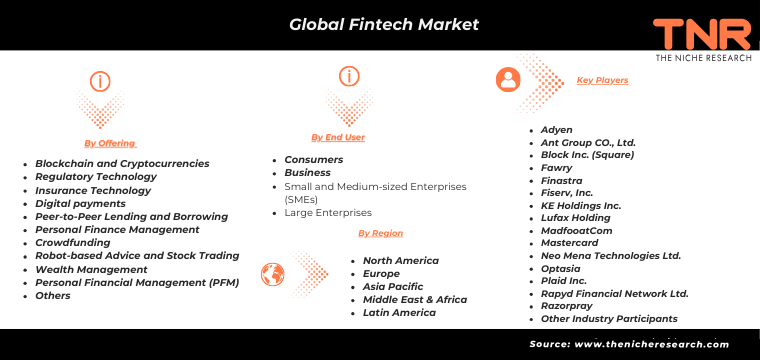

The global fintech market is experiencing a period of unprecedented growth, fueled by consumer demand for innovative financial solutions and the rapid adoption of new technologies.

Driving Forces Behind the Boom of the Global Fintech Market

- Rising consumer demand: Consumers are increasingly seeking convenient, secure, and personalized financial experiences. Fintech solutions cater to this demand by offering mobile-first platforms, frictionless transactions, and data-driven insights for financial management.

- Technological advancements: The emergence of technologies like artificial intelligence (AI), blockchain, and cloud computing is revolutionizing the financial services industry. Fintech firms are harnessing these technologies to create cutting-edge products and services, automate operations, and bolster security measures.

- Top of Form

- Bottom of Form

- Shifting regulatory environment: Regulatory bodies around the world are increasingly recognizing the potential of fintech and are implementing frameworks that foster innovation while maintaining financial stability. This supportive regulatory environment is providing a fertile ground for fintech companies to thrive.

- Growing smartphone penetration: The ubiquitous presence of smartphones, particularly in emerging economies, is fuelling the adoption of mobile-based fintech solutions. This trend is democratizing access to financial services, reaching previously unbanked and underbanked populations.

Key Trends Shaping the Future of Global Fintech Market

The fintech market is constantly evolving, with several key trends likely to shape its future:

- Embedded finance: The integration of financial services within non-financial ecosystems is a growing trend. This allows users to seamlessly access financial products and services, like payments, loans, or investments, directly within the platforms they already use.

- RegTech: Fintech companies are increasingly using RegTech solutions to navigate the evolving regulatory landscape. These solutions help automate compliance processes, manage risk, and ensure regulatory adherence.

- Focus on Financial Inclusion: Fintech companies are playing a vital role in promoting financial inclusion by offering innovative solutions that cater to the underserved population. This includes mobile wallets, microloans, and digital identity solutions.

- Rise of Blockchain: Blockchain technology holds transformative potential for the financial services sector, enhancing security, transparency, and operational efficiency. We can expect to see increased adoption of blockchain-based solutions in areas like cross-border payments, trade finance, and identity management.

Regional Variations in Global Fintech Market Growth

- Asia Pacific (APAC): The APAC region is expected to witness the fastest growth in the fintech market due to factors like a large unbanked population, increasing smartphone penetration, and government initiatives promoting financial inclusion. China and India are at the forefront in this region, boasting vibrant ecosystems of pioneering fintech startups.

- North America: North America remains a mature fintech market with established players. However, continued innovation in areas like AI and blockchain is driving growth in this region.

- Europe: Europe has a diverse fintech landscape with strong regulatory frameworks. Open banking regulations are fostering collaboration between traditional financial institutions and fintech startups in this region.

- Latin America: The Latin American fintech market is experiencing rapid growth due to a large unbanked population and a growing middle class. Mobile-based payment solutions and digital lending platforms are seeing strong adoption in this region.

- Middle East and Africa: The MEA region is at an early stage of fintech development, but there is significant potential for growth. Mobile money solutions are gaining traction in this region, providing financial services to previously unbanked populations.

The global fintech market is poised for a transformative journey with significant growth opportunities. As technology continues to evolve and consumer expectations rise, innovative fintech solutions will play a critical role in shaping the future of finance.