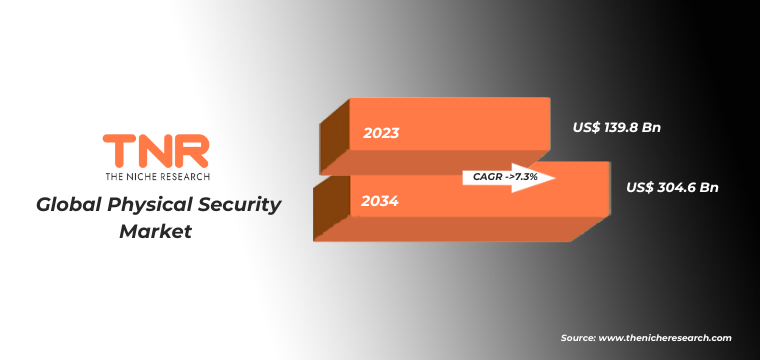

According to recent statistics, the global physical security market was valued at approximately USD 139.8 Bn in 2023 projected to reach USD 304.6 Bn by 2034; expected to grow at a CAGR of 7.3% from 2024 to 2034. Physical security applications are broad, spanning various industry verticals. In the corporate sector, it secures facilities and sensitive information. In retail, it helps prevent theft and ensure customer safety. Healthcare institutions use it to protect patient data and ensure staff safety. Critical infrastructure sectors, such as energy and transportation, rely on physical security to safeguard against potential threats and disruptions. The growing focus on security and technological advancements drive the expansion and innovation within this market.

Global Physical Security Market Segmental Analysis:

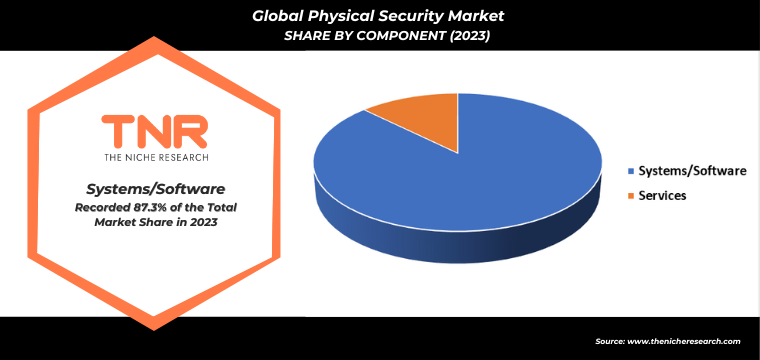

Global Physical Security Market By Component

Systems/software segment, by component, is anticipated to lead the global physical security market in the upcoming years. This segment encompasses advanced technologies such as video management systems (VMS), access control systems, and integrated security platforms that enhance overall security operations. With increasing demand for centralized control and real-time monitoring, businesses and organizations are investing heavily in sophisticated software solutions. These systems provide comprehensive functionalities, including alarm management, video analytics, and IoT integration, facilitating more effective and streamlined security management. The rapid advancements in technology and the growing need for robust, scalable security solutions are driving the strong growth and market leadership of the systems/software segment.

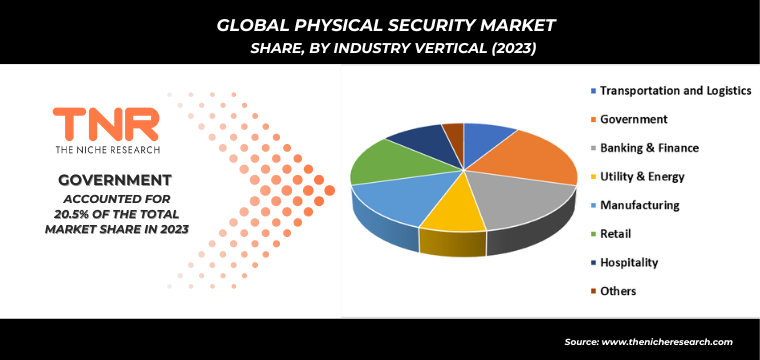

Global Physical Security Market By Industry Vertical

The government sector is a leading industry vertical in the global physical security market due to its extensive use of advanced security measures. Governments prioritize the protection of critical infrastructure, sensitive data, and public safety, driving significant investments in physical security systems. This includes deployment of surveillance cameras, access control systems, and alarm systems across various government facilities. The need for enhanced security against potential threats, such as terrorism and cyber-attacks, further fuels the demand for comprehensive security solutions. Consequently, the government’s substantial spending on physical security technologies establishes it as a dominant segment within the market, reflecting its critical role in national and public safety.

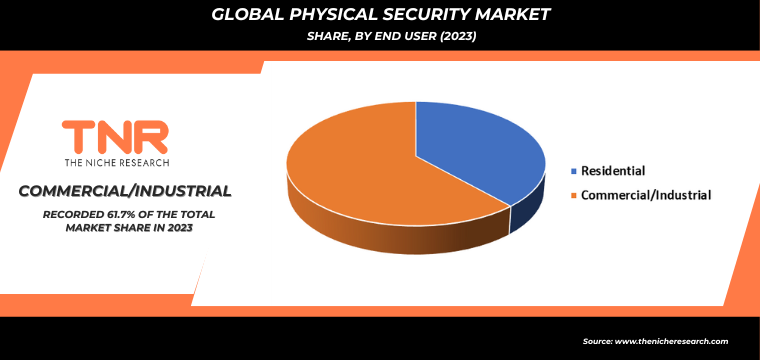

Global Physical Security Market By End User

The residential segment is projected to experience the fastest growth in the global physical security market in the coming years. This surge is driven by increasing consumer awareness about home safety, advancements in affordable smart home technology, and a rising desire for enhanced security measures among homeowners. The adoption of systems such as smart locks, video doorbells, and integrated security cameras is becoming more prevalent as homeowners seek to protect their property and loved ones. Additionally, the growing availability of user-friendly and cost-effective solutions contributes to the segment’s expansion. As residential security technology becomes more accessible and sophisticated, the residential segment is set to lead the market’s growth.

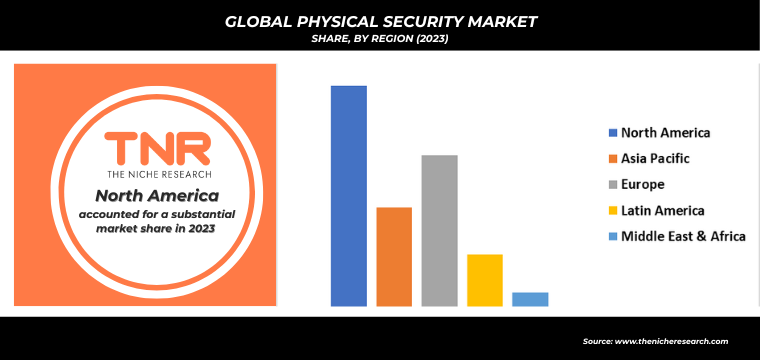

Global Physical Security Market By Region

Latin America has the potential to become a dominant player in the global physical security market in the coming years. This growth is driven by increasing investments in infrastructure development, heightened security concerns, and rising urbanization across the region. Governments and private sectors are prioritizing advanced security solutions to address challenges related to crime and safety. Additionally, the expanding adoption of smart technologies and IoT-based security systems in residential, commercial, and government sectors further supports this trend. As economic growth continues and technological advancements are embraced, Latin America is well-positioned to lead in the global physical security market.

Global Physical Security Market Dynamics

Global Physical Security Market Growth Driver:

- Technological Advancements: The integration of advanced technologies such as IoT, AI, and machine learning into physical security systems enhances threat detection, response times, and operational efficiency, driving growth in the global physical security market.

- Rising Security Concerns: Increasing concerns over terrorism, vandalism, and theft across various sectors amplify the demand for robust physical security solutions. This heightened awareness drives investment in comprehensive security systems to protect assets and ensure safety.

Global Physical Security Market Restraint:

- High Implementation Costs: The initial investment required for advanced physical security systems, including installation and maintenance, can be significant. This high cost may deter smaller organizations from adopting comprehensive security solutions, limiting market growth potential.

- Complex Integration Challenges: Integrating new physical security technologies with existing systems can be complex and resource-intensive. Compatibility issues and the need for specialized expertise may hinder seamless deployment, affecting the overall adoption rate of advanced security solutions.

Global Physical Security Market Opportunity:

- Smart City Initiatives: As cities worldwide invest in smart infrastructure, there is an opportunity for physical security providers to integrate advanced solutions like IoT-based surveillance and automated access control, enhancing urban safety and operational efficiency.

- Growing Demand for Cyber-Physical Security: The convergence of cybersecurity and physical security creates opportunities for integrated solutions that protect against both digital and physical threats, addressing the increasing need for comprehensive security strategies in various industry sectors.

Global Physical Security Market Trends:

- Integration of AI and Machine Learning: The adoption of AI and machine learning in physical security systems enhances real-time threat detection, predictive analytics, and automated responses, leading to more efficient and adaptive security solutions in various sectors.

- Cloud-Based Security Solutions: The shift towards cloud-based platforms for physical security management offers scalable, flexible, and cost-effective solutions. This trend enables remote monitoring, real-time data access, and easier integration with other security technologies.

Competitive Landscape

The global physical security market is highly competitive, with major players like Honeywell, Johnson Controls, and Bosch leading the sector. Companies focus on technological innovation, strategic partnerships, and acquisitions to enhance their product portfolios and maintain market leadership amid evolving security needs.

Recent Developments:

- In August 2023, Fingerprint Cards AB, specializing in biometrics, joined forces with BenjiLock, known for premium biometric locks, to advance the global promotion of high-end biometric access control systems.

- In March 2023, Rhombus, Inc., a cloud-based enterprise physical security provider, launched ‘Rhombus Access Control,’ a solution allowing enterprises to manage access control, security alarms, video surveillance, and sensors through a single web-based console or mobile app.

- In July 2023, Solink Corp, a company offering cloud-based video surveillance, secured USD 60 million in Series C funding. The investment round was led by Goldman Sachs, with additional participation from BDC IT and Omers Ventures.

Some of the players operating in the physical security market are

- ADT LLC

- Axis Communications AB

- Bosch Sicherheitssysteme GmbH

- Cisco Systems Inc.

- Dahua Technology Co., Ltd

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International, Inc.

- Johnson Controls

- Pelco

- Robert Bosch GmbH

- SECOM CO., LTD.

- Siemens

- Other Industry Participants

Global Physical Security Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 139.8 Bn |

| Market Size Forecast by 2034 | US$ 304.6 Bn |

| Growth Rate (CAGR) | 7.3% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Component, By Industry Vertical, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | ADT LLC, Axis Communications AB, Bosch Sicherheitssysteme GmbH, Cisco Systems Inc., Dahua Technology Co., Ltd, Genetec Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Honeywell International, Inc., Johnson Controls, Pelco, Robert Bosch GmbH, SECOM CO., LTD., Siemens |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Physical Security Market Segmentation:

By Component

- Systems/Software

- Video Surveillance Systems

- Biometrics & Access Control Systems

- Intrusion Detection and Prevention Systems

- Fire Detection Systems

- Physical Security Information Management (PSIM)

- Others

- Services

- System Integration

- Remote Monitoring

- Others

By Industry Vertical

- Transportation and Logistics

- Government

- Banking & Finance

- Utility & Energy

- Manufacturing

- Retail

- Hospitality

- Others

By End User

- Residential

- Commercial/Industrial

- Small and Medium-sized Enterprises

- Large Enterprises

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Physical Security Market Segmentation:

By Component

- Systems/Software

- Video Surveillance Systems

- Biometrics & Access Control Systems

- Intrusion Detection and Prevention Systems

- Fire Detection Systems

- Physical Security Information Management (PSIM)

- Others

- Services

- System Integration

- Remote Monitoring

- Others

By Industry Vertical

- Transportation and Logistics

- Government

- Banking & Finance

- Utility & Energy

- Manufacturing

- Retail

- Hospitality

- Others

By End User

- Residential

- Commercial/Industrial

- Small and Medium-sized Enterprises

- Large Enterprises

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.