Global Robotic Radiotherapy Market, By Product, By Technology, By Application, By End-User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Healthcare

- Report ID: TNR-110-1077

- Number of Pages: 420

- Table/Charts : Yes

- May, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10155

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Robotic radiotherapy, also known as robotic radiosurgery or robotic-assisted radiation therapy, is an advanced medical technology that utilizes robotic systems to deliver precise and targeted radiation therapy to cancerous tumors. This cutting-edge approach combines robotics, imaging technology, and radiation therapy to enhance treatment accuracy, minimize radiation exposure to healthy tissues, and improve patient outcomes.

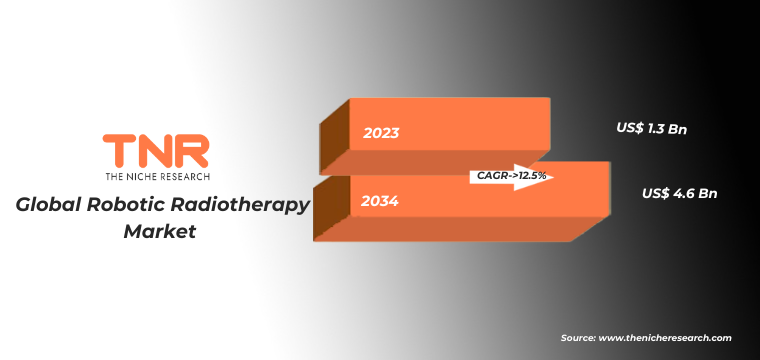

The robotic manipulator is the core component of the system, consisting of robotic arms equipped with specialized tools and devices for radiation delivery. These robotic arms are controlled by computer algorithms and software, allowing for precise positioning and movement during treatment. Advanced imaging technologies such as computed tomography (CT), magnetic resonance imaging (MRI), and positron emission tomography (PET) are integrated into robotic radiotherapy systems to accurately visualize the tumor and surrounding anatomy in real-time. High-resolution imaging helps clinicians identify tumor location, shape, size, and nearby critical structures, enabling precise treatment planning and delivery. In terms of revenue, the global robotic radiotherapy market was worth US$ 1.25 Bn in 2023, anticipated to witness CAGR of 12.5% During 2024 – 2034.

Trends in the Global Robotic Radiotherapy Market

· Increasing Adoption of Stereotactic Body Radiation Therapy (SBRT) and Stereotactic Radiosurgery (SRS): There is a growing trend towards the adoption of SBRT and SRS techniques in robotic radiotherapy for the treatment of various cancer types, including lung, liver, prostate, and brain tumors. These techniques deliver high doses of radiation with pinpoint accuracy, allowing for shorter treatment courses and improved tumor control rates while minimizing damage to surrounding healthy tissues.

· Integration of Artificial Intelligence (AI) and Machine Learning: Robotic radiotherapy systems are increasingly incorporating AI and machine learning algorithms to optimize treatment planning, automate treatment delivery, and improve clinical outcomes. AI-based tools can analyse large datasets of patient imaging and treatment data to personalize treatment plans, predict treatment response, and optimize radiation dose delivery based on individual patient characteristics.

· Advancements in Imaging Technology: Continued advancements in imaging technology, such as cone-beam CT (CBCT), MRI-guided radiotherapy, and positron emission tomography (PET) imaging, are enhancing the precision and accuracy of robotic radiotherapy treatments. These imaging modalities provide real-time visualization of the tumor and surrounding anatomy, enabling clinicians to adapt treatment plans and ensure accurate radiation delivery.

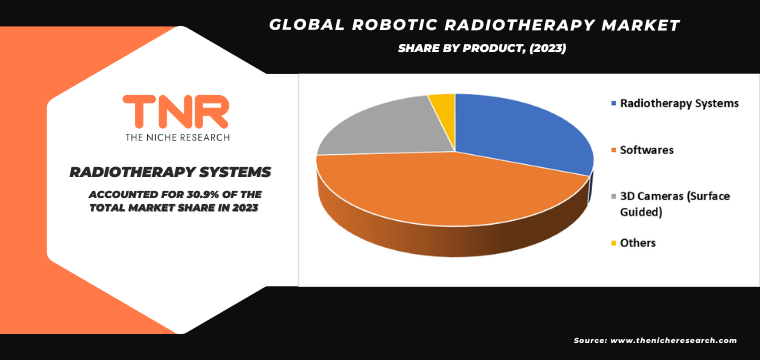

Software products is projected as the fastest growing segment in the global robotic radiotherapy market during the forecast period.

Software plays a crucial role in the planning, delivery, and management of radiotherapy treatments. In the context of radiotherapy systems, several types of software are utilized to optimize treatment planning, ensure accurate delivery, and enhance patient care. Treatment planning software is used to design individualized radiation therapy treatment plans for each patient. This software incorporates patient-specific imaging data, such as CT, MRI, or PET scans, to delineate the tumor and surrounding critical structures.

Treatment planners use advanced algorithms and optimization techniques to calculate the optimal arrangement of radiation beams, dose distributions, and treatment parameters to achieve the desired treatment goals while minimizing radiation exposure to healthy tissues. Radiotherapy systems are sophisticated medical devices used in the treatment of cancer. These systems deliver high-energy radiation to target and destroy cancerous cells while minimizing damage to surrounding healthy tissues.

Linear accelerators are the most common type of radiotherapy system used for external beam radiation therapy. They generate high energy X-rays or electrons that are directed at the tumor from various angles to deliver precise doses of radiation. LINACs can be equipped with advanced technologies such as intensity modulated radiation therapy (IMRT), image-guided radiation therapy (IGRT), and volumetric modulated arc therapy (VMAT) to optimize treatment delivery and spare healthy tissues.

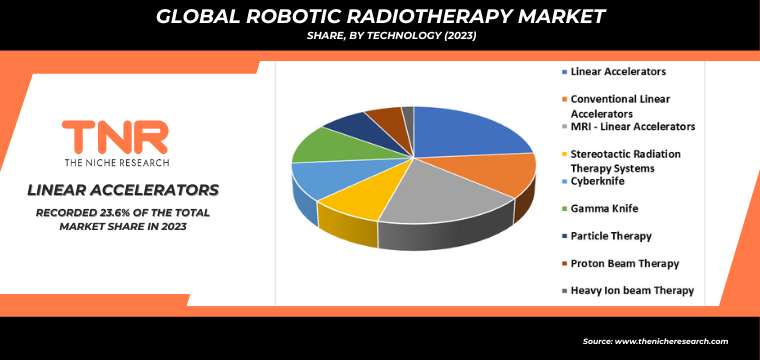

Linear accelerators segment had the highest share in the global robotic radiotherapy market in 2023.

The linear accelerators segment is expected to account for the for the largest share of robotic radiotherapy market due to the widespread usage of upgraded systems and their availability. Additionally, as more oncologists become aware of the benefits of MR LINAC, more money is being spent on developing automated LINAC technology. There is also a growing trend of industry-cancer institution collaborations, with the goal of promoting innovation and expanding LINAC technology accessibility.

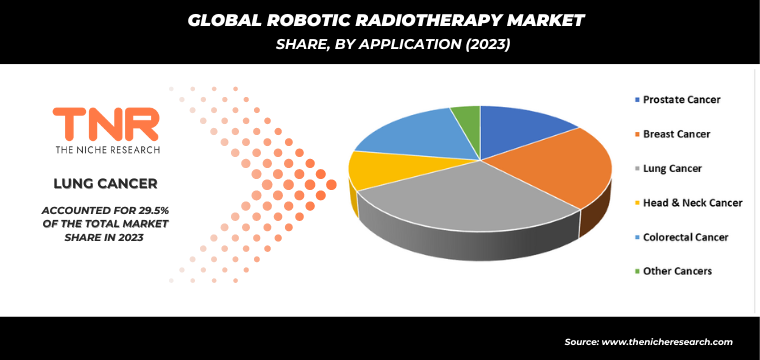

Lung cancer segment had the highest share in the global robotic radiotherapy market in 2023.

Lung cancer segment has garnered major market share and is anticipated to be the fastest growing segment in the robotic radiotherapy market during the forecast period (2024 – 2034).

Robotic radiotherapy systems, such as CyberKnife and TrueBeam, offer unparalleled precision in targeting lung tumors while sparing surrounding healthy tissues. This precise tumor targeting is particularly important for lung cancer treatment, where tumors are often located near critical structures such as the heart, spinal cord, and major blood vessels. The ability of robotic systems to deliver highly conformal radiation doses to lung tumors contributes to their effectiveness and minimizes the risk of treatment-related side effects.

Lung tumors can move significantly due to respiratory motion, posing a challenge for accurate radiation delivery. Robotic radiotherapy systems incorporate advanced motion management techniques to track and adjust for tumor motion during treatment delivery. Real-time tracking and adaptive treatment planning ensure that the radiation beams remain aligned with the tumor’s position throughout the breathing cycle, enhancing treatment accuracy and efficacy.

Motion management capabilities are essential for treating lung cancer with robotic radiotherapy and drive demand for these advanced systems. Growth in this market is anticipated to be driven by the sharp increase in the prevalence of lung cancer and the number of patients choosing radiation treatment. About 237,000 Americans were diagnosed with lung cancer in 2022, according to the American Lung Association (ALA).

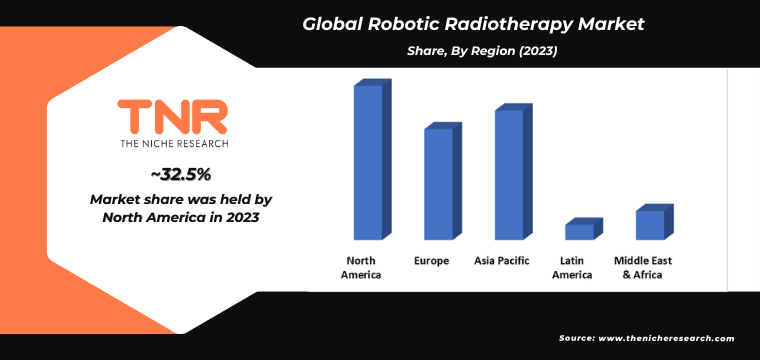

North America is at the forefront of technological innovation in robotic radiotherapy market.

Leading manufacturers such as Accuray (CyberKnife) and Varian Medical Systems (TrueBeam) have developed state-of-the-art robotic platforms that offer unparalleled precision, accuracy, and versatility in delivering radiation therapy. These systems incorporate advanced imaging, motion management, and treatment planning capabilities to optimize treatment outcomes for patients. Robotic radiotherapy has been widely adopted in academic medical centers, community hospitals, and cancer centers across North America.

Clinicians utilize robotic systems for a range of cancer indications, including lung cancer, where precise tumor targeting and motion management are critical for treatment success. The ability of robotic systems to deliver stereotactic body radiation therapy (SBRT) and stereotactic radiosurgery (SRS) has revolutionized the treatment of lung tumors, offering highly effective and non-invasive alternatives to surgery for eligible patients.

Competitive Landscape: Global Robotic Radiotherapy Market:

Competitive Landscape: Global Robotic Radiotherapy Market:

- Accuray Incorporated

- C-RAD

- Elekta

- Hitachi Ltd.

- IBA

- Mevion Medical Systems

- Optivus Proton Therapy, Inc

- Panacea Medical Technologies Pvt. Ltd

- P-Cure

- Siemens Healthcare GmbH

- ViewRay Technologies

- Other Industry Participants

Global Robotic Radiotherapy Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 1.3 Bn |

| Market Size Forecast by 2034 | US$ 4.6 Bn |

| Growth Rate (CAGR) | 12.5% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Product, By Technology, By Application, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Siemens Healthcare GmbH, Elekta, Accuray Incorporated, IBA, ViewRay Technologies, C-RAD, Hitachi Ltd., Mevion Medical Systems, Optivus Proton Therapy, Inc, Panacea Medical Technologies Pvt. Ltd, P-Cure, Other Market Participants |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com |

Global Robotic Radiotherapy Market

By Product

- Radiotherapy Systems

- Softwares

- 3D Cameras (Surface Guided)

- Others

By Technology

- Linear Accelerators

- Conventional Linear Accelerators

- MRI – Linear Accelerators

- Stereotactic Radiation Therapy Systems

- Cyberknife

- Gamma Knife

- Particle Therapy

- Proton Beam Therapy

- Heavy Ion beam Therapy

By Application

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head & Neck Cancer

- Colorectal Cancer

- Other Cancers

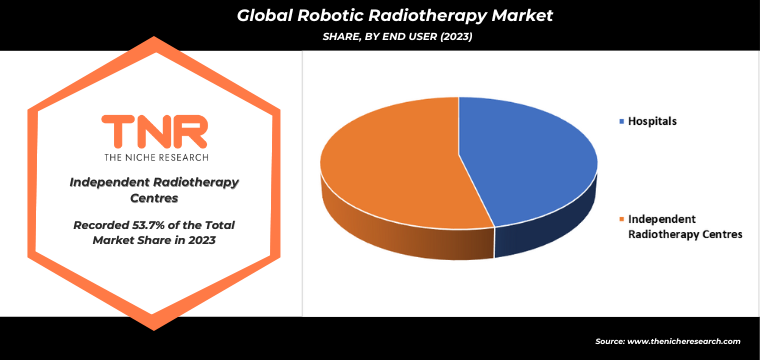

By End User

- Hospitals

- Independent Radiotherapy Centres

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout

Table of Contents

**Exclusive for Multi-User and Enterprise User.

Global Robotic Radiotherapy Market

By Product

- Radiotherapy Systems

- Softwares

- 3D Cameras (Surface Guided)

- Others

By Technology

- Linear Accelerators

- Conventional Linear Accelerators

- MRI – Linear Accelerators

- Stereotactic Radiation Therapy Systems

- Cyberknife

- Gamma Knife

- Particle Therapy

- Proton Beam Therapy

- Heavy Ion beam Therapy

By Application

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head & Neck Cancer

- Colorectal Cancer

- Other Cancers

By End User

- Hospitals

- Independent Radiotherapy Centres

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.