Global Sustainable Agriculture Market, By Type, By Application, By End User, By Region, & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: Agriculture

- Report ID: TNR-110-1295

- Number of Pages: 420

- Table/Charts : Yes

- September, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10196

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

Sustainable agriculture refers to farming practices that meet current food and textile needs without compromising future generations’ ability to do the same. This approach emphasizes environmental health, economic profitability, and social equity. The sustainable agriculture market is growing rapidly as consumers and governments push for greener practices to combat climate change and resource depletion.

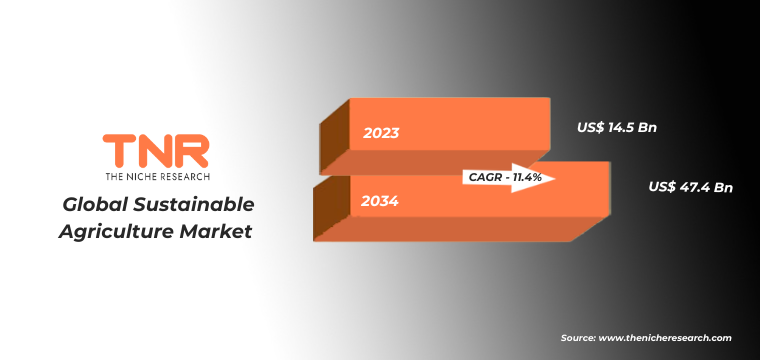

Applications of sustainable agriculture include crop rotation, organic farming, integrated pest management, and conservation tillage. These methods aim to reduce environmental impact, enhance soil health, and increase biodiversity. Nowadays, sustainable agriculture is crucial for ensuring food security, reducing greenhouse gas emissions, and preserving natural resources. Its importance is amplified by the rising global population and increasing demand for food, driving innovation and adoption across the agricultural sector. In Terms of Revenue, the Global Sustainable Agriculture Market was Worth US$ 14.5 Bn in 2023, Anticipated to Witness CAGR of 11.4% During 2024 – 2034.

Opportunities in Global Sustainable Agriculture Market

- Technological Advancements in Precision Agriculture: The integration of advanced technologies such as artificial intelligence (AI), Internet of Things (IoT), and drone-based monitoring presents significant opportunities in the sustainable agriculture market. Precision agriculture allows farmers to optimize inputs like water, fertilizers, and pesticides, leading to more efficient and environmentally friendly farming practices. For example, AI-powered tools can predict crop yields and identify pest threats early, minimizing waste and reducing chemical use. As these technologies become more accessible, they can drive widespread adoption of sustainable practices, increasing farm profitability while enhancing environmental sustainability. This synergy of technology and sustainability is set to revolutionize the agriculture industry globally.

- Growth in Organic Farming Practices: Organic farming, which avoids synthetic chemicals and genetically modified organisms (GMOs), aligns with sustainable agriculture principles by promoting soil health, biodiversity, and ecological balance. As awareness of the environmental and health benefits of organic food grows, farmers are increasingly shifting toward organic practices. This shift not only meets consumer demand but also opens new markets for organic products, particularly in regions with stringent environmental regulations. Additionally, governments are providing incentives and support for organic farming, further fueling its expansion and creating long-term growth opportunities in the sector.

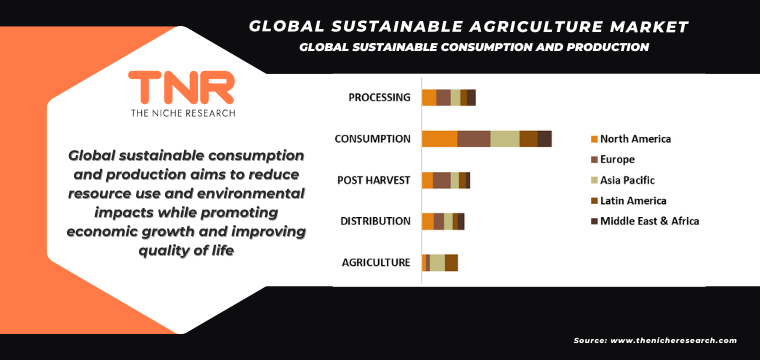

Global Sustainable Consumption and Production:

Global sustainable consumption and production (SCP) focuses on using resources efficiently to meet human needs while minimizing environmental impact. It promotes a circular economy, where products are designed for durability, reuse, and recycling, reducing waste and pollution.

SCP encourages responsible consumer behaviour, sustainable business practices, and policies that support green growth. By balancing economic growth with environmental stewardship and social equity, SCP aims to ensure that development meets present needs without compromising future generations’ ability to meet theirs, contributing to a more sustainable and resilient global economy.

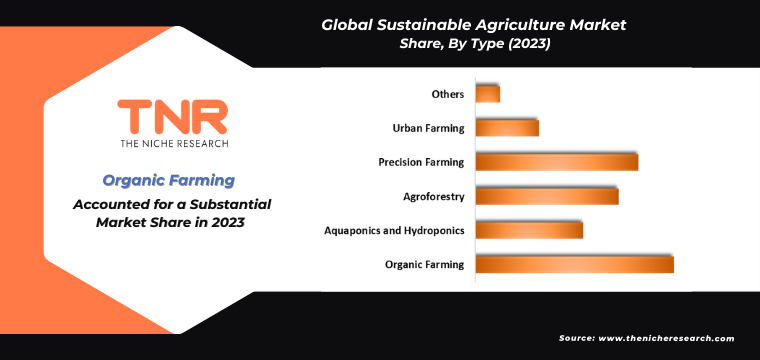

Organic farming by type category have emerged as a dominant segment in the global sustainable agriculture market capturing a revenue share of 28.3% in 2023. Farmers and other end users adopt organic farming to produce crops and livestock without synthetic pesticides, fertilizers, or GMOs, emphasizing natural inputs and soil health. New techniques, such as organic no-till farming, companion planting, and the use of biofertilizers, enhance crop yield and soil fertility while reducing environmental impact. Applications of organic farming extend to food production, textiles, and cosmetics, driven by growing consumer demand for natural, eco-friendly products, making it a cornerstone of sustainable agriculture practices worldwide.

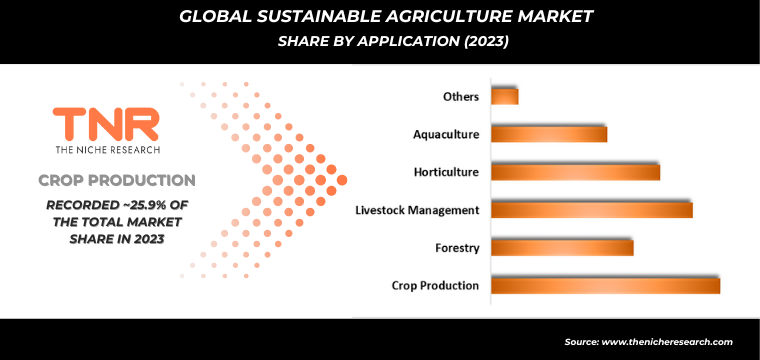

In 2023, livestock management segment solidified its position as the second-largest application category within the global sustainable agriculture market with revenue share of 22.7%. This segment focuses on sustainable practices in animal husbandry, such as rotational grazing, organic feed, and integrated waste management. Farmers are increasingly adopting these methods to reduce the environmental impact of livestock production, enhance animal welfare, and improve soil health. Innovations like precision livestock farming and regenerative grazing techniques are gaining traction, enabling more efficient resource use and minimizing greenhouse gas emissions. As demand for sustainably produced animal products rises, livestock management remains pivotal to sustainable agriculture’s growth.

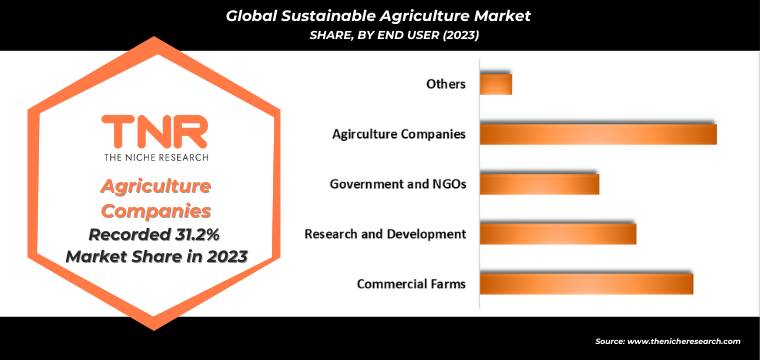

Sustainable agriculture is predominantly used by agricultural companies. Agricultural companies are at the forefront of adopting sustainable agriculture practices, integrating them into their operations to meet growing environmental and consumer demands. These companies use sustainable methods to enhance crop yields, conserve resources, and reduce their carbon footprint. Techniques such as crop rotation, organic farming, and precision agriculture are widely employed to ensure long-term soil health and biodiversity. By focusing on sustainability, these companies not only contribute to environmental protection but also appeal to consumers seeking eco-friendly products. As a result, sustainable agriculture has become a core strategy for agricultural companies aiming to achieve both profitability and environmental stewardship acquiring 31.2% revenue share in 2023.

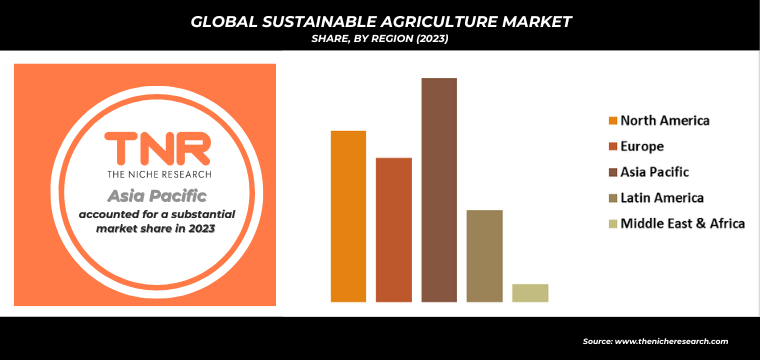

In 2023, Asia Pacific is set to solidified its dominance in the global sustainable agriculture market, contributing a revenue share of 34.4%. This dominance reflects the region’s strong adoption of eco-friendly farming practices and supportive government initiatives. Countries like India and China are anticipated to be key growth markets in the sustainable agriculture sector. For instance, in India, the government has introduced several initiatives, such as the Paramparagat Krishi Vikas Yojana (PKVY), which focuses on promoting organic farming across the nation. Additionally, the rising consumer demand for sustainably produced food is fueling market growth in India. Similarly, in China, the government launched the “Action Plan for Zero Growth in Fertilizer and Pesticide Use by 2020,” which aims to decrease the use of fertilizers and pesticides and encourage sustainable agricultural practices.

Competitive Landscape

Some of the players operating in the sustainable agriculture market are

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- Bunge Limited

- Cargill, Incorporated

- Corteva Agriscience

- Danone

- General Mills, Inc.

- Kellogg Company

- Kraft Heinz Company

- Mars, Incorporated

- Monsanto Company

- Nestlé S.A.

- PepsiCo, Inc.

- Syngenta AG

- The Coca-Cola Company

- The Hershey Company

- Unilever

- Yara International ASA

- Zoetis Inc.

- Other Industry Participants

Manufacturers in the sustainable agriculture sector are concentrating on several key areas to drive innovation and market growth. They are focusing on developing advanced technologies such as precision agriculture tools, which use data analytics and IoT to optimize resource use and enhance crop yields. Innovations include eco-friendly pest control solutions, biodegradable materials, and smart irrigation systems that reduce water waste.

Manufacturers are also investing in research and development to create new organic fertilizers and bio-based crop protection products. Strategies involve collaborating with research institutions, adopting circular economy principles, and expanding their product lines to meet the increasing demand for sustainable agricultural practices.

- In 2024, Pivot Bio released its Pivot Bio Proven Performance soybean seed treatment, designed to help soybeans withstand drought conditions and boost yields.

- In 2023, Indigo Agriculture introduced the Indigo Yield Platform, leveraging precision agriculture technology to enhance crop yields and lower input costs for farmers.

Global Sustainable Agriculture Market Scope:

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 14.5 Bn |

| Market Size Forecast by 2034 | US$ 47.4 Bn |

| Growth Rate (CAGR) | 11.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Type, By Application, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | Archer Daniels Midland Company, BASF SE, Bayer AG, Bunge Limited, Cargill, Incorporated, Corteva Agriscience, Danone, General Mills, Inc., Kellogg Company, Kraft Heinz Company, Mars, Incorporated, Monsanto Company, Nestlé S.A., PepsiCo, Inc., Syngenta AG, The Coca-Cola Company, The Hershey Company, Unilever, Yara International ASA, Zoetis Inc. |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Sustainable Agriculture Market

By Type

- Organic Farming

- Aquaponics and Hydroponics

- Agroforestry

- Precision Farming

- Urban Farming

- Others

By Application

- Crop Production

- Forestry

- Livestock Management

- Horticulture

- Aquaculture

- Others

By End User

- Commercial Farms

- Research and Development

- Government and NGOs

- Agriculture Companies

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Sustainable Agriculture Market

By Type

- Organic Farming

- Aquaponics and Hydroponics

- Agroforestry

- Precision Farming

- Urban Farming

- Others

By Application

- Crop Production

- Forestry

- Livestock Management

- Horticulture

- Aquaculture

- Others

By End User

- Commercial Farms

- Research and Development

- Government and NGOs

- Agriculture Companies

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.