Global Wealth Management Market, By Service Type, By Organization Size, By End User, By Region & Segmental Insights Trends and Forecast, 2024 – 2034

- Industry: BFSI

- Report ID: TNR-110-1188

- Number of Pages: 420

- Table/Charts : Yes

- June, 2024

- Base Year : 2024

- No. of Companies : 10+

- No. of Countries : 29

- Views : 10134

- Covid Impact Covered: Yes

- War Impact Covered: Yes

- Formats : PDF, Excel, PPT

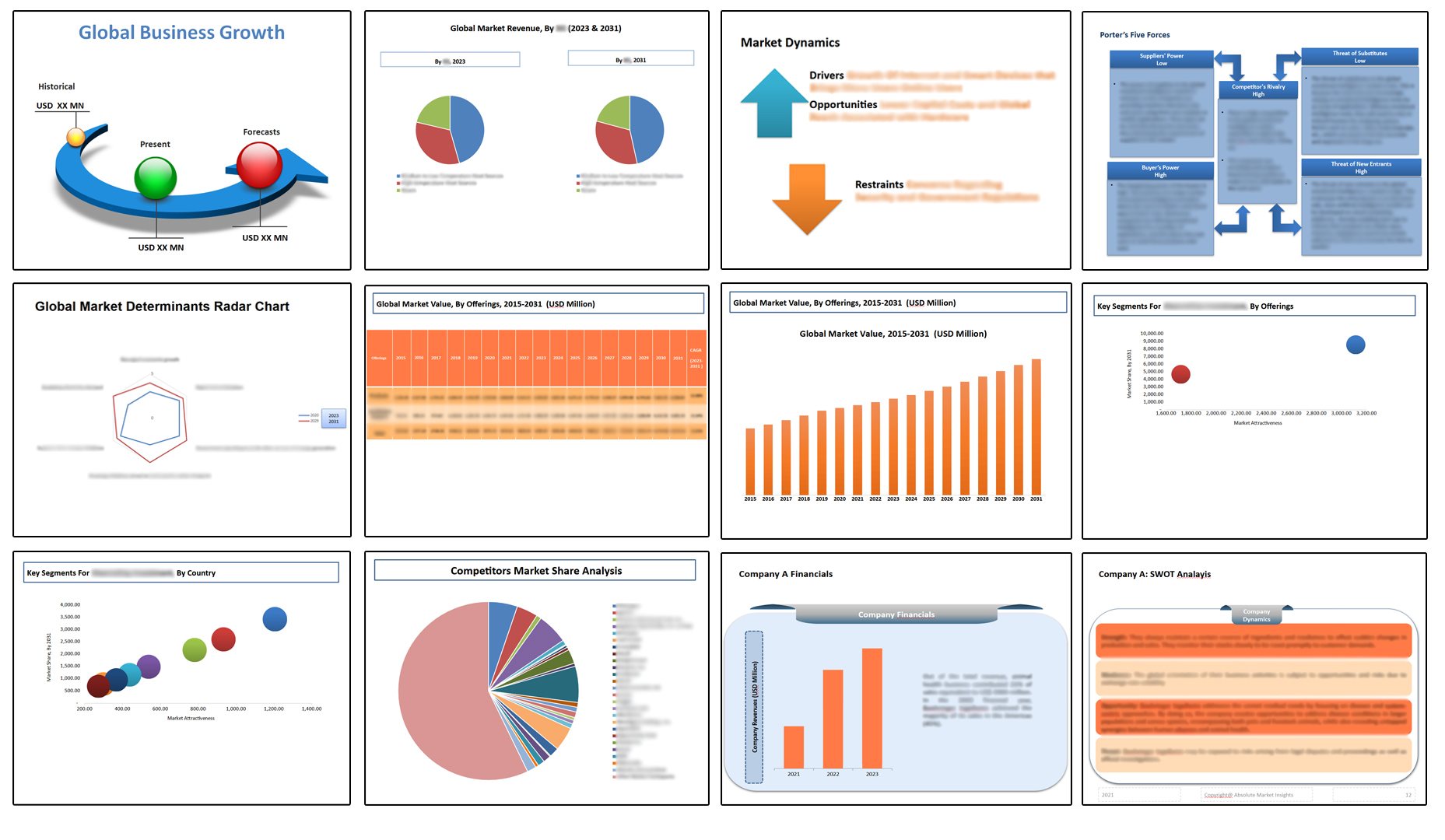

In Terms of Revenue, the Global Wealth Management Market was Worth US$ 1,531.8 Bn in 2023 and is Anticipated to Witness a CAGR of 11.4% During 2024 – 2034.

Wealth management refers to the professional advisory and management services provided to high-net-worth individuals (HNWIs) and affluent clients to help them manage their wealth effectively. These services encompass a wide range of financial disciplines, including investment management, financial planning, estate planning, tax planning, and risk management. The goal is to optimize the client’s financial situation and achieve their long-term financial objectives. The wealth management market is experiencing robust growth globally, driven by several key trends. There is a growing demand for personalized financial advice and services due to increasing wealth accumulation among individuals worldwide.

Technological advancements have led to the rise of digital wealth management platforms, offering more accessible and efficient services to a broader audience. Regulatory changes and evolving investor preferences towards sustainable and socially responsible investing are shaping the market dynamics. Opportunities in the wealth management market include expanding into emerging markets, leveraging artificial intelligence and big data analytics for personalized insights, and addressing the needs of intergenerational wealth transfer. Overall, the market’s growth is propelled by increasing wealth levels globally, technological innovations, and evolving client expectations for holistic wealth management solutions.

Wealth Management Market Dynamic

Growth Driver-

Increasing Adoption of Digital and Fintech Solutions

As technology continues to advance, wealth management firms are leveraging digital platforms to enhance client engagement, streamline operations, and offer personalized services at scale. Digital tools such as robo-advisors, online portfolio management platforms, and mobile apps enable wealth managers to reach a broader client base efficiently and cost-effectively. These technologies not only improve accessibility to wealth management services but also provide real-time insights and analytics, empowering clients to make informed financial decisions. Moreover, digital solutions help wealth management firms to lower operational costs, comply with regulatory requirements more effectively, and differentiate themselves in a competitive market by delivering a superior client experience. Thus, the integration of digital innovations is driving growth and reshaping the landscape of wealth management globally.

Trends-

Increasing Focus on Sustainable and Responsible Investing

More affluent clients and institutional investors are placing emphasis on environmental, social, and governance (ESG) criteria when making investment decisions. This trend is driven by growing awareness of global sustainability challenges, regulatory pressures encouraging ESG disclosures, and investor preferences for ethical and socially responsible investing practices. Wealth management firms are responding by integrating ESG considerations into their investment strategies and product offerings.

They are developing ESG-focused portfolios, engaging in shareholder advocacy for sustainable practices among investee companies, and providing transparency on the ESG impact of investments. This trend not only meets the evolving demands of clients but also aligns with broader societal goals of promoting sustainability and responsible corporate behavior. As ESG investing gains momentum, wealth managers are poised to capitalize on this trend by attracting a new generation of socially conscious investors and differentiating their services in a competitive market landscape.

Challenge-

Increasing Complexity of Regulatory Requirements and Compliance Burdens

As financial regulations evolve and become more stringent across different jurisdictions, wealth management firms face the daunting task of navigating a complex regulatory landscape. Compliance costs have risen substantially, requiring firms to allocate significant resources to ensure adherence to regulations related to client data protection, anti-money laundering (AML), know-your-customer (KYC) requirements, and more. The challenge is exacerbated by the global nature of wealth management operations, where firms often operate across multiple jurisdictions with varying regulatory frameworks.

Achieving compliance can be resource-intensive and time-consuming, potentially impacting operational efficiency and profitability. Moreover, regulatory changes can introduce uncertainty and require constant adaptation of business practices and technologies to remain compliant. Addressing these regulatory challenges requires robust compliance frameworks, investment in technology for regulatory reporting and monitoring, and proactive engagement with regulatory authorities to stay abreast of evolving requirements.

Wealth Management Market Segmentation by Service Type, Organization Size, End User, Region

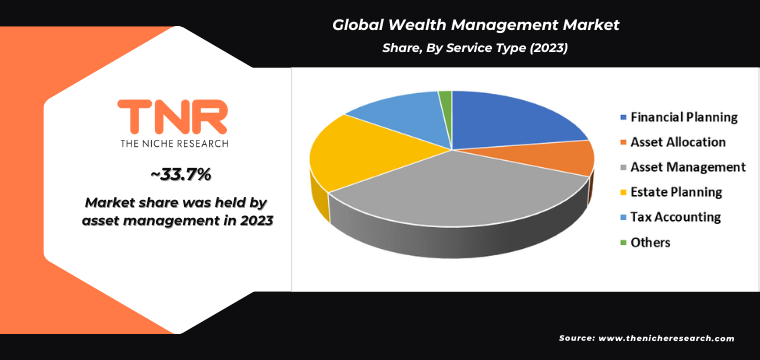

Asset management segment is set to dominate the wealth management market, commanding a substantial revenue share of 33.7% over the forecast period.

This dominance stems from the critical role asset managers play in overseeing and optimizing clients’ investment portfolios. Asset managers are tasked with making informed decisions on behalf of their clients, aiming to achieve optimal returns while managing risks according to clients’ financial objectives and risk tolerance. The growth of the asset management segment is driven by increasing global wealth levels, which necessitate professional management to preserve and grow assets effectively. Advancements in technology have empowered asset managers with sophisticated tools for portfolio analysis, risk management, and client reporting, enhancing their ability to deliver value-added services. As asset management continues to evolve with changing market dynamics and client demands, it remains a cornerstone of the broader wealth management landscape.

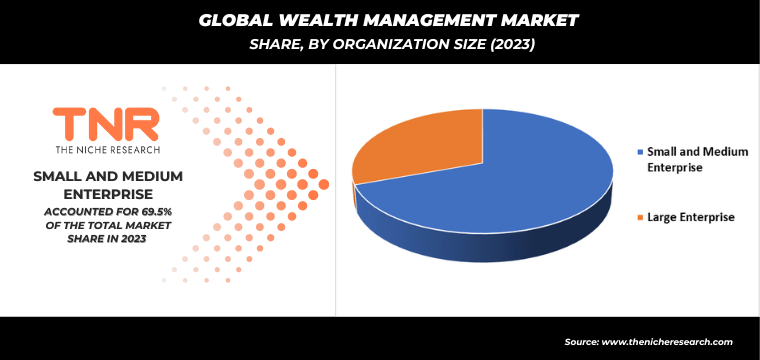

Large enterprise segment is anticipated to be the fastest-growing organization size in the wealth management market, capturing a substantial revenue share of 30.5% over the forecast period.

This surge is driven by the increasing demand for sophisticated wealth management solutions among large corporations and multinational enterprises. These entities often possess substantial financial resources and complex wealth management needs that necessitate specialized services and robust technology platforms. Large enterprises are increasingly turning to wealth management solutions to effectively manage corporate assets, employee benefits, executive compensation packages, and other financial portfolios.

The globalization of businesses and expansion into diverse markets require comprehensive wealth management strategies to navigate regulatory compliance, optimize returns, and mitigate financial risks. The growth of the large enterprise segment is also bolstered by advancements in fintech and digital solutions, enabling scalable and integrated wealth management services tailored to the specific requirements of corporate clients. As these enterprises prioritize strategic financial management, the demand for tailored wealth management solutions is expected to continue expanding robustly.

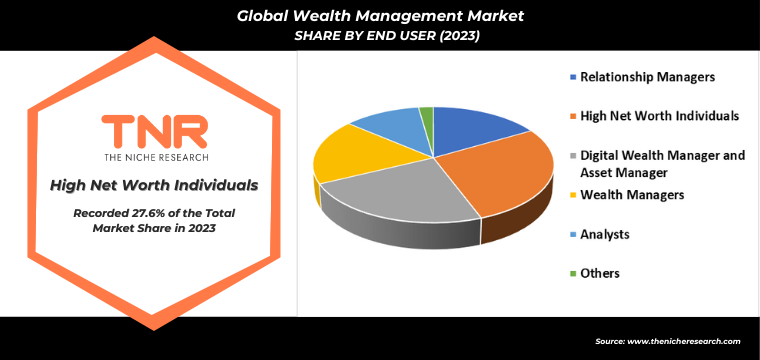

High net worth individual segment by end user dominated the wealth management market, capturing a significant revenue share of 27.6% over the forecast period.

This dominance is rooted in the unique needs and preferences of affluent individuals who seek specialized financial advisory and investment management services to preserve and grow their substantial assets. HNWIs typically require personalized wealth management strategies tailored to their financial goals, risk tolerance, and lifestyle aspirations. They often engage wealth managers to oversee diverse portfolios, including investments, estate planning, tax optimization, and philanthropic endeavors.

The complexity of their financial situations necessitates sophisticated solutions that can adapt to changing market conditions and regulatory landscapes. As global wealth continues to concentrate among HNWIs, the demand for exclusive and tailored wealth management services is expected to grow. This segment’s significance underscores its role as a primary driver of innovation and differentiation within the broader wealth management industry, influencing service offerings and market dynamics significantly.

In 2023, North America is anticipated to play a significant role in propelling the growth of the wealth management market, contributing approximately 36.8% to its overall expansion.

This region’s leadership stems from several factors, including a high concentration of high net worth individuals (HNWIs), sophisticated financial infrastructure, and robust demand for comprehensive wealth management services. North America benefits from a mature financial services sector characterized by a strong regulatory framework and deep market expertise, facilitating the delivery of innovative wealth management solutions. Wealth management firms in the region leverage advanced technology, data analytics, and personalized advisory services to meet the diverse needs of affluent clients.

Furthermore, North America’s economic resilience and stable investment environment attract both domestic and international investors seeking secure wealth management options. As the region continues to foster innovation and cater to evolving client expectations, it remains a pivotal market driving the global growth trajectory of wealth management services.

Key Developments

- In April 2022, HCL Technologies (HCL) and Avaloq, a provider of digital banking solutions, expanded their global collaboration to establish a lifecycle management center for digital wealth management. This initiative aims to leverage Avaloq’s advanced technologies, enabling a broader range of financial institutions to benefit from state-of-the-art digital banking solutions through their expanded partnership.

- In July 2022, FIS, a financial technology company, revealed enhancements to its wealth management solutions by expanding and upgrading its self-invested personal pension (SIPP) operations in the UK.

Major Players in Wealth Management Market

- ADIB

- Allianz

- Barclays Wealth Management

- BlackRock

- BNY Mellon

- CA Indosuez

- Capital Wealth Management, LLC

- DWS

- Fidelity Investments

- P. Morgan Chase & Co.

- State Street Global

- The Vanguard Group, Inc.

- UBS

- Other Industry Participants

Global Wealth Management Market Scope

| Report Specifications | Details |

| Market Revenue in 2023 | US$ 1,531.8 Bn |

| Market Size Forecast by 2034 | US$ 5,022.8 Bn |

| Growth Rate (CAGR) | 11.4% |

| Historic Data | 2016 – 2022 |

| Base Year for Estimation | 2023 |

| Forecast Period | 2024 – 2034 |

| Report Inclusions | Market Size & Estimates, Market Dynamics, Competitive Scenario, Trends, Growth Factors, Market Determinants, Key Investment Segmentation, Product/Service/Solutions Benchmarking |

| Segments Covered | By Service Type, By Organization Size, By End User, By Region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | U.S., Canada, Mexico, Rest of North America, France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa, Brazil, Argentina, Rest of Latin America |

| Key Players | ADIB, Allianz, Barclays Wealth Management, BlackRock, BNY Mellon, CA Indosuez, Capital Wealth Management, LLC, DWS, Fidelity Investments, J.P. Morgan Chase & Co., State Street Global, The Vanguard Group, Inc., UBS |

| Customization Scope | Customization allows for the inclusion/modification of content pertaining to geographical regions, countries, and specific market segments. |

| Pricing & Procurement Options | Explore purchase options tailored to your specific research requirements |

| Contact Details | Consult With Our Expert

Japan (Toll-Free): +81 663-386-8111 South Korea (Toll-Free): +82-808- 703-126 Saudi Arabia (Toll-Free): +966 800-850-1643 United Kingdom: +44 753-710-5080 United States: +1 302-232-5106 E-mail: askanexpert@thenicheresearch.com

|

Global Wealth Management Market

By Service Type

- Financial Planning

- Asset Allocation

- Asset Management

- Estate Planning

- Tax Accounting

- Others

By Organization Size

- Small and Medium Enterprise

- Large Enterprise

By End User

- Relationship Managers

- High Net Worth Individuals

- Digital Wealth Manager and Asset Manager

- Wealth Managers

- Analysts

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

Report Layout:

Table of Contents

Note: This ToC is tentative and can be changed according to the research study conducted during the course of report completion.

**Exclusive for Multi-User and Enterprise User.

Global Wealth Management Market

By Service Type

- Financial Planning

- Asset Allocation

- Asset Management

- Estate Planning

- Tax Accounting

- Others

By Organization Size

- Small and Medium Enterprise

- Large Enterprise

By End User

- Relationship Managers

- High Net Worth Individuals

- Digital Wealth Manager and Asset Manager

- Wealth Managers

- Analysts

- Others

By Region

- North America (U.S., Canada, Mexico, Rest of North America)

- Europe (France, The UK, Spain, Germany, Italy, Nordic Countries (Denmark, Finland, Iceland, Sweden, Norway), Benelux Union (Belgium, The Netherlands, Luxembourg), Rest of Europe)

- Asia Pacific (China, Japan, India, New Zealand, Australia, South Korea, Southeast Asia (Indonesia, Thailand, Malaysia, Singapore, Rest of Southeast Asia), Rest of Asia Pacific)

- Middle East & Africa (Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of Middle East & Africa)

- Latin America (Brazil, Argentina, Rest of Latin America)

The Niche Research approach encompasses both primary and secondary research methods to provide comprehensive insights. While primary research is the cornerstone of our studies, we also incorporate secondary research sources such as company annual reports, premium industry databases, press releases, industry journals, and white papers.

Within our primary research, we actively engage with various industry stakeholders, conducting paid interviews and surveys. Our meticulous analysis extends to every market participant in major countries, allowing us to thoroughly examine their portfolios, calculate market shares, and segment revenues.

Our data collection primarily focuses on individual countries within our research scope, enabling us to estimate regional market sizes. Typically, we employ a bottom-up approach, meticulously tracking trends in different countries. We analyze growth drivers, constraints, technological innovations, and opportunities for each country, ultimately arriving at regional figures.Our process begins by examining the growth prospects of each country. Building upon these insights, we project growth and trends for the entire region. Finally, we utilize our proprietary model to refine estimations and forecasts.

Our data validation standards are integral to ensuring the reliability and accuracy of our research findings. Here’s a breakdown of our data validation processes and the stakeholders we engage with during our primary research:

- Supply Side Analysis: We initiate a supply side analysis by directly contacting market participants, through telephonic interviews and questionnaires containing both open-ended and close-ended questions. We gather information on their portfolios, segment revenues, developments, and growth strategies.

- Demand Side Analysis: To gain insights into adoption trends and consumer preferences, we reach out to target customers and users (non-vendors). This information forms a vital part of the qualitative analysis section of our reports, covering market dynamics, adoption trends, consumer behavior, spending patterns, and other related aspects.

- Consultant Insights: We tap into the expertise of our partner consultants from around the world to obtain their unique viewpoints and perspectives. Their insights contribute to a well-rounded understanding of the markets under investigation.

- In-House Validation: To ensure data accuracy and reliability, we conduct cross-validation of data points and information through our in-house team of consultants and utilize advanced data modeling tools for thorough verification.

The forecasts we provide are based on a comprehensive assessment of various factors, including:

- Market Trends and Past Performance (Last Five Years): We accurately analyze market trends and performance data from preceding five years to identify historical patterns and understand the market’s evolution.

- Historical Performance and Growth of Market Participants: We assess the historical performance and growth trajectories of key market participants. This analysis provides insights into the competitive landscape and individual company strategies.

- Market Determinants Impact Analysis (Next Eight Years): We conduct a rigorous analysis of the factors that are projected to influence the market over the next eight years. This includes assessing both internal and external determinants that can shape market dynamics.

- Drivers and Challenges for the Forecast Period:Identify the factors expected to drive market growth during the forecast period, as well as the challenges that the industry may face. This analysis aids in deriving an accurate growth rate projection.

- New Acquisitions, Collaborations, or Partnerships: We keep a close watch on any new acquisitions, collaborations, or partnerships within the industry. These developments can have a significant impact on market dynamics and competitiveness.

- Macro and Micro Factors Analysis:A thorough examination of both macro-level factors (e.g., economic trends, regulatory changes) and micro-level factors (e.g., technological advancements, consumer preferences) that may influence the market during the forecast period.

- End-User Sentiment Analysis: To understand the market from the end-user perspective, we conduct sentiment analysis. This involves assessing the sentiment, preferences, and feedback of the end-users, which can provide valuable insights into market trends.

- Perspective of Primary Participants: Insights gathered directly from primary research participants play a crucial role in shaping our forecasts. Their perspectives and experiences provide valuable qualitative data.

- Year-on-Year Growth Trend: We utilize a year-on-year growth trend based on historical market growth and expected future trends. This helps in formulating our growth projections, aligning them with the market’s historical performance.

Research process adopted by TNR involves multiple stages, including data collection, validation, quality checks, and presentation. It’s crucial that the data and information we provide add value to your existing market understanding and expertise. We have also established partnerships with business consulting, research, and survey organizations across regions and globally to collaborate on regional analysis and data validation, ensuring the highest level of accuracy and reliability in our reports.