Global Prebiotics and Probiotics Supplements Market, By Product Type, By Application, By Form, By End User, By Distribution Channel, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Food & Beverages

- Report ID: TNR-110-1329

- Number of Pages: 420

- Table/Charts : Yes

- October, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10045

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

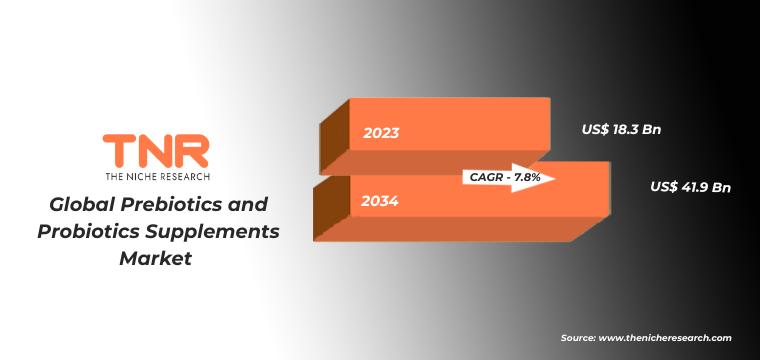

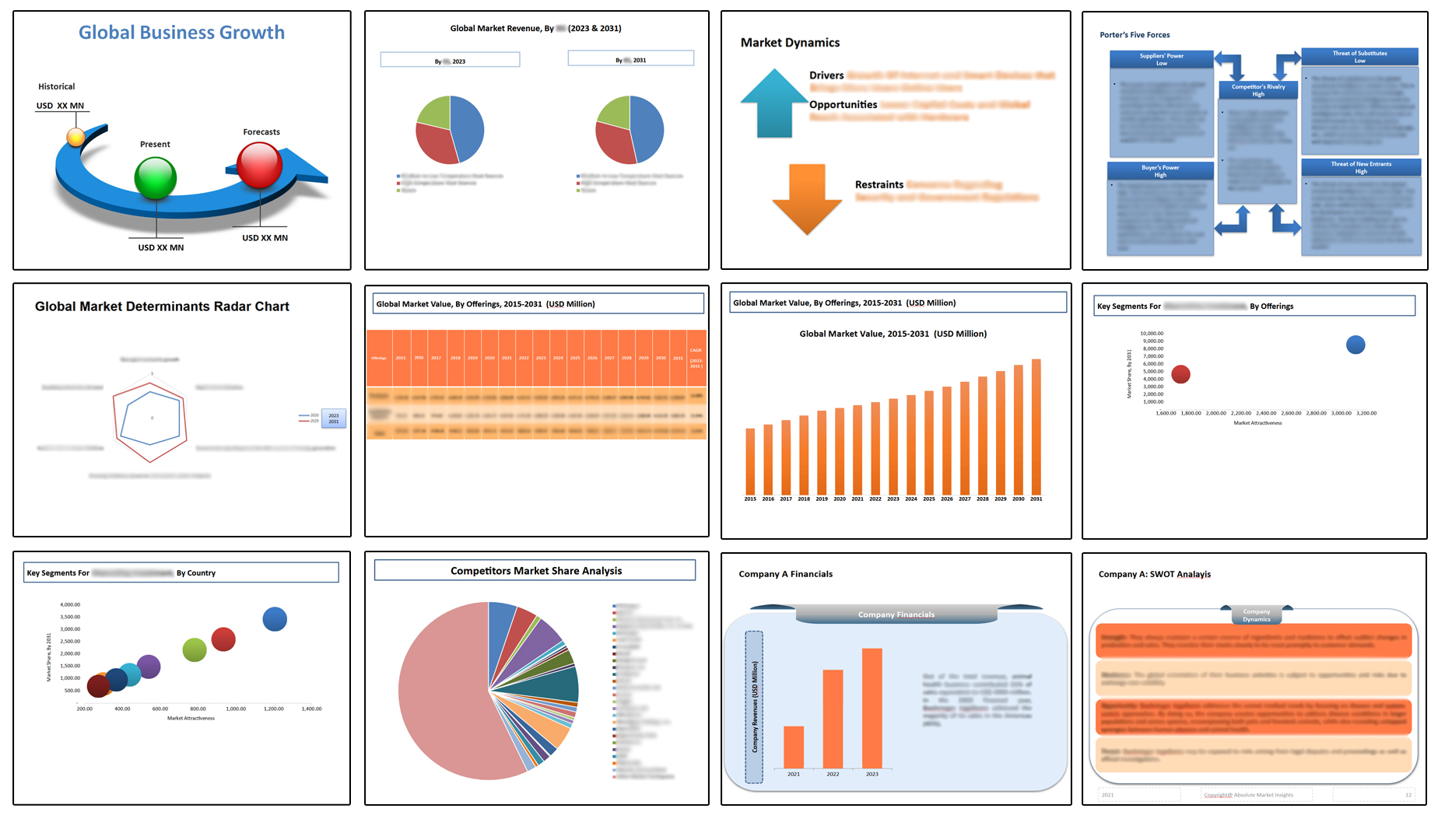

The global prebiotics and probiotics supplements market has experienced significant growth, driven by increasing consumer awareness of gut health and overall wellness. “In Terms of Revenue, the Global Prebiotics and Probiotics Supplements Market was Worth US$ 18.3 Bn in 2023, Anticipated to Witness CAGR of 7.8% During 2024 – 2034.” Prebiotics, such as inulin and fructooligosaccharides, are non-digestible fibers that promote the growth of beneficial gut bacteria. Probiotics, found in products like yogurt and kefir, are live microorganisms that confer health benefits.

These supplements are commonly used in daily diets to enhance digestion, boost immunity, and improve nutrient absorption. For example, taking a daily probiotic capsule can help alleviate digestive issues like bloating and constipation. Moreover, a balanced intake of prebiotics and probiotics can support mental health, as emerging research suggests a link between gut microbiota and mood regulation. Overall, these supplements play a crucial role in maintaining a healthy gut microbiome.

| Application | Description | Examples |

| Digestive Health | Probiotics help balance gut microbiota, alleviating issues like bloating, constipation, and diarrhea. | Products like Align and Culturelle are widely recommended for digestive health. |

| Immunity Support | Probiotics and prebiotics boost the immune system by enhancing gut health, which is crucial for immune function. | Yakult and Danone’s Activia yogurts promote immunity through their probiotic content. |

| Weight Management | Certain probiotics may aid in weight loss and fat reduction by influencing metabolism and appetite. | ProbioFerm is marketed for supporting weight management and digestive health. |

| Mental Health | Emerging research links gut health to mental well-being, with probiotics potentially alleviating symptoms of anxiety and depression. | Products like Garden of Life’s Dr. Formulated Probiotics focus on gut-brain health. |

| Geriatric Care | Probiotics are increasingly used in elderly populations to improve digestive health and nutrient absorption. | Culturelle offers formulations specifically designed for seniors. |

| Children’s Health | Probiotics are beneficial for infants and children, helping with colic, constipation, and overall gut health. | SmartyPants Kids Probiotic Gummies cater specifically to children’s digestive health. |

| Athletic Performance | Athletes use probiotics to enhance gut health, which can improve overall performance and recovery. | Brands like Athletic Greens provide probiotic blends tailored for active lifestyles. |

Growth Drivers of the Global Prebiotics and Probiotics Supplements Market

- Growing Awareness of Gut Health: Increasing awareness of the significance of gut health is a major growth driver for the global prebiotics and probiotics supplements market. As more individuals understand the link between gut microbiota and overall health, including immune function and mental well-being, demand for these supplements has surged. For instance, a 2022 survey conducted by the International Probiotics Association revealed that over 70% of consumers actively seek products that promote digestive health. This trend is further fueled by health professionals recommending probiotics for conditions like irritable bowel syndrome (IBS) and antibiotic-associated diarrhea. Popular products such as Yakult and Activia have capitalized on this awareness, highlighting gut health benefits on their packaging. This heightened consumer focus on preventive healthcare continues to drive the market, with a projected CAGR of 7.8% from 2024 to 2034.

- Rise in Functional Foods and Beverages: The increasing popularity of functional foods and beverages significantly boosts the prebiotics and probiotics supplements market. Consumers are seeking foods that offer health benefits beyond basic nutrition, driving manufacturers to incorporate prebiotics and probiotics into their products. For example, brands like kombucha and kefir have gained traction for their probiotic content, while fiber-enriched snacks featuring prebiotics have become mainstream. This trend is evident as companies innovate by adding these beneficial ingredients to everyday products, making it easier for consumers to incorporate them into their diets and improve their health proactively.

Global Prebiotics and Probiotics Supplements Market Segmental Analysis:

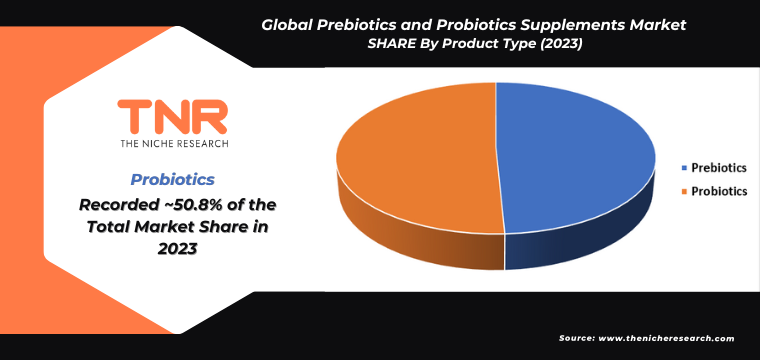

Probiotics by product type have emerged as a dominant segment in the global prebiotics and probiotics supplements market capturing a revenue share of 50.8% in 2023. This growth can be attributed to the increasing consumer preference for probiotic-rich products like yogurt, kefir, and dietary supplements. For instance, brands such as Danone’s Activia and General Mills’ Yoplait offer probiotic yogurts that promote digestive health. Additionally, probiotic capsules and powders from companies like Garden of Life and Culturelle are gaining popularity for their convenience and targeted health benefits. This rising demand for diverse probiotic options underscores the growing emphasis on gut health and wellness in today’s health-conscious market.

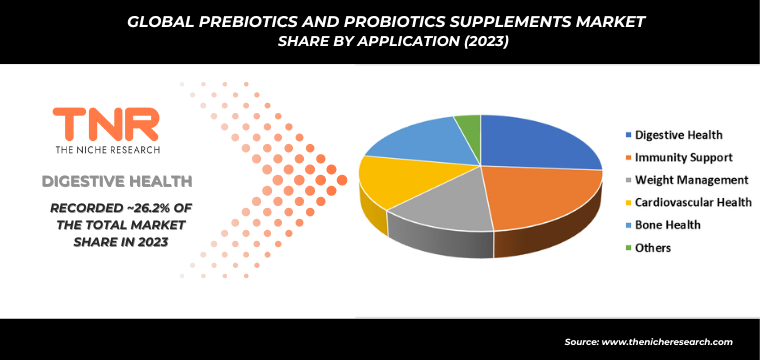

In 2023, immunity support segment solidified its position as the second-largest application category within the global prebiotics and probiotics supplements market in 2023, with a revenue share of 22.3%. This growth reflects rising consumer awareness of the link between gut health and immune function. Products like probiotic supplements from brands such as Nature’s Bounty and Garden of Life are specifically formulated to enhance immune health by promoting a balanced gut microbiome. Additionally, prebiotic-rich foods like chicory root and garlic are increasingly incorporated into diets to support immunity. This focus on strengthening the immune system has driven significant demand for products that offer both preventative and supportive health benefits.

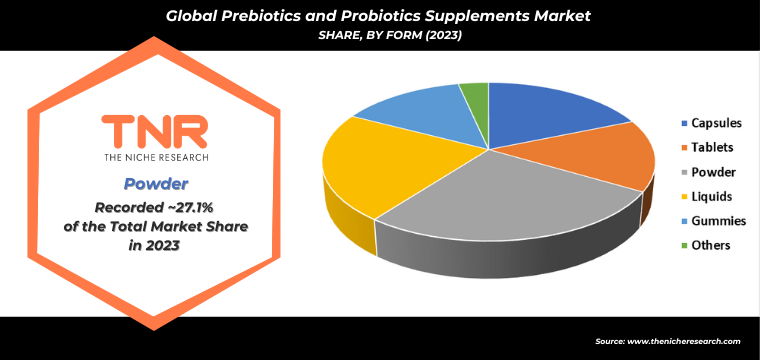

By form, gummies segment is anticipated to grow fastest over the forecast timeline in global prebiotics and probiotics supplements market, capturing a revenue share of 13.9% in 2023. This growth is driven by consumer preference for convenient and tasty formats. Brands like SmartyPants and Olly have popularized gummy probiotics, appealing to both children and adults who prefer an enjoyable way to support their digestive health. The appealing flavors and ease of consumption make gummies a preferred choice for many, highlighting a shift towards more palatable supplement options in the health and wellness sector.

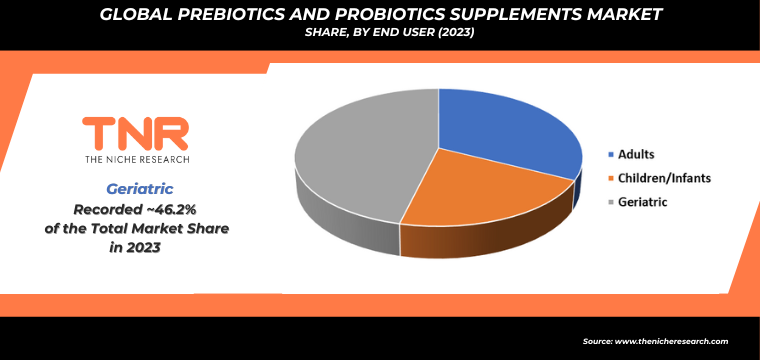

Geriatric, by end user category dominated the global prebiotics and probiotics supplements market in 2023 capturing a revenue share of 46.2%. This trend highlights the growing awareness of gut health among older adults, who often face digestive issues and weakened immune systems. Probiotic products tailored for seniors, such as those from Align and Culturelle, are specifically formulated to address these concerns. Additionally, prebiotic supplements like Benefiber are increasingly being used to enhance digestive health and improve nutrient absorption in this age group. The focus on maintaining health and vitality in later years drives significant demand for these beneficial products among geriatric consumers.

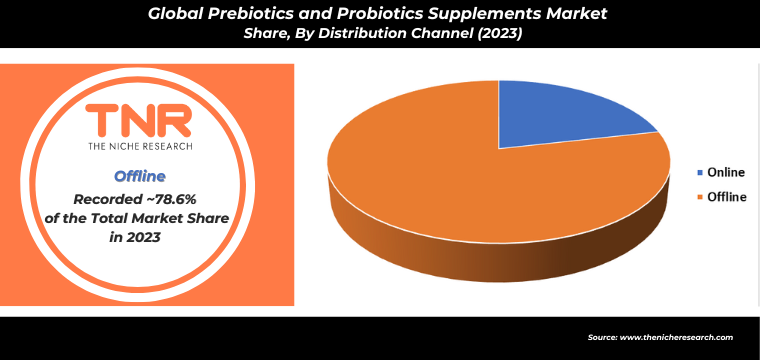

Offline segment generated the largest revenue share of 78.6% in 2023 in global prebiotics and probiotics supplements market. This dominance is largely attributed to the widespread availability of these products in pharmacies, health food stores, and supermarkets. Consumers often prefer purchasing probiotics and prebiotics in person to consult with knowledgeable staff and examine product labels firsthand. Popular brands like Garden of Life and Nature’s Bounty are prominently featured in physical retail locations, making it convenient for consumers to access their favorite supplements while benefiting from in-store promotions and discounts.

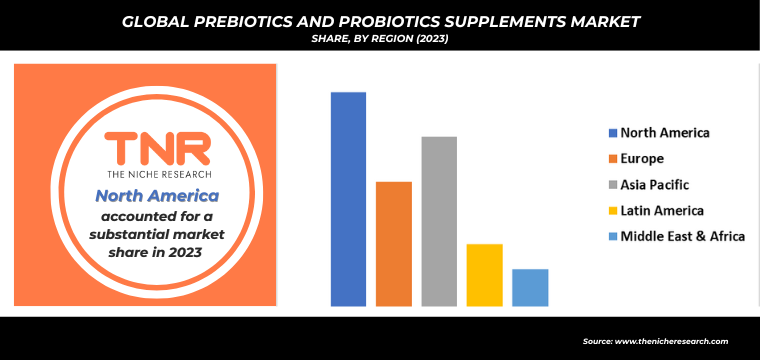

In 2023, Latin America solidified as fourth leading position in the global prebiotics and probiotics supplements market, contributing a revenue share of 10.9%. This growth can be attributed to rising health consciousness and increased interest in gut health among consumers in countries like Brazil and Mexico. Local brands, such as Probióticos México, have gained popularity by offering affordable probiotic yogurts and supplements tailored to regional tastes. Additionally, the introduction of innovative products, like prebiotic-enriched snacks, further drives market expansion in this dynamic region, emphasizing the importance of digestive health among Latin American consumers.

Competitive Landscape

Some of the players operating in the prebiotics and probiotics supplements market are

- Abbott Laboratories

- Align

- BENEO GmbH

- Billion Cheers (Fermentis Life Sciences Pvt Ltd)

- Bright Food (Group) Corp. Ltd.

- Cargill Inc.

- Cosucra Groupe Warcoing SA

- Culturelle (i-Health, Inc.)

- Digestive Advantage

- FrieslandCampina

- Garden of Life (Nestle SA)

- HUM Nutrition Inc.

- Jarrow Formulas, Inc.

- Kraft Foods Group, Inc.

- Natrol

- Nature Made

- Now Foods

- OLLY

- Ora Organics

- Parmalat S.p.A

- Roquette Frères

- Royal Cosun

- Spring Valley

- The Kraft Heinz Company

- thegoodbug

- Yakult Honsha Co., Ltd.

- Other Industry Participants

Global Prebiotics and Probiotics Supplements Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 18.3 Bn |

| Market Size Forecast by 2034 | US$ 41.9 Bn |

| Growth Rate (CAGR) | 7.8% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product Type, By Application, By Form, By End User, By Distribution Channel, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Abbott Laboratories, Align, BENEO GmbH, Billion Cheers (Fermentis Life Sciences Pvt Ltd), Bright Food (Group) Corp. Ltd., Cargill Inc., Cosucra Groupe Warcoing SA, Culturelle (i-Health, Inc.), Digestive Advantage, FrieslandCampina, Garden of Life (Nestle SA), HUM Nutrition Inc., Jarrow Formulas, Inc., Kraft Foods Group, Inc., Natrol, Nature Made, Now Foods, OLLY, Ora Organics, Parmalat S.p.A, Roquette Frères, Royal Cosun, Spring Valley, The Kraft Heinz Company, Thegoodbug, Yakult Honsha Co., Ltd. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Prebiotics and Probiotics Supplements Market

By Product Type

- Prebiotics

- Fructooligosaccharides (FOS)

- Galactooligosaccharides (GOS)

- Inulin

- Mannan-oligosaccharides (MOS)

- Other

- Probiotics

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Bacillus

- Yeast (e.g., Saccharomyces boulardii)

- Other

By Application

- Digestive Health

- Immunity Support

- Weight Management

- Cardiovascular Health

- Bone Health

- Others

By Form

- Capsules

- Tablets

- Powder

- Liquids

- Gummies

- Others

By End User

- Adults

- Children/Infants

- Geriatric

By Distribution Channel

- Online

- Offline

- Pharmacies/Drugstores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Prebiotics and Probiotics Supplements Market

By Product Type

- Prebiotics

- Fructooligosaccharides (FOS)

- Galactooligosaccharides (GOS)

- Inulin

- Mannan-oligosaccharides (MOS)

- Other

- Probiotics

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Bacillus

- Yeast (e.g., Saccharomyces boulardii)

- Other

By Application

- Digestive Health

- Immunity Support

- Weight Management

- Cardiovascular Health

- Bone Health

- Others

By Form

- Capsules

- Tablets

- Powder

- Liquids

- Gummies

- Others

By End User

- Adults

- Children/Infants

- Geriatric

By Distribution Channel

- Online

- Offline

- Pharmacies/Drugstores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.